Cardano Price Forecast: Grayscale files for ADA ETF with NYSE

- Cardano price continues to recover slightly on Tuesday after a rebound of almost 5% the previous day.

- Crypto asset manager Grayscale has filed for a Cardano ETF with the New York Stock Exchange on Monday.

- The technical outlook and on-chain data suggest a sustained price recovery is likely.

Cardano (ADA) price continues to recover by 6% and trades around $0.75 at the time of writing on Tuesday after retesting its key support level the previous week. Crypto asset manager Grayscale has filed for a Cardano exchange-traded fund (ETF) with the New York Stock Exchange (NYSE) on Monday. The technical outlook and on-chain data for ADA suggest further recovery.

Grayscale files for Cardano exchange-traded fund

Crypto asset manager Grayscale filed for a Cardano ETF with the New York Stock Exchange on Monday, expanding its crypto ETF offerings after recent Ripple (XRP), Solana (SOL), and Litecoin (LTC) ETFs applications.

ETF fillings by big investment companies are generally positive signs for Cardano in the long term, as an ETF can make it easier for traditional investors to gain exposure to ADA without needing to purchase and store the cryptocurrency directly. Moreover, approving an ETF could lend more legitimacy to ADA and increase liquidity.

Cardano technical outlook: Recovery on the cards

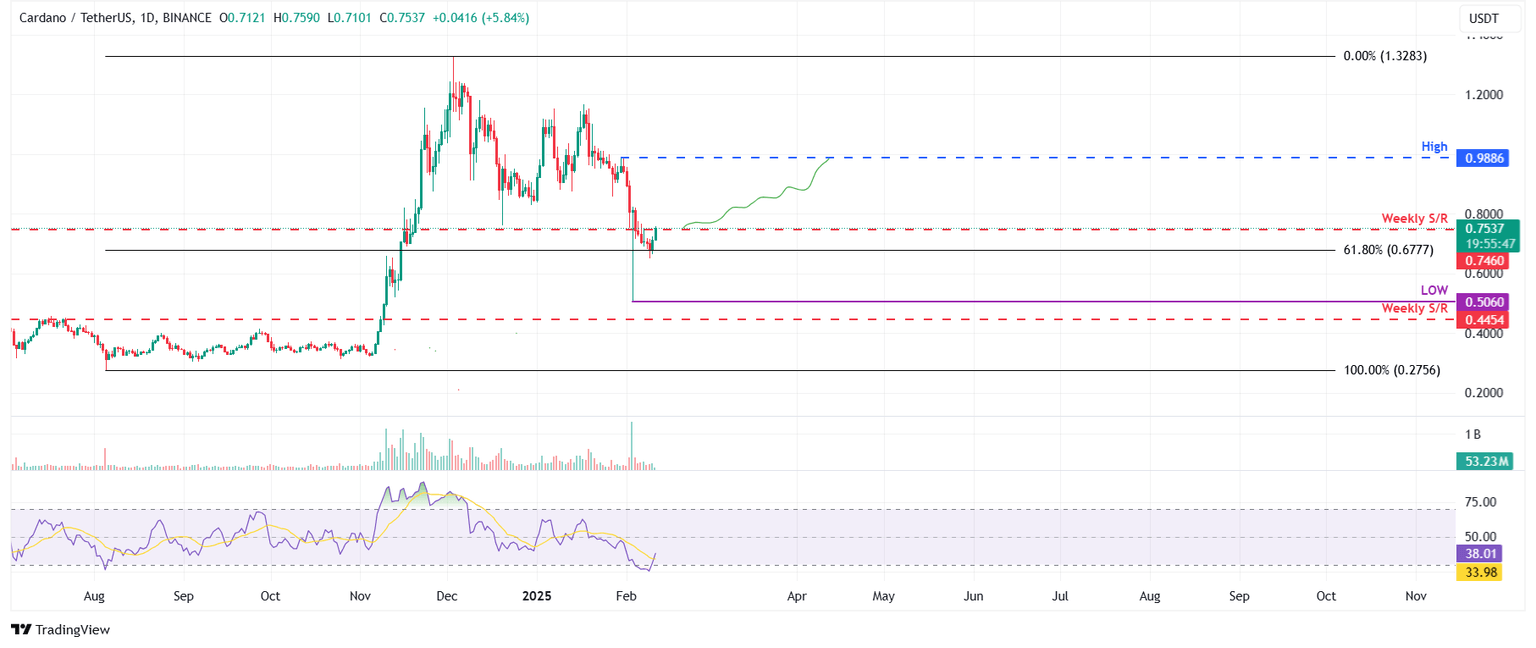

Cardano price found support around its 61.8% Fibonacci retracement level (drawn from the August 5 low of $0.27 to the December 3 high of $1.32) at $0.67 on Sunday and rose 4.51% on Monday. At the time of writing on Tuesday, it continues to recover by 6%, breaking above its weekly resistance at $0.74.

If ADA breaks and closes above its $0.74 weekly resistance, it could extend the recovery to retest its high of $0.98.

The Relative Strength Index (RSI) on the daily chart reads 38, bouncing off from its oversold level of 30 on Sunday, indicating a mild rise in bullish momentum. However, the RSI must trade above its neutral level of 50 for the bullish momentum to be sustained. Such a development would add a tailwind to the recovery rally.

ADA/USDT daily chart

According to Coinglass’s OI-Weighted Funding Rate data, the number of traders betting that the price of ADA will slide further is fewer than that anticipating a price increase.

This index is based on the yields of futures contracts, which are weighted by their open interest rates. Generally, a positive rate (longs pay shorts) indicates bullish sentiment, while negative numbers (shorts pay longs) indicate bearishness.

In the case of ADA, the metric increased from -0.0098% on Monday to 0.0041% on Tuesday, reflecting a positive rate and indicating that longs are paying shorts. This scenario often signifies bullish sentiment in the market, suggesting potential upward pressure on Cardano’s price.

ADA OI-Weighted Funding Rate chart. Source: Coinglass

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.