Cardano Price Forecast: ADA joins the party, revealing extraordinary upside potential

- Cardano price breakout from trading range delivers largest daily gain since March.

- Polygon (MATIC) precedent suggests the ADA rally is just beginning.

- ADA/BTC pair is on the verge of an explosive rally.

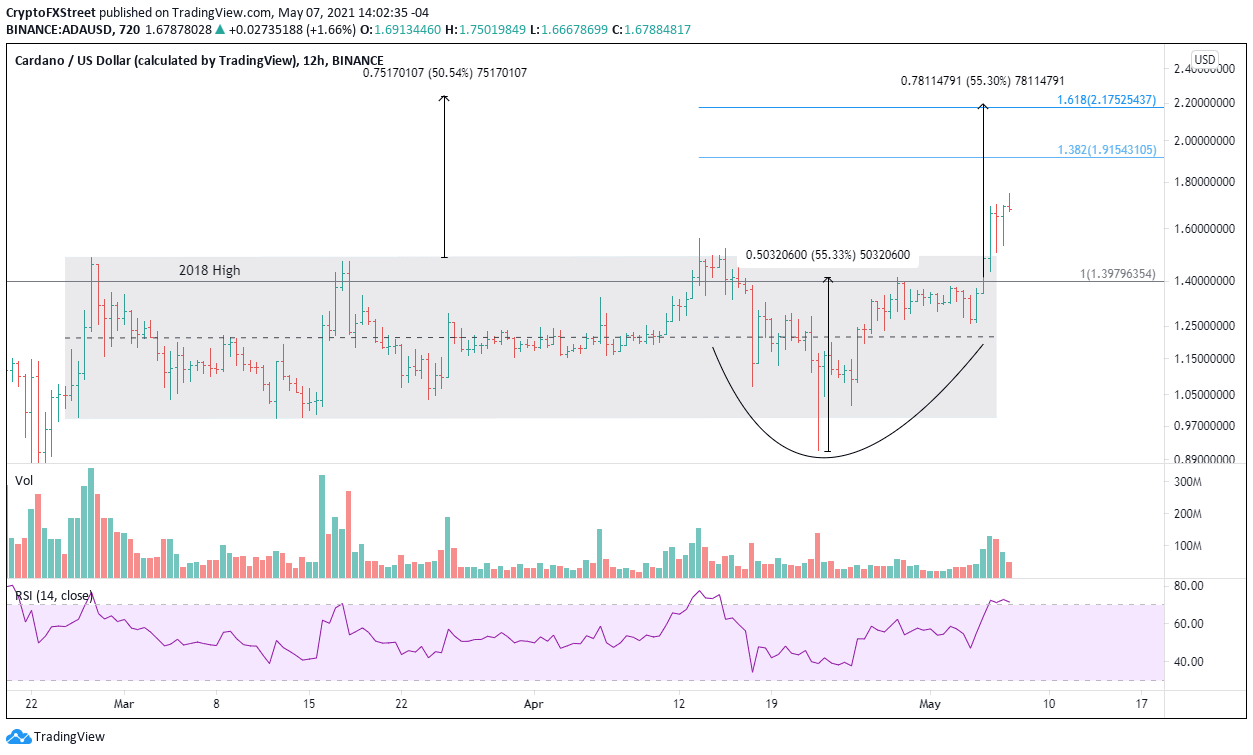

Cardano price successfully released from a bullish cup-with-handle pattern on May 5, kickstarting a rally through the longstanding trading range highs while setting new all-time highs in the process. Historical precedent suggests that ADA has further to rally moving forward.

Cardano price catches the fever for altcoins

During March and April, Polygon (MATIC) moved in a well-defined 50% trading range before unleashing a furious 100% rally over five days. As a result, MATIC was one of the first cryptocurrencies to print an all-time high following the cryptocurrency correction in April.

MATIC/USD 12-hour chart

On May 5, Cardano price began a new rally from a similar trading range as MATIC, presenting a bullish investment opportunity for traders.

Since the breakout originated from a cup-with-handle base, the measured move target is $2.19, a gain of 55% from the handle high and 29% from the price at the time of writing. The target fits perfectly with the 161.8% Fibonacci extension of the cup-with-handle pattern at $2.17, and the trading range measured move target of $2.23. It is a 50% return from the range’s upper boundary.

Cardano price will need to overcome resistance at $1.91, the 138.2% extension level and the psychologically important $2.00 to reach the target prices.

ADA/USD 12-hour chart

Of course, Cardano price could fail and revert lower. The first necessary support is the 10-week simple moving average (SMA) at $1.24 and then the midline of the trading range at $1.21.

To advance the bullish outlook, the ADA/BTC pair graph illustrates a cup-completion-cheat pattern, offering early entry into the shift in Cardano price relative strength. A cup-completion-cheat is pattern that forms following a break in the downtrend and in the lower third of the eventual cup.

A breakout from this pattern would further confirm that Cardano price is in the early stages of an explosive move.

ADA/BTC weekly chart

The historical precedent of MATIC, combined with the power of the new rally and the almost-perfect base for ADA/BTC, creates an extraordinary opportunity for traders in the coming weeks.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.