Cardano Price Forecast: ADA needs at least 6% rally before bulls return

- Cardano price is trading at $0.2674 after a 12% recovery rally in the last week.

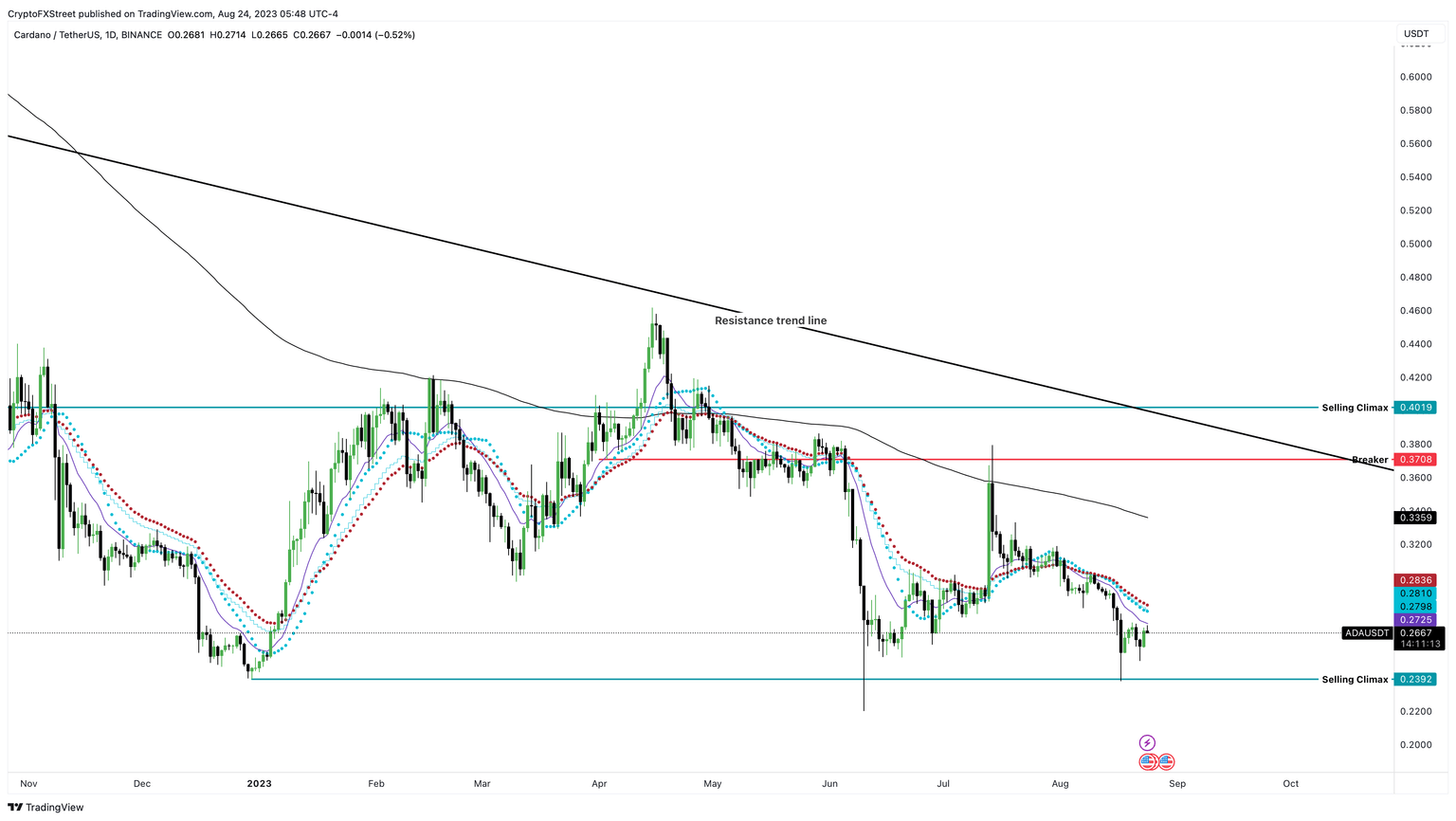

- If ADA can rally 6% and flip $0.2836, it could trigger an 18% move to $0.3359.

- In a highly bullish case, the altcoin could shoot up to $0.3708.

- A daily candlestick close below the $0.2392 support level will invalidate the bullish thesis.

Cardano price slips into consolidation mode after August 17’s decline. The consolidation is an opportunity in disguise for sidelined buyers as the end of this accumulation phase is likely to result in another upside move to key resistance levels.

Also read: Cardano price nearing June lows could extend the losses for more than 3.8 million investors

Cardano price needs to overcome a few hurdles

Cardano price has been on a steady downtrend since September 2021. From May 2022, however, ADA slipped into a consolidation phase. After 469 days of sideways moves, the altcoin currently trades at around $0.2668.

The price action between January and August 2023 suggests that a triple tap bottom formation is in play. But the breakout is far away, or at least until Cardano price manages to overcome the Exponential Moving Average (EMA) hurdle zone, which extends from $0.2725 to $0.2810.

Cardano price needs to rally at least 6% to retest the $0.2810 hurdle. Flipping this barrier into a support floor will be key for bulls and a buy signal for sidelined buyers. Successfully overcoming this blockade will open ADA up for an 18% ascent to tag the 200-day Simple Moving Average at $0.3359.

In a highly bullish case, ADA could shoot up to $0.3708, or a 40% gain from the current price.

ADA/USDT 1-day chart

However, if Cardano price produces a daily candlestick close below the $0.2392 support level it will create a lower low and invalidate the bullish thesis. In such a case, ADA could retest the June 10 swing low at $0.2200, which would represent an 8% fall from current price levels.

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.