- Cardano price trades down by 11.5% on Monday after rallying 72.15% the previous day.

- US President Donald Trump’s announcement of a US ‘Crypto Strategic Reserve’ boosted ADA price.

- On-chain and technical outlook suggest a rally continuation as ADA’s open interest and trading volume rise.

Cardano (ADA) price trades down by 11.5%, around $1 at the time of writing on Monday, after rallying more than 70% the previous day. US President Donald Trump’s announcement on his Truth Social platform of a US ‘Crypto Strategic Reserve’ boosted Cardano’s price on Sunday. On-chain and technical outlook suggest a rally continuation as ADA’s open interest and trading volume rise.

Donald Trump’s announcement of ‘Crypto Strategic Reserve’ boosts Cardano price

US President Donald Trump announced on his Truth Social platform on Sunday a US ‘Crypto Strategic Reserve,’ including Bitcoin (BTC), Ethereum (ETH), XRP (Ripple), Solana (SOL), and Cardano (ADA), aiming to boost America’s crypto leadership.

He wrote: “A US Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the US is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

Cryptocurrency valuations leaped upward after this announcement, with Cardano rallying more than 70% that day.

Cardano Price Forecast: Bulls aiming for the $1.32 mark

Cardano price broke above a descending trendline (drawn by connecting multiple highs since mid-January) on Sunday and rallied 72.15%. When writing on Monday, it trades slightly down around $1.

If Cardano continues its upward momentum, it could extend the rally to retest its December high of $1.32.

The Relative Strength Index (RSI) on the daily chart reads 67, above its neutral level of 50, indicating a strong bullish momentum. Moreover, the Moving Average Convergence Divergence (MACD) indicator also shows a bullish crossover on Sunday, giving a buy signal and suggesting an upward trend.

ADA/USDT daily chart

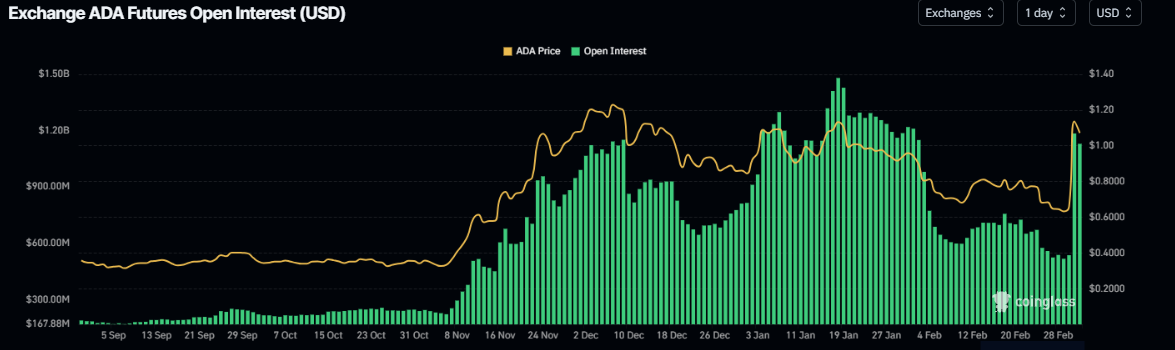

Cardano’s Open Interest (OI) further supports the bullish outlook. Coinglass’s data shows that the futures’ OI in ADA at exchanges rose from $536 million on Saturday to $1.18 billion on Sunday, the highest level since early February. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the ADA price.

Cardano Open Interest chart. Source: Coinglass

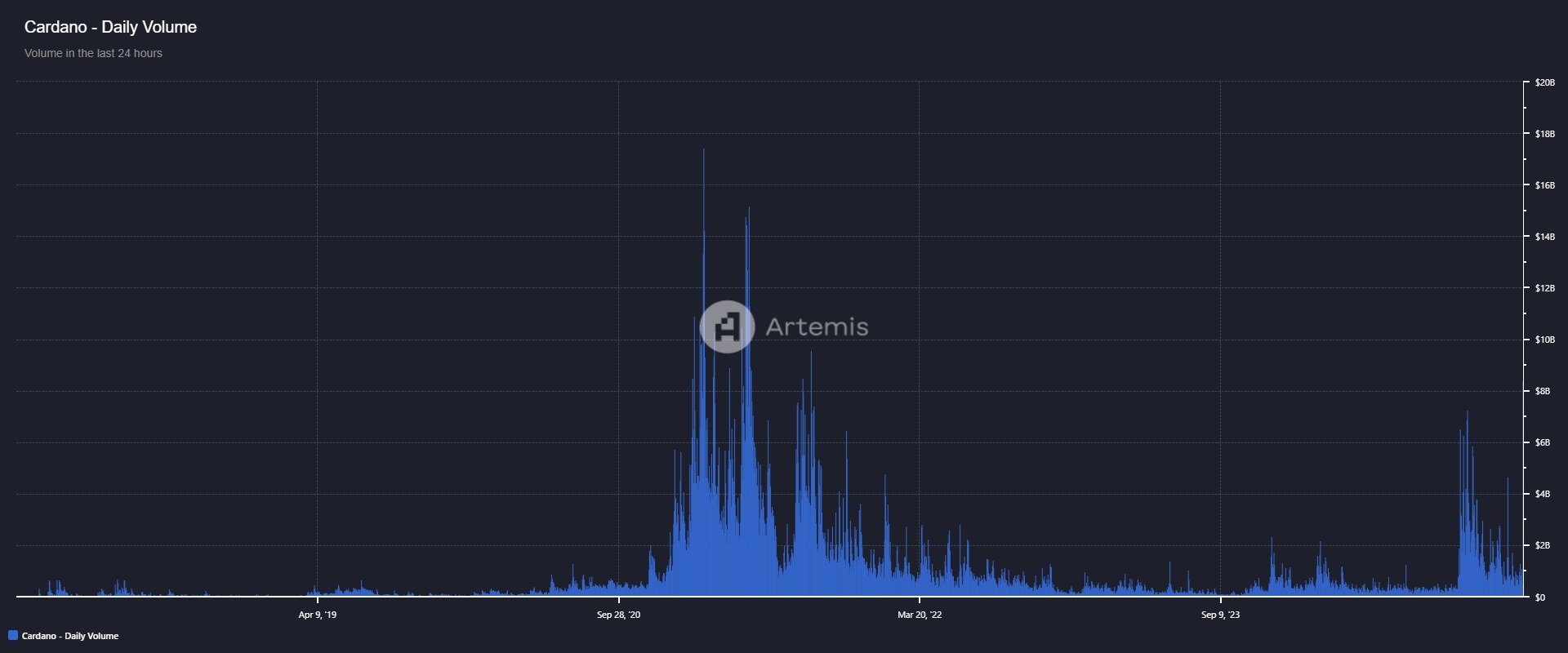

Another factor bolstering the platform’s bullish outlook is a recent surge in traders’ interest and liquidity in the ADA chain. Artemis data shows that ADA Chain’s trading volume rose from $536.9 million on Saturday to $8.4 billion on Sunday, the highest since September 2021.

Cardano trading volume chart. Source: Artemis

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.