Cardano Price Forecast: ADA traders position price action at key crossroads just hours before Fed speech

- Cardano price keeps trading near $0.38 for the sixth day in a row.

- ADA has received numerous rejections and false breaks to the upside.

- Bulls keep buying and supporting price action as a breakout trade is signalled.

Cardano (ADA) price is in rough territory as bears dig trenches to defend the last line of bearishness that is still left over from the crypto winter. With a big pivotal level and a technical moving indicator, bulls are facing a very hard patch to go through. The white knight in shining armour that could help ADA bulls take the bearish fortress could well be Fed Chair Jerome Powell if he delivers a light dovish tone with a 25-basis-point hike this Wednesday evening near 19:00 GMT.

Cardano price is set to pop 10% in the last trading hours of Wednesday

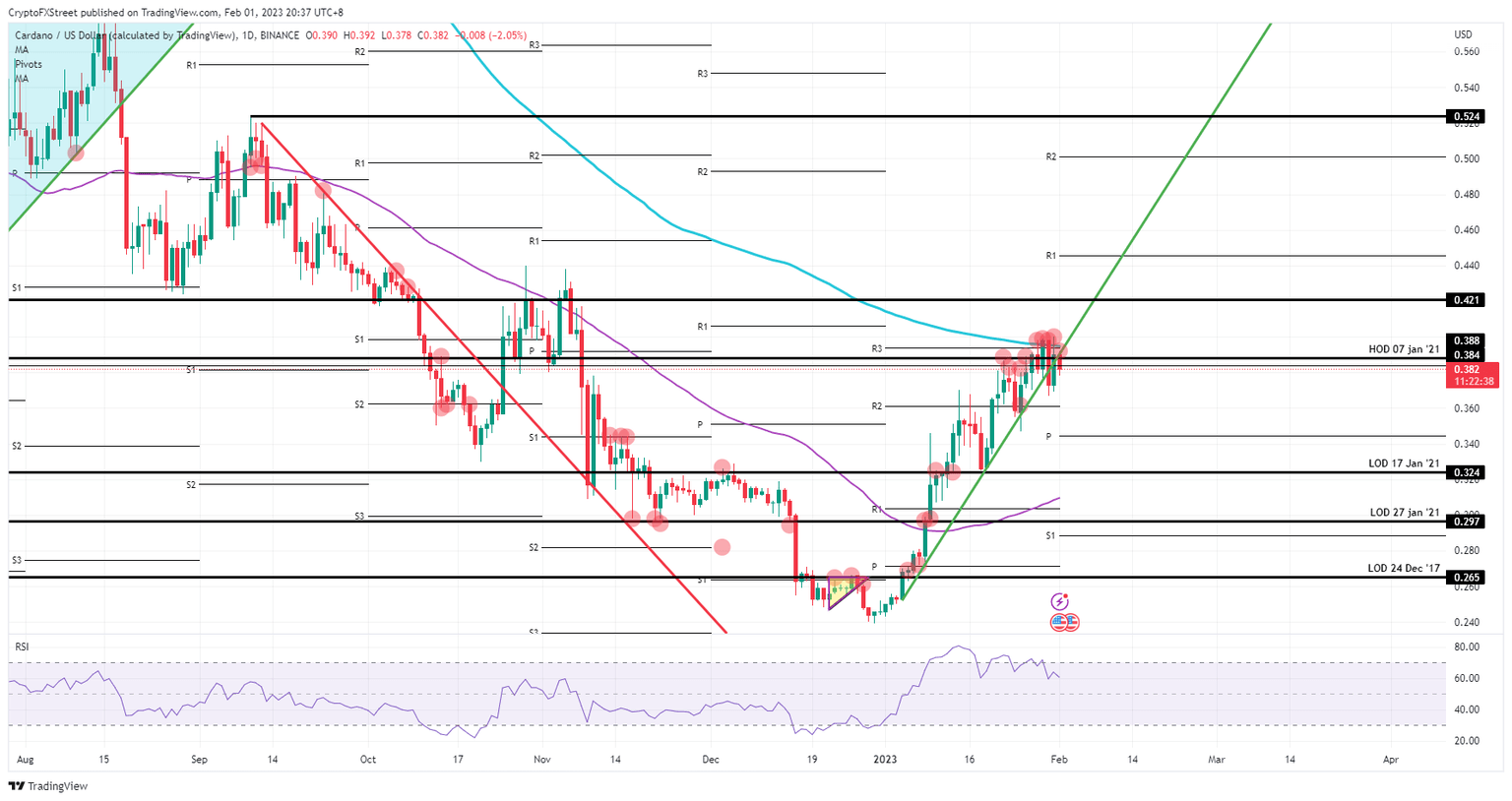

Cardano price looks like a famous episode from the HBO hit Game of Thrones called the “Battle of the Bastards.” To spare any more comparisons for those who are not yet familiar with the series or the episode: Bulls are being smashed against a massive bearish castle wall that exists out of the historic pivot level near $0.388, the 200-day Simple Moving Average (SMA) at $0.396 and the monthly pivot level from January. Although bulls received plenty of rejections and false breaks that normally bears would use to run price action into the ground, that has not happened.

ADA bulls are sticking to their belief that 2023 is a turnaround year and the crypto winter is long due for a defrosting period. To break the bearish castle and its defences, a daily close above the 200-day SMA needs to unfold. Then, and only then, can bulls advance toward $0.421 in the near term and to $0.524 in the longer term. Luckily for the bulls, markets expect that Jerome Powell, the chairman of the Fed, will be the white knight to create a much-needed breakthrough with a less restrictive monetary policy and to underlie the good elements that are helping inflation lower.

ADA/USD daily chart

A big systemic risk is another rejection this Wednesday due to a hawkish Powell. This would disappoint the markets and could pour cold water on the hopes for a Goldilocks scenario. The Relative Strength Index (RSI) seems to be pointing in that direction, while the price action is not selling off and the RSI is trending down as selling occurs. In case the positive mood dissipates after the Fed, ADA will drop back to $0.324 in search of support and lose roughly half of its gains for 2023.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.