- Cardano price is traversing a descending triangle, hinting at a 17% crash if it breaches crucial support.

- Transaction data shows that a bullish move for ADA is not possible as its path is riddled with underwater investors.

- A decisive close above $1.30 will create a higher high and invalidate the bullish thesis.

Cardano price is consolidating inside a bearish setup that is due for a breakdown soon. If the bears shatter one crucial level, it will trigger a crash that will knock ADA down to levels last seen six months ago.

Cardano price on a delicate footing

Cardano price has set up four lower highs and four equal lows since December 7. Connecting these swing points using trend lines reveals a descending triangle setup in play. This technical formation forecasts a 17% downswing, obtained by adding the distance between the first swing high and swing low to the breakout point at $1.20.

The threat of a crash builds up as Cardano price trades around the apex of the triangle at $1.24. A four-hour candlestick close below $1.20 will indicate a breakdown and trigger a 17% downswing to $1. However, investors need to note that the support level at $1.15 will play a vital role in defending the incoming crash. If the selling pressure overwhelms, ADA will head straight to the next support floor at $1.02, present in the proximity of the theoretical target at $1.

ADA/USDT 4-hour chart

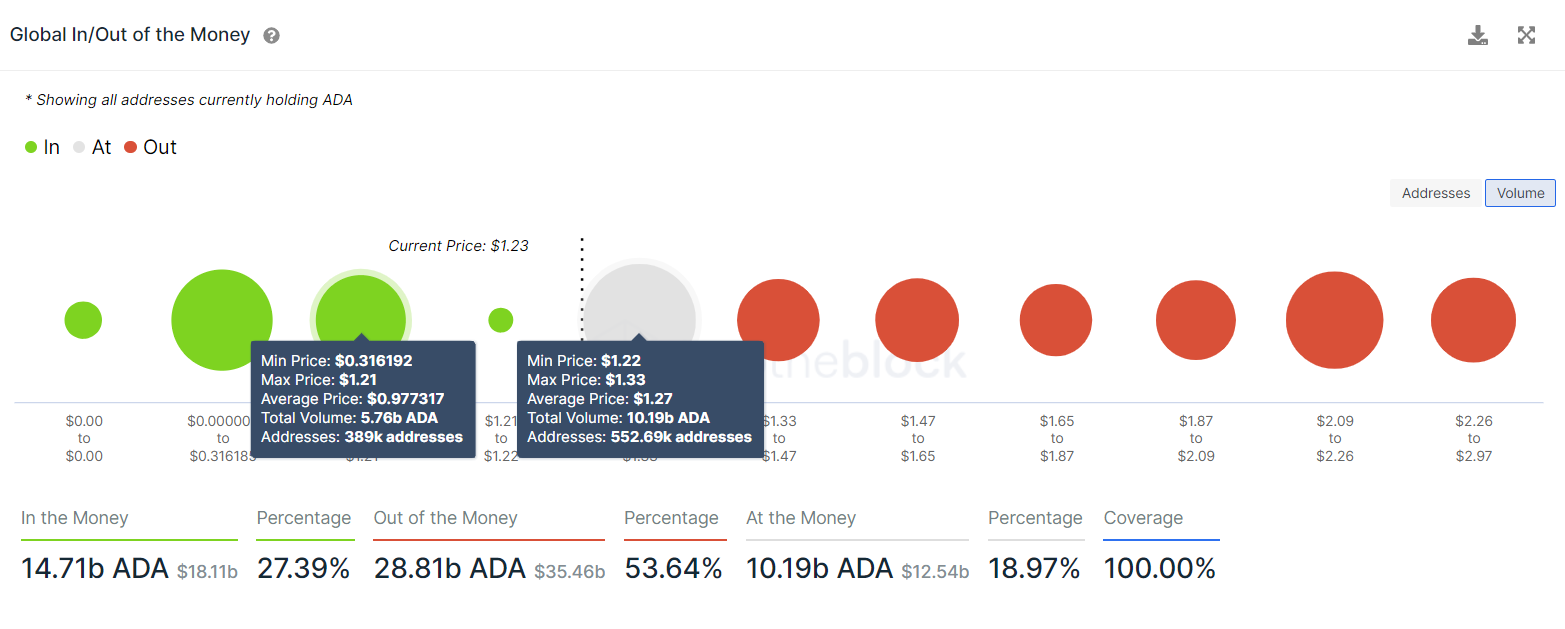

Supporting this crash for Cardano price is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows that a strong support level is present at around $0.977. Here, roughly 3890,000 addresses that purchased roughly 5.76 billion ADA are “In the Money” and are likely to buy more if ADA heads lower.

