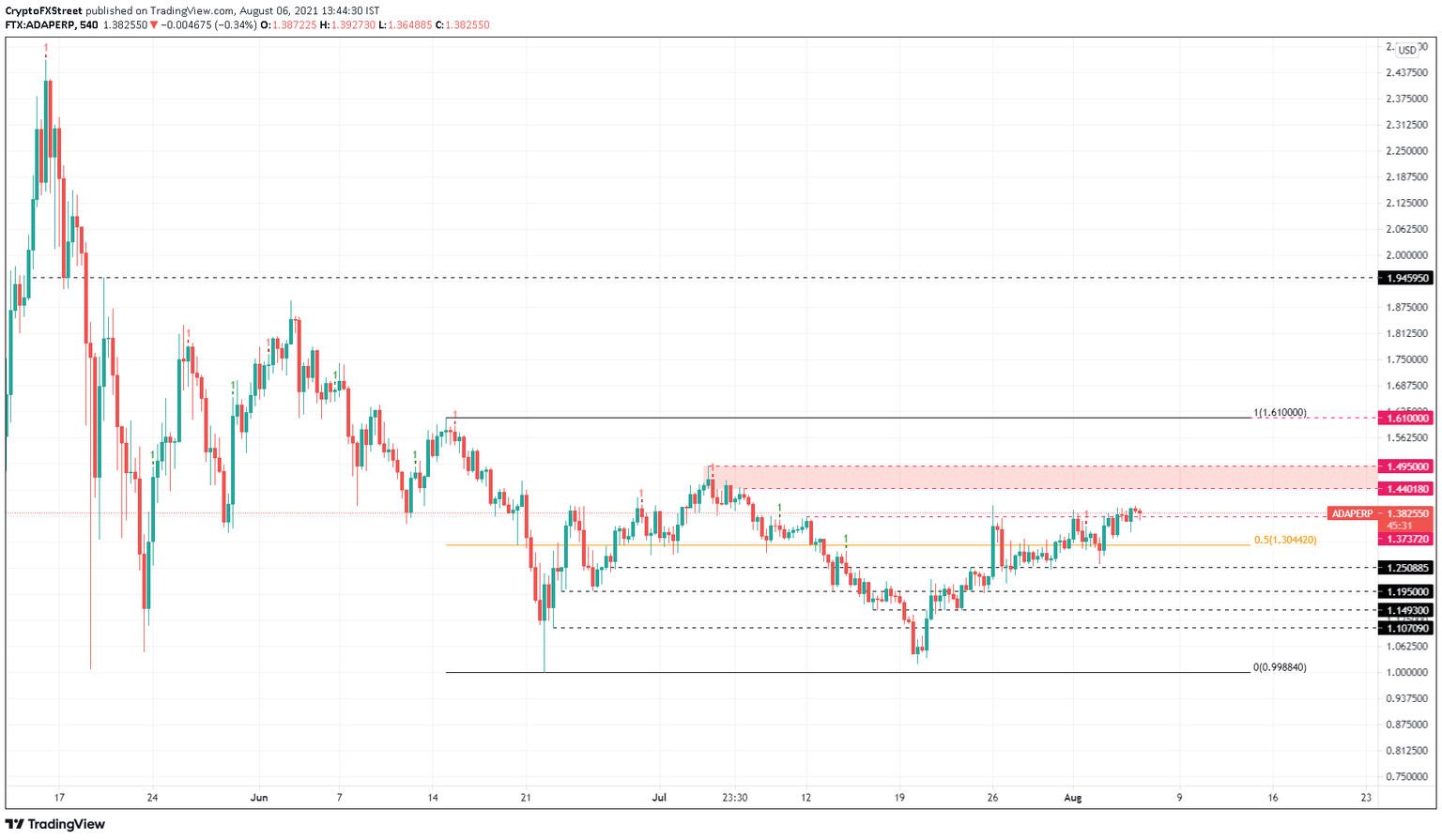

Cardano price nearing pullback as it approaches $1.44 target

- Cardano price recently swept the July 12 swing high at $1.373, a step close to the $1.44 target.

- A continuation of this trend could see it pierce the supply zone, extending from $1.44 to $1.5.

- Investors should expect a retracement near or before testing the resistance area mentioned above.

Cardano price ended its explosive moves on July 26, paving the way for a slow and consolidative uptrend. This move has allowed ADA to slice through a crucial resistance level, making way to the subsequent barrier.

While this development was tiresome, a pullback seems likely. Therefore, investors need to watch out for a retracement to stable support levels.

Cardano price struts toward an inflection point

Cardano price pierced the July 12 swing high at $1.373 on July 26 but failed to hold above it. The pullback from the failed attempt stemmed a second upswing on August 1 that failed to close above $1.373.

After two failed tries, ADA has finally produced a 9-hour candlestick close above $1.373, but it is unclear if this move will sustain. If the bulls defend this level and propel ADA higher, the supply zone will be tested, ranging from $1.44 to $1.50.

The slow and steady uptrend suggests that the momentum is vanishing. Therefore, investors can expect a pullback to either the 50% Fibonacci retracement level at $1.304 or the $1.251 support level.

ADA/USDT 9-hour chart

While things look a little bleak for Cardano price, a decisive close above $1.495 would invalidate the bearish thesis and indicate the presence of bulls.

Such a move would open the possibility of a retest of the $1.61 resistance level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.