Cardano Price Forecast: ADA aims for $0.50 with little to no resistance ahead

- Cardano price aims for a 30% upswing as the critical supply barrier at $0.35 is breached.

- Increasing on-chain investor activity provides further bullish confirmation to the incoming surge to $0.50

- ADA price needs to keep above the $0.35 support level to continue its uptrend, failing to do so could invalidate the bullish thesis.

Cardano price broke out of a consolidation pattern as it surged by more than 15% on February 1. The ongoing bullish momentum could push ADA’s market value towards $0.50 as several on-chain metrics turn bullish.

Cardano price targets higher highs

After going through a two-week-long consolidation period, Cardano price seemed primed to breakout. The development of a symmetrical triangle on ADA’s 12-hour chart suggested that a spike in volatility was going to see it move by 30% in either direction.

Fortunately for the bulls, a recent increase in buying pressure was significant enough to send Cardano through the $0.35 resistance barrier, which served as confirmation of the optimistic outlook.

Now, a continuation of the uptrend is very likely if ADA keeps trading above the $0.35 support level and the 50 twelve-hour EMA.

ADA/USDT 12-hour chart

Indeed, IntoTheBlock’s In/Out of the Money Around Price (IOMAP) shows that there is little to no resistance ahead of Cardano that will prevent it from achieving its upside potential. Although there are some underwatered investors, they aren’t as significant as those who are “In the Money.”

Cardano IOMAP

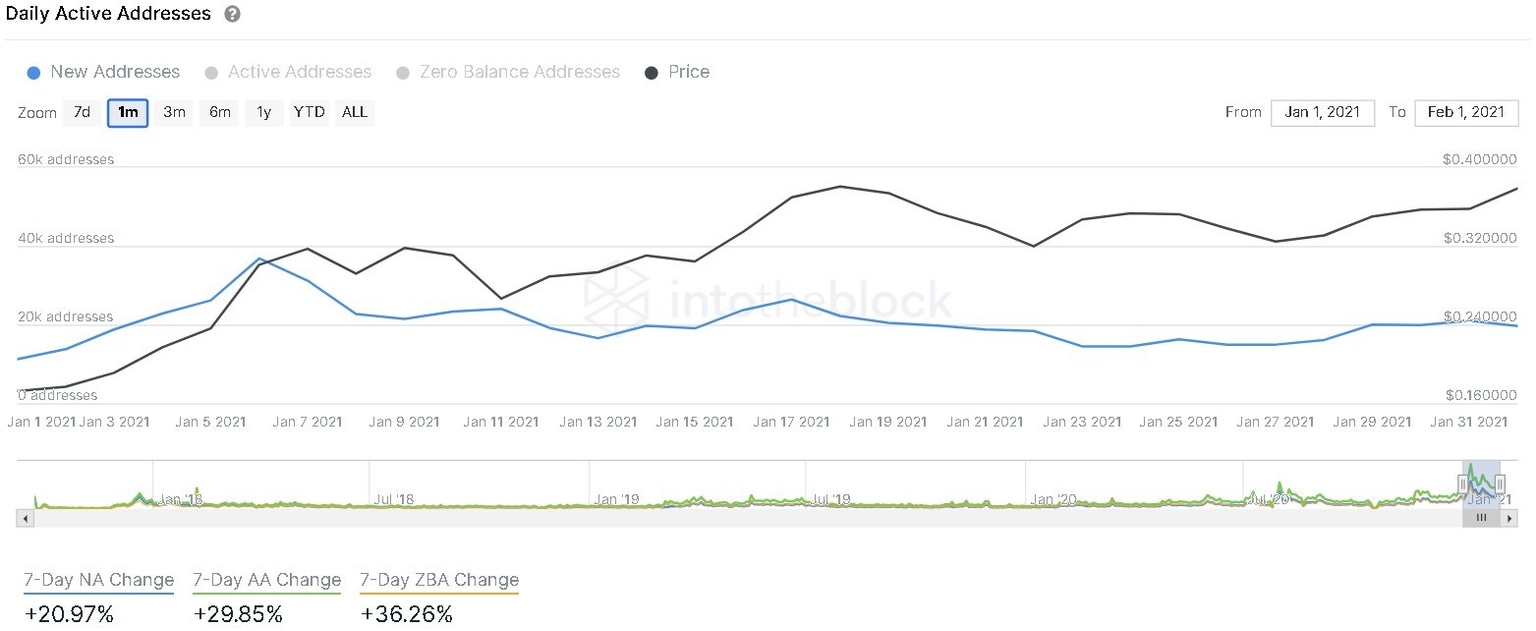

Adding credence to the bullish bias is a healthy uptick in daily active addresses. More than 19,000 new addresses are joining the network today, representing a 30% upswing over the past week. Such market behavior shows that investors are interested in buying Cardano at the current price levels.

Cardano Daily Active Addresses chart

Regardless of the bullish outlook, a failure to hold above the $0.35 support level and the 50 twelve-hour EMA could invalidate the bullish thesis and lead to a steep correction pushing Cardano price towards the 100 or 200 twelve hour EMA.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.