Cardano Price Forecast: ADA outperforms Solana as DeFi TVL nears $700M

- Cardano price settles at $1.20 on Wednesday, outperforming Solana and Ethereum with a 109% gain since Gensler hinted at his SEC exit on November 14.

- Cardano’s TVL grew $373 million, signaling a 120% increase in demand for DeFi projects built on the blockchain over the last 20 days.

- Technical indicators suggest more upside potential as bulls mount steady support at the $1.20 territory.

Cardano price held firm above $1.20 on Wednesday. Recent on-chain inflows observed amid Gensler’s imminent exit suggest the rally could advance further toward $1.50 in the days ahead.

Cardano has outperformed Solana and Ethereum since Gensler’s SEC exit confirmation

Cardano has closed at a higher price in 17 of the last 20 trading days, outperforming the likes of Solana and Ethereum and smashing various major milestones along the way.

First, ADA closed November 2024 with over 230% gains, making its best-performing month since August 2021.

More so, as ADA’s price hit $1 on November 23, Cardano’s market capitalization crossed the $40 billion mark for the first time in three years.

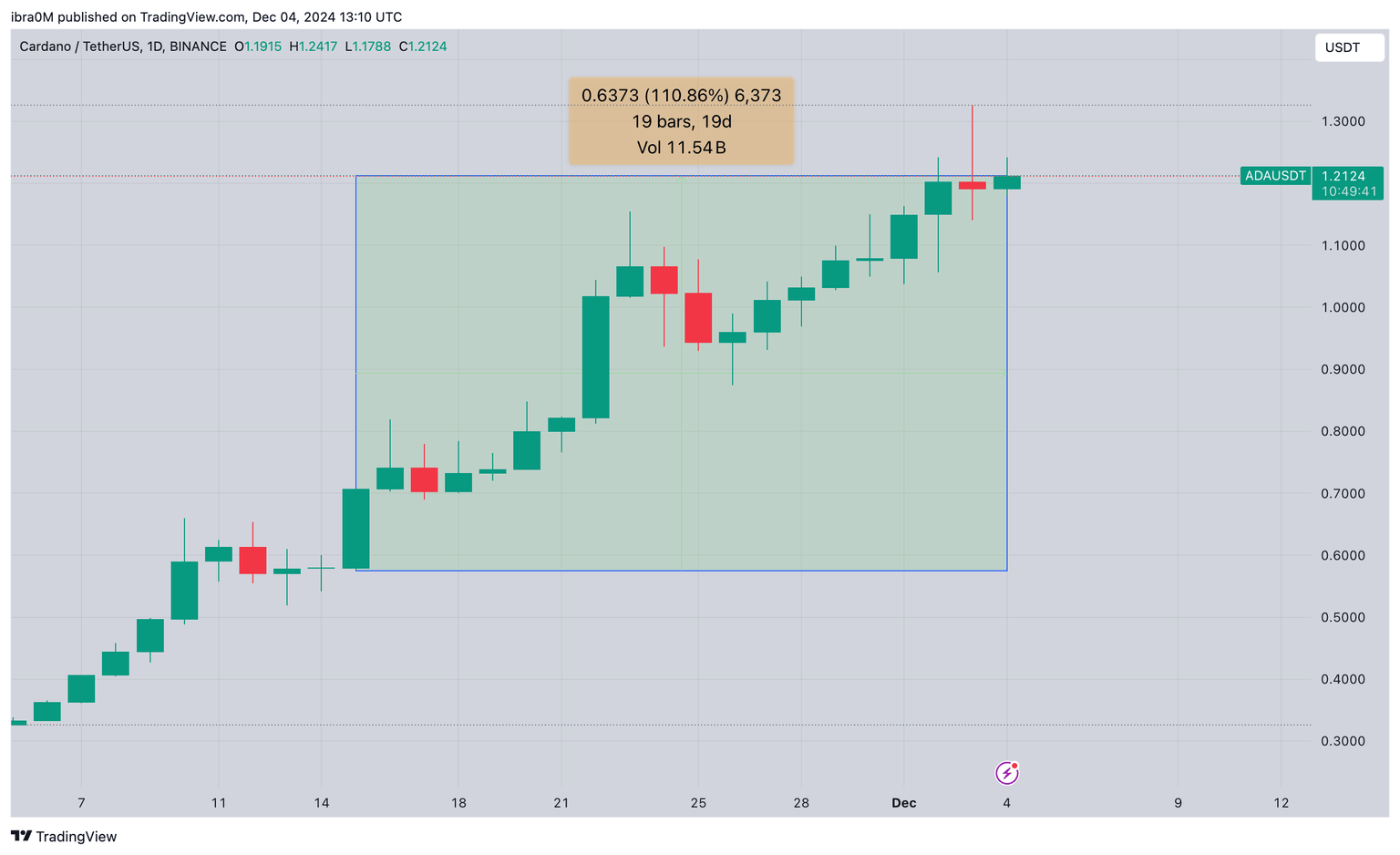

Cardano price action | ADAUSDT (Binance)

Recent market reports show that Cardano’s ongoing price rally has coincided with the expected exit of the United States (US) Securities and Exchange Commission (SEC) Chair, Gary Gensler.

Cardano price traded as low as $0.57 on November 14, when Gensler first hinted at his exit.

Since then, ADA has increased by 110%, hitting the $1.20 level at the time of writing on Wednesday, outperforming Solana and Ethereum.

Cardano TVL nears $700M milestone after 120% surge in 20 days

At first glance, Cardano’s recent 110% price gains have coincided with increased short-term demand for assets viewed as undervalued due to SEC litigation in recent years.

However, a closer look at critical on-chain data trends suggests the ADA price rally has been supported by organic demand for projects hosted on the Cardano blockchain.

