- Cardano price is likely to slow down and pull back to the $0.516 support level after a 55% rally.

- A bounce around the aforementioned level could trigger another 52% uptrend.

- A four-hour candlestick close below $0.471 will invalidate the bullish thesis for ADA.

Cardano price has managed to make an explosive run higher over the last four days as Bitcoin bulls make a comeback. This impressive upswing looks now to be preparing for another leg up.

Cardano blockchain development through the roof

Supporting this bullish outlook are the recent developments from both a fundamental and an on-chain scenario. Perhaps the most significant one is the recent uptick in the development activity for the ADA blockchain.

Based on Santiment’s data, this metric hit an all-time high of 68 on May 27. Considering the upcoming Vasil hard fork, which is set to debut in June, this spike in development activity makes complete sense.

The new upgrade should, in theory, boost the smart contract capabilities of Cardano and its smart contract platform known as Plutus.

ADA development activity

Investors try to catch up

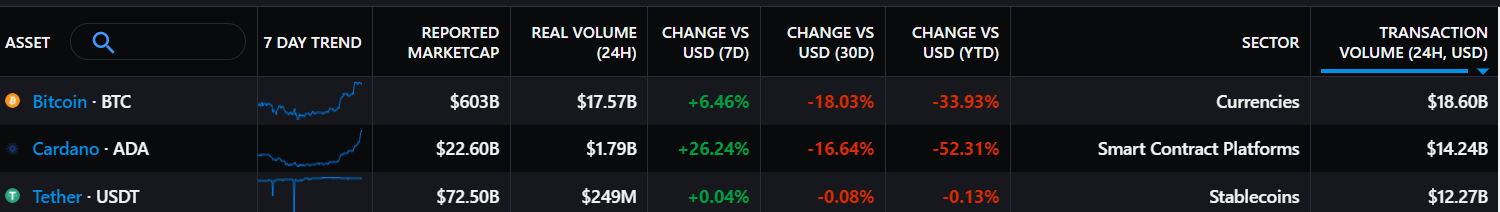

Adding to this spike in backend activity for the Cardano blockchain is the recent uptick in the 24-hour transaction volume. This number is currently hovering around $14.24 billion under Bitcoin’s at $18.60 billion.

This massive on-chain volume transacted on the ADA chain indicates a high level of activity from investors or users. Investors need to note that Cardano has been undergoing massive changes not just due to the recent Vasil hard fork – since the implementation of the smart contracts and the ability to mint native assets, the activity of investors, developers and users has grown exponentially.

As a result, the massive transaction volume number that almost competes with the big crypto could be a combination of transactions on the blockchain, dApps and NFT marketplaces.

ADA 24-hour transaction volume

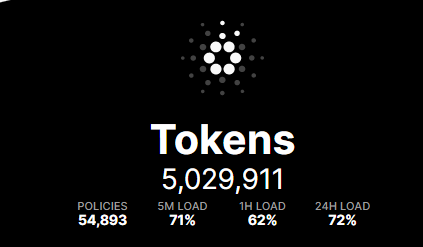

Further adding credence to such a high transaction volume for Cardano is the recent lift-off of the NFT marketplaces. Pool.pm, a data aggregation platform, shows that more than 5 million NFTs or native assets were minted on the Cardano blockchain.

Pool.pm

This massive uptick in user interest in the ADA blockchain came after the Mary hard fork that launched on March 1, 2021. In July 2020, Cardano’s founder Charles Hoskin foreshadowed the launch of multi-asset functionality by tweeting,

This time next year I predict there will be hundreds of assets running on Cardano, thousands of DApps, tons of interesting projects and lots of unique use and utility. 2021 is going to be so much fun watching Cardano grow and evolve. The community is definitely ready to innovate

— Charles Hoskinson (@IOHK_Charles) July 26, 2020

More recently, Hoskinson replied to a critique stating that his aforementioned tweet,

Aged great, and 4 million assets issued. How about you actually get informed before you shitpost and make yourself look like an idiot.

Ethereum-killer connects with Ethereum

Adding credence to the fundamental outlook for Cardano is the launch of the Iagon Token Bridge. This bridge allows investors to swap their ERC-20 tokens for Cardano native tokens. Similar to the connections across different ecosystems, this bridge between the ETH and ADA ecosystem will allow users to seamlessly connect, transfer and swap their assets.

Moreover, the primary reason for bridges is to allow the transfer of liquidity or capital across blockchains. Since Ethereum is the reigning champion in terms of network effects and total value locked, competing blockchains try to siphon this liquidity.

Therefore, the recent uptick in development activity and the users interacting with the Cardano blockchain can be explained by the ability to seamlessly connect and transfer assets to and from the Ethereum blockchain.

With these major updates from a fundamental perspective, the technicals are bound to see a noticeable increase in the market value of the underlying token, as reflected in ADA rallying roughly 55% over the last five days.

ADA price ready for a new move

Cardano price swept the lower limit of the $0.487 to $0.614 range on May 26 but took another day to consolidate and recover. From May 27 swing low at $0.444, ADA has rallied by roughly 55%, piercing the range high at $0.614 and tagging the $0.677 hurdle.

As investors continue to book profits, ADA is going to retrace to stable support levels. In this regard, the $0.614 can serve as a foothold, but the barriers that will prevent a further sell-off are $0.516 and $0.541.

Investors can accumulate ADA at these discounted prices and wait patiently for the next leg, which could propel Cardano price by 52% to tag the lower limit of the $0.785 to $0.90 hurdle.

ADA/USDT 1-day chart

While things are favoring bulls when it comes to Cardano price, a sudden spike in selling pressure could knock ADA down to retest the range low at $0.487. If Cardano price produces a four-hour candlestick close below $0.471 will invalidate the bullish thesis by producing a lower low.

In this case, ADA could crash to $0.397, where buyers could make a comeback.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.