Moreover, the 552,690 addresses that purchased 10.19 billion ADA at an average price of $1.27 are “Out of the Money.” These holders might offload their holdings and serve as a source of selling pressure if ADA rises higher.

ADA GIOM

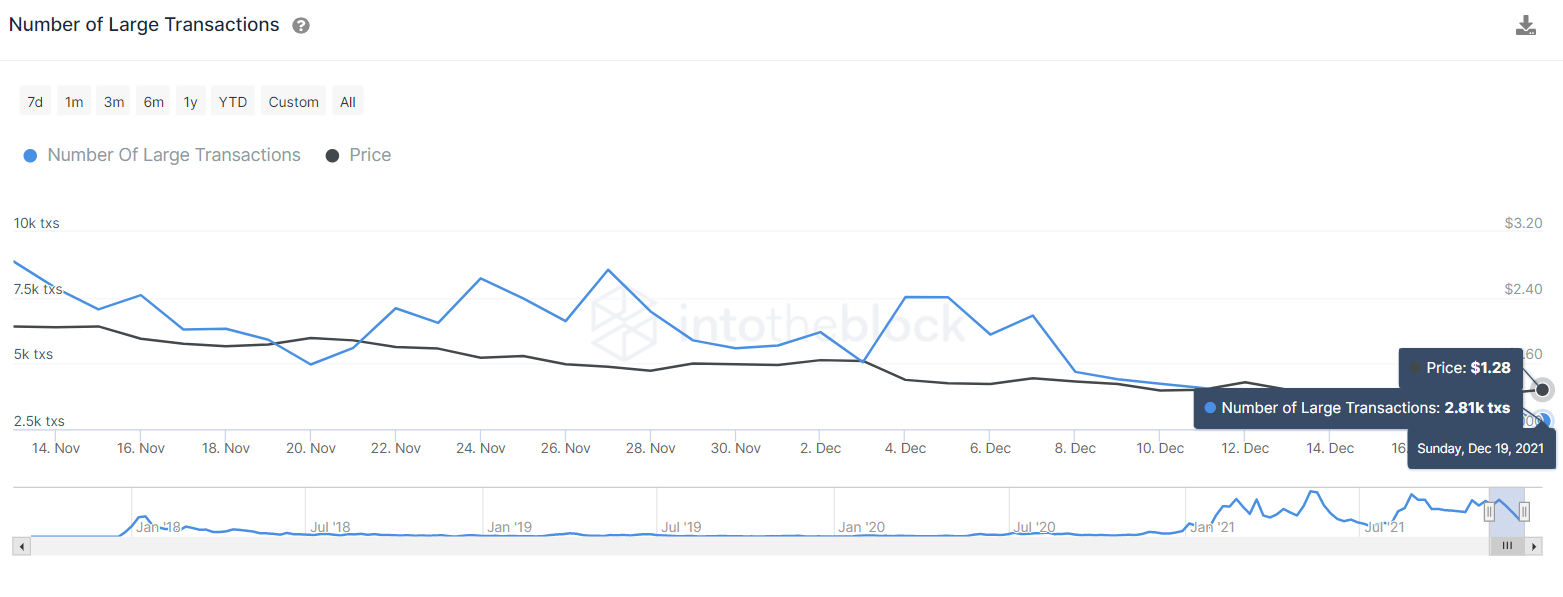

Lastly, the number of large transactions worth $100,000 or more has dropped from 8,870 to 2,880 over the past month. This 67.5% decline suggests waning interests from high networth or whale investors.

ADA large transactions

While things are going against Cardano price, a decisive four-hour candlestick close above $1.30 will alleviate any short-term selling pressure and create a higher high, invalidating the bearish thesis.

In such a case, investors can expect ADA to rally to retest $1.45 before tagging the $1.51 hurdle.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH consolidates below $2,000 as Standard Chartered alters its prediction for 2025

Ethereum remained just below $2,000 in the Asian session on Tuesday as Standard Chartered's Global Head of Digital Assets Research, Geoffrey Kendrick, updated the bank's 2025 price forecast for ETH.

Solana price faces 50-day resistance as SOL futures debut on CME Group with $5M volume on fifth anniversary

Solana (SOL) stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Canary Capital proposes first-ever Sui ETF following S-1 filing with the SEC

SUI saw slight gains on Monday as Canary Capital submitted an S-1 application with the Securities & Exchange Commission (SEC) to launch a Sui exchange-traded fund (ETF). This adds to the growing list of altcoin ETF filings awaiting approvals from the regulator.

Outflows in crypto funds reach $6.4 billion over five weeks amid long-term holder accumulation

Crypto exchange-traded funds (ETFs) extended their outflow streak last week, totaling $1.7 billion, bringing the total outflows in the past 5 weeks to $6.4 billion, per CoinShares weekly report on Monday.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.