Confirming this narrative, the DeFilama chart below tracks real-time changes in the total value of assets locked within the Cardano DeFi ecosystem.

This provides clear insights into changes in network demand and user activity around key market events.

Cardano Total Value Locked (TVL) | Source: DeFillama

The chart above shows that Cardano TVL stood at $313 million as of November 13.

That figure has since skyrocketed by 120% to hit the $685 million area on Wednesday, reflecting a 120% increase since Gensler’s exit hint hit the newsreels.

As more users deploy assets and perform DeFi transactions on the Cardano blockchain, it increases demand for ADA, in the form of transaction fees and gas.

This paints a long-term bullish outlook for Cardano price action, driven by two key factors.

First, the 120% growth in TVL over the last 20 days exceedsADA’s 110% price gains.

This rare market dynamic suggests that the ongoing rally has been driven predominantly by organic network demand rather than short-term speculative frenzy.

Second, the surge in TVL highlights growing confidence in Cardano's DeFi ecosystem, particularly after the regulatory headwinds in the US following SEC Chair Gary Gensler’s decision to step down.

Cardano price forecast: $1.50 breakout ahead if $1.20 support holds

With TVL growth currently outpacing price, Cardano price still has considerable upside potential, which could evolve into another leg-up towards the $1.50 level in the near term.

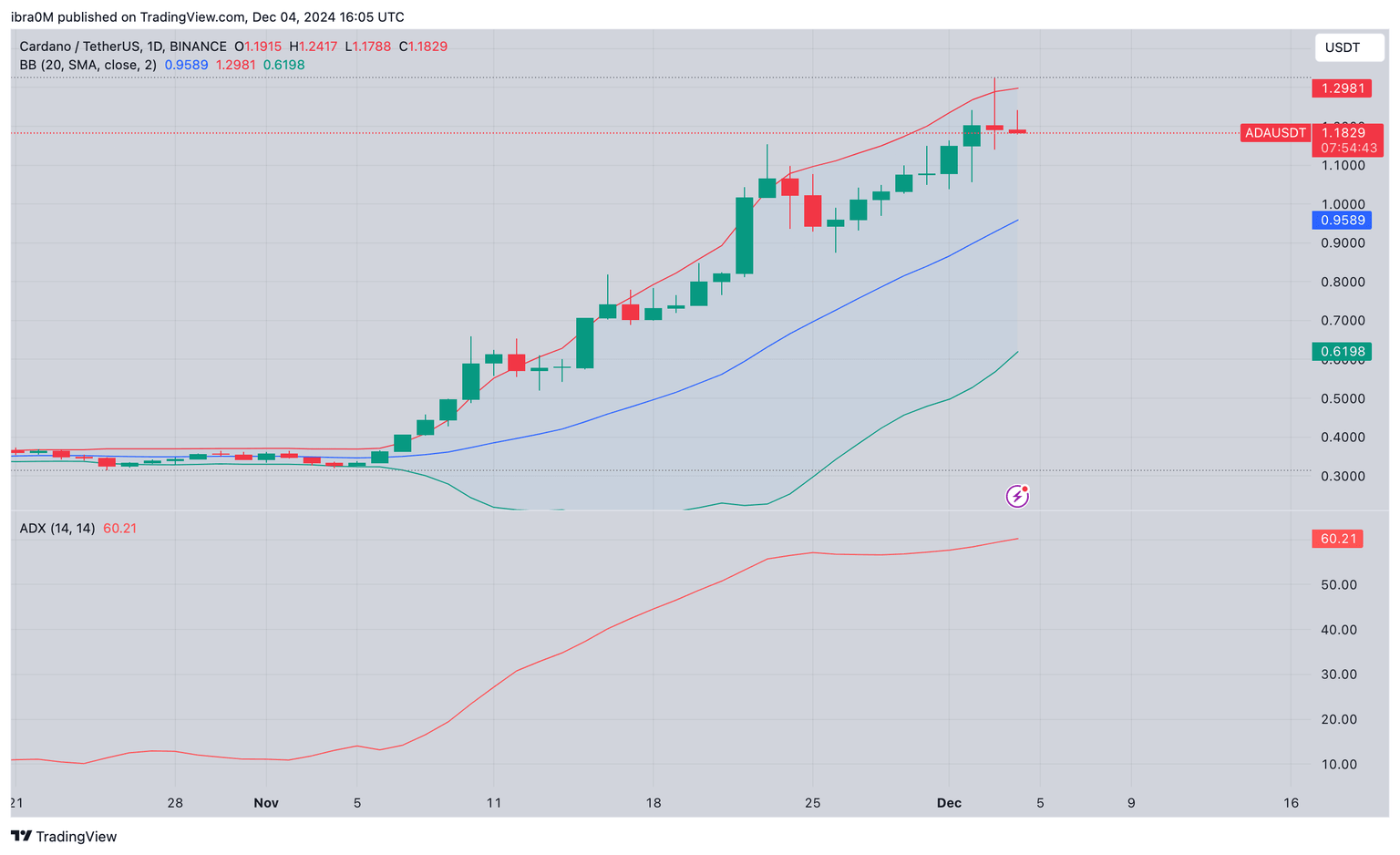

Cardano Price Forecast | ADAUSDT

Technical indicators on the ADAUSD daily chart also support this bullish ADA price forecast narrative.

The widening Bollinger bands signals increased buying momentum. If $1.20 holds, ADA bulls could aim for a swift move toward the upper Bollinger Band at $1.30, paving the way for a potential rally to the $1.50 psychological resistance.

More so, the Average Directional Index (ADX), rising above 60, signals that ADA is still trending in bullish territories.

However, on the downside, failure to hold $1.20 could shift focus back to $0.95 as the next major support.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.