Cardano price holds key support, eying up new all-time highs

- Cardano price held a key moving average on the 12-hour chart after a brief pullback.

- The digital asset will encounter weak resistance above its current price.

- Several metrics indicate that ADA is poised to reach new all-time highs.

Cardano had a massive 40% breakout thanks to the launch of ADA trading on Coinbase pro. In the past 24 hours, the digital asset had a healthy pullback with the intention to resume the uptrend as soon as possible.

Cardano price aims for new all-time highs

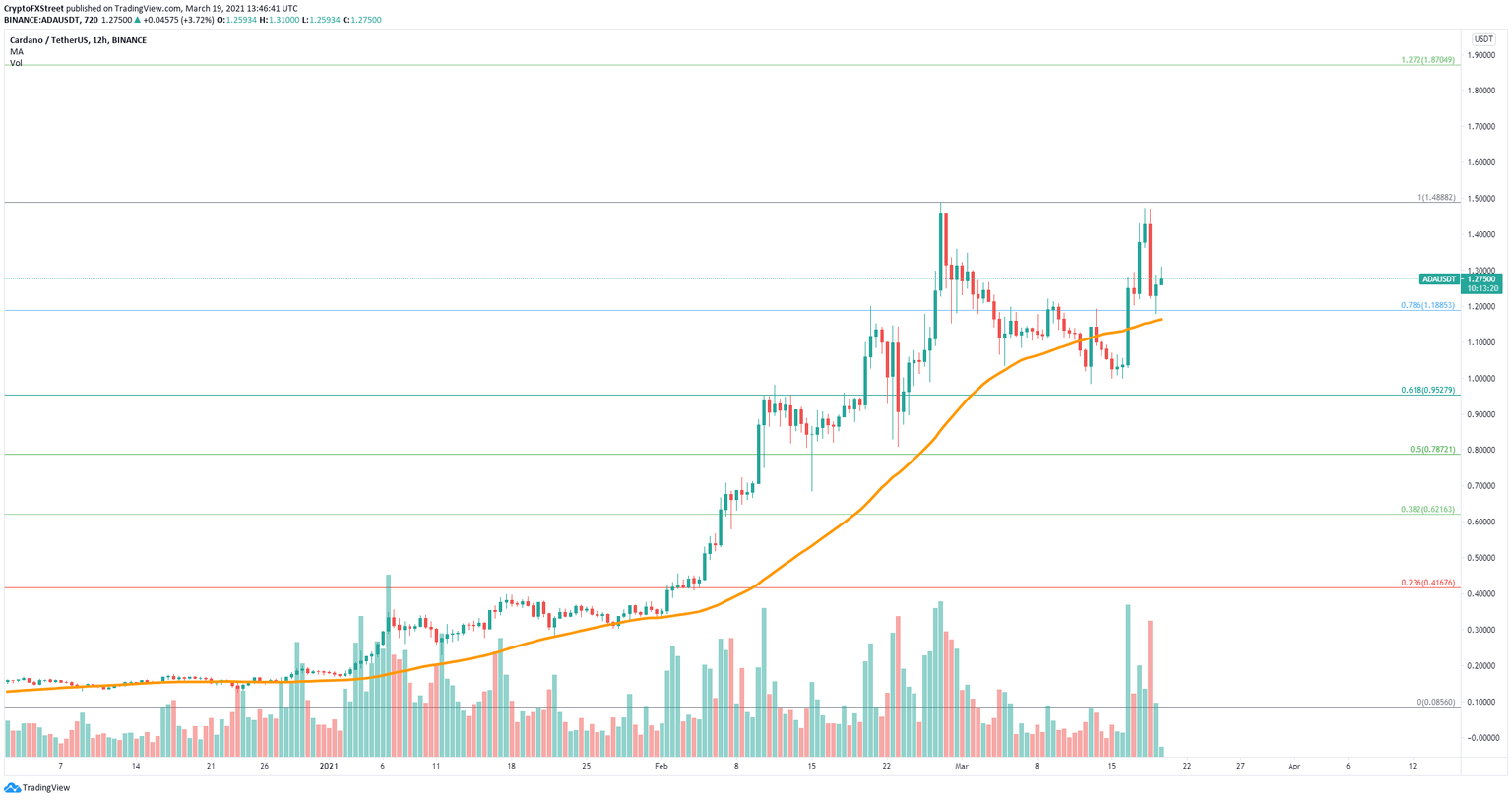

On the 12-hour chart, after climbing above the 50-SMA thanks to Coinbase's announcement, Cardano had a major move towards the previous all-time high at $1.48 but suffered a healthy pullback down to the support level, which bulls managed to hold.

ADA/USD 12-hour chart

A rebound from this key support level should be enough for ADA bulls to drive the price towards new all-time highs. The In/Out of the Money Around Price (IOMAP) chart indicates that Cardano only faces one strong resistance level.

ADA IOMAP chart

The area between $1.34 and $1.36 holds a volume of 2.69 billion ADA from almost 50,000 addresses. A breakout above this point should easily push Cardano towards $1.48. The next price target is located at $1.87, which is the 127.2% Fibonacci level.

On the other hand, to invalidate the bullish outlook, bears must push Cardano price below the 78.6% Fibonacci Retracement level, which coincides with the 50-SMA at $1.16. A breakdown below this point has a price target of $0.95.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.