Cardano Price Forecast: ADA on cusp of colossal breakout toward $2

- Cardano price has formed a bull flag on the 3-day chart.

- ADA faces one key resistance level before a potential massive breakout to new all-time highs.

- On-chain metrics suggest that ADA bulls will encounter relatively weak resistance ahead.

After establishing a new all-time high of $1.48 on February 27, Cardano (ADA) has been trading sideways, forming a potential bull flag on the 3-day chart. There is only one crucial resistance level that separates ADA from a massive breakout.

Cardano price must conquer this barrier to see new all-time highs

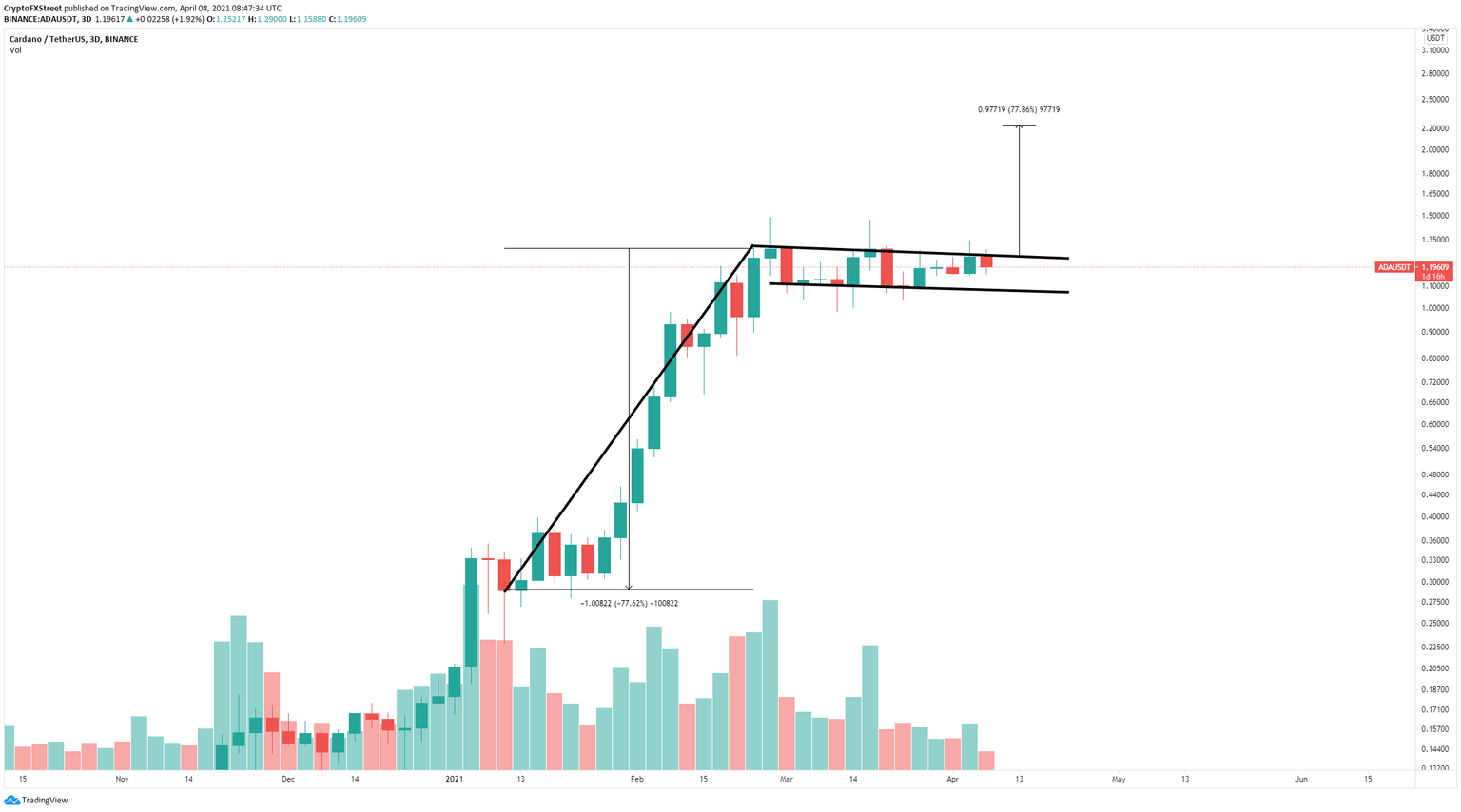

On the 3-day chart, Cardano has formed a potential bull flag with a resistance trend line at $1.25. This key barrier separates ADA from a 77% breakout, calculated using the pole's height as a reference point. This breakout would have ADA trading near $2.20.

ADA/USD 3-day chart

But how likely is Cardano to break this key level?

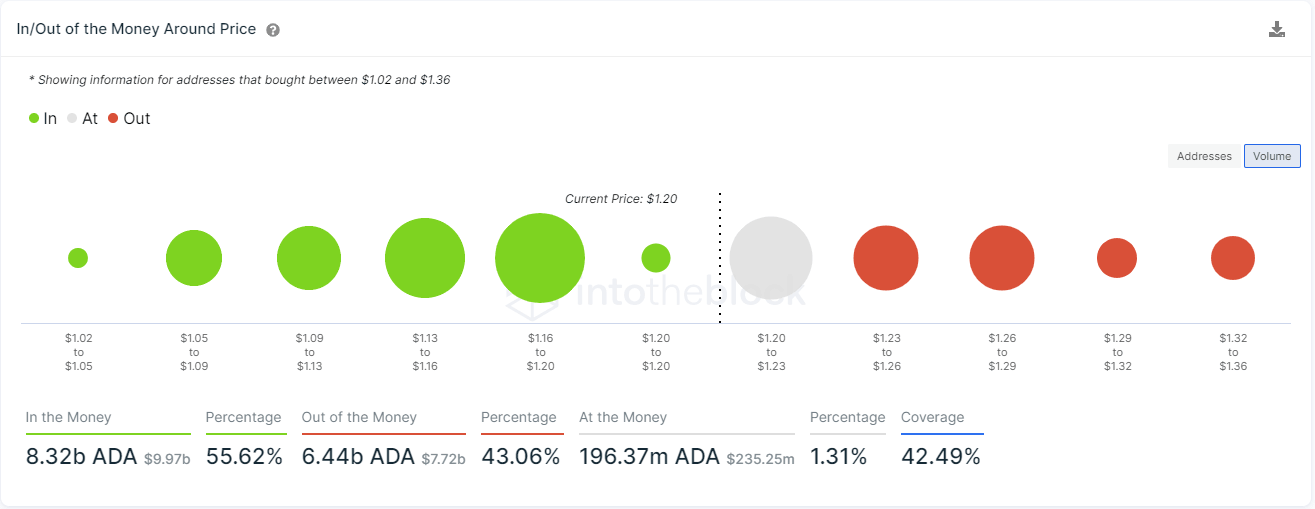

The In/Out of the Money Around Price (IOMAP) chart suggests that the most substantial resistance area is located between $1.20 and $1.23, where 120,000 addresses purchased 2.65 billion ADA. However, above this point, there are relatively weaker resistance levels.

ADA IOMAP chart

So far, Cardano price has been rejected from the upper trend line at $1.25 several times in the past month. The most recent rejection could lead ADA toward the lower boundary of the pattern at $1.07.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.