Cardano price ignored the Vasil hard fork, but here is a promising bullish pattern

- Cardano price slides back on the drawing board as buyers defend the support at $0.4250.

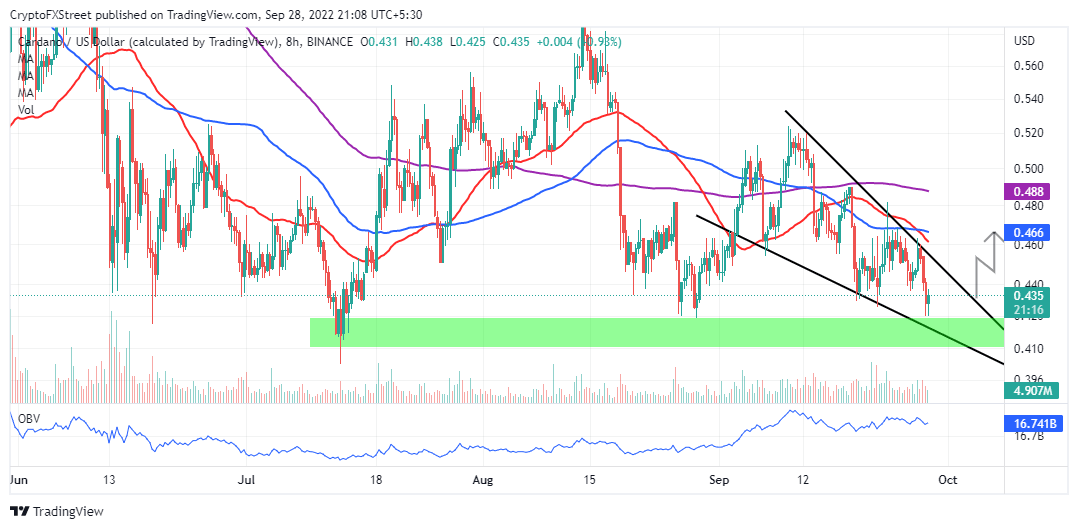

- ADA price eyes a significant bullish move, but first, a falling wedge pattern resistance must come out of the way.

- The lack of investor interest may invalidate its bullish potential while propagating downside risk.

Cardano price has a lot to prove to investors amid questions over frequent declines despite increased development activities. The smart contracts token is trading slightly below its price level before the Vasil hard fork.

A bullish move to $0.4800 was invalidated, possibly due to well-timed profit-taking activities. Now, ADA price is doddering at $0.4340 while buyers work on a potential move north of its primary support at $0.4250.

What's next for Cardano price after the Vasil hard fork?

After several delays, Cardano's IOHK (Input Output Hong Kong) successfully released the much-awaited Vasil hard fork upgrade on September 22. According to IOHK, the organization tasked with building and maintaining the network, the software upgrade will increase ADA's transaction throughput by capitalizing on new scalability features.

"The upgrade aims to improve the network's scalability and enhance Cardano's smart contract capabilities," Shahaf Bar-Geffen, the CEO of COTI, a stablecoin building platform, told Cointelegraph.

The Vasil hard fork only managed a minor impact on the Cardano price, but the token gave up all the gains due to early profit booking. With ADA price sitting on top of a solid support area highlighted by the green band between $0.4100 and $0.4250, buyers still have the upper hand.

Perhaps, future developments such as Charles Hoskinson's Daedalus Turbo proposal on the network's wallet could bring a more significant price impact. Hoskinson, the protocol's founder, says that to achieve a better user experience, Cardano needs to have a certified wallet designed to improve decentralization and not compromise on speed.

Is this the pullback Cardano price has been waiting for?

ADA price is trading in the apex of a falling wedge pattern formed after the token snapped out of an early September upswing to $0.5200. As the two trend lines (connecting its lower highs and lower lows) converge, the trading volume shrinks, allowing consolidation to occur.

ADA/USD eight-hour chart

This wedge pattern is often highly bullish, with a break above the upper trend line signifying a possible trend reversal. Waiting for the breakout confirmation is crucial to avoiding fake price moves.

A volume indicator like the OBV (On Balance Volume) can be used to show if bulls have a greater influence on ADA price for a breakout. Short timeframe traders could consider exiting from their positions at $0.0440, $0.4800 and $0.5200 – Cardano price's medium-term target.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren