- Cardano price had a massive jump in the past few hours thanks to Coinbase.

- Coinbase Pro announced that it will support ADA against four trading pairs.

- ADA got rejected from a significant resistance trendline.

Earlier today Coinbase Pro announced the support of Cardano with four trading pairs including USD, BTC, EUR, and GBP. Trading will commence at 9 AM Pacific Time Thursday, March 18 as long as liquidity is met.

Cardano price jumps on Coinbase news, but will the move last?

Cardano price is up by 24% in the past few hours after Coinbase announcement. However, investors are concerned whether this move will last or not.

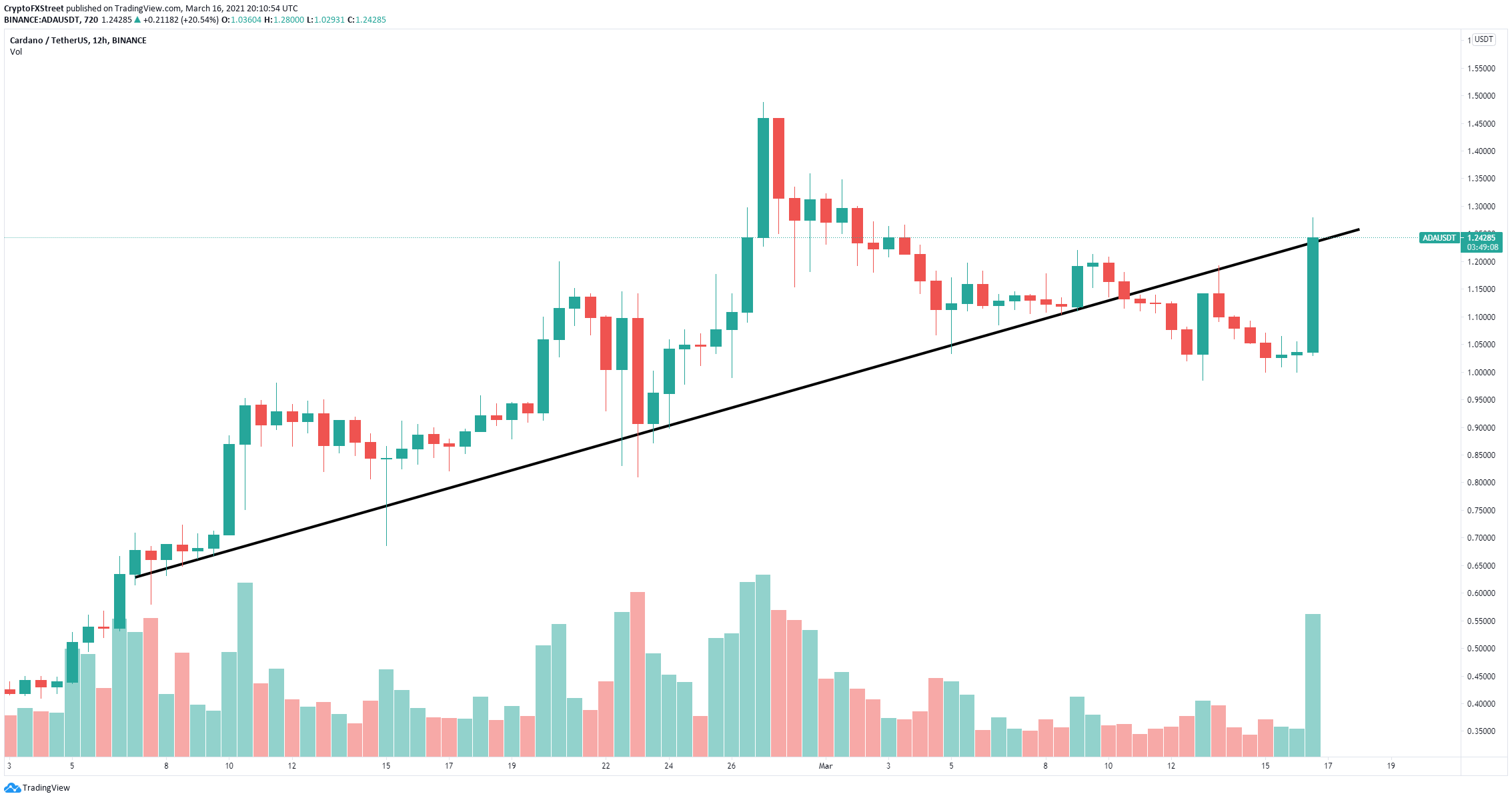

ADA/USD 12-hour chart

Cardano formed a significant support trendline since February 7 which was eventually broken on March 11 leading to a notable sell-off. The same trendline is now acting as a robust resistance level and has just rejected Cardano price again.

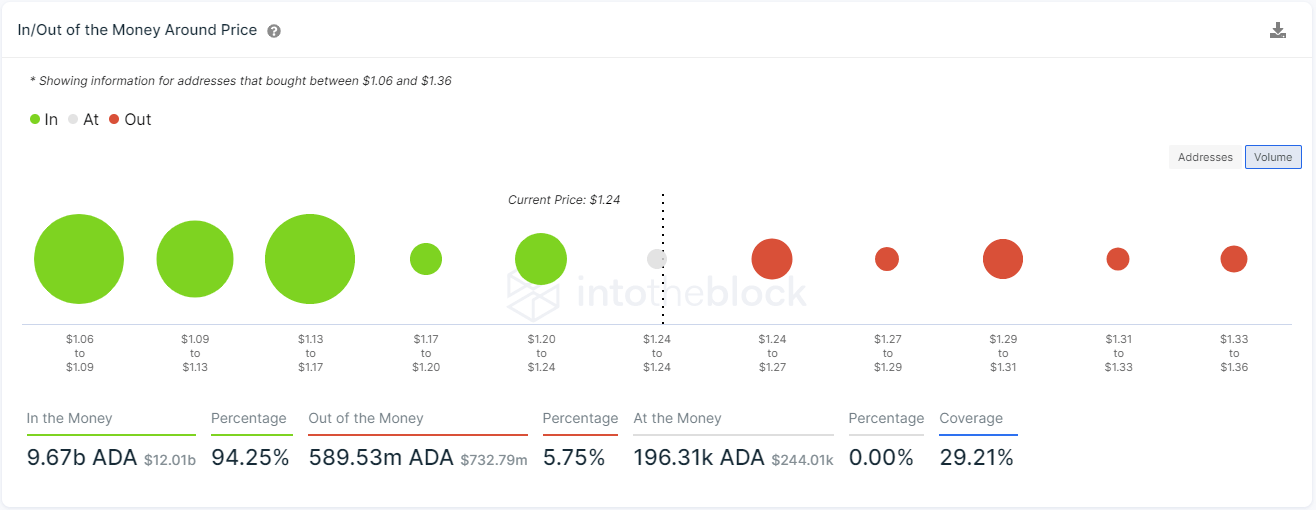

ADA IOMAP chart

However, despite the robust trendline resistance, the In/Out of the Money Around Price (IOMAP) chart shows practically no barriers above $1.27 and strong support between $1.17 and $1.06. A strong rejection from $1.24 would drive Cardano towards $1.17 and potentially down to $1.06.

On the other hand, breaking through the robust trendline of $1.24 should push Cardano towards $1.36 as there is no resistance ahead.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.