Cardano price falls 4% despite mother company's open-source toolset launch for users

- Cardano price is down 4%, ignoring the bullish tone of a new feature released by mother company, Input Output Global Inc (IOG).

- IOG launched the open-source toolset, Marlowe, to allow users to create smart contracts and dApps on the Cardano blockchain.

- The innovation gives users a chance to present their dApp ideas to life on the Cardano blockchain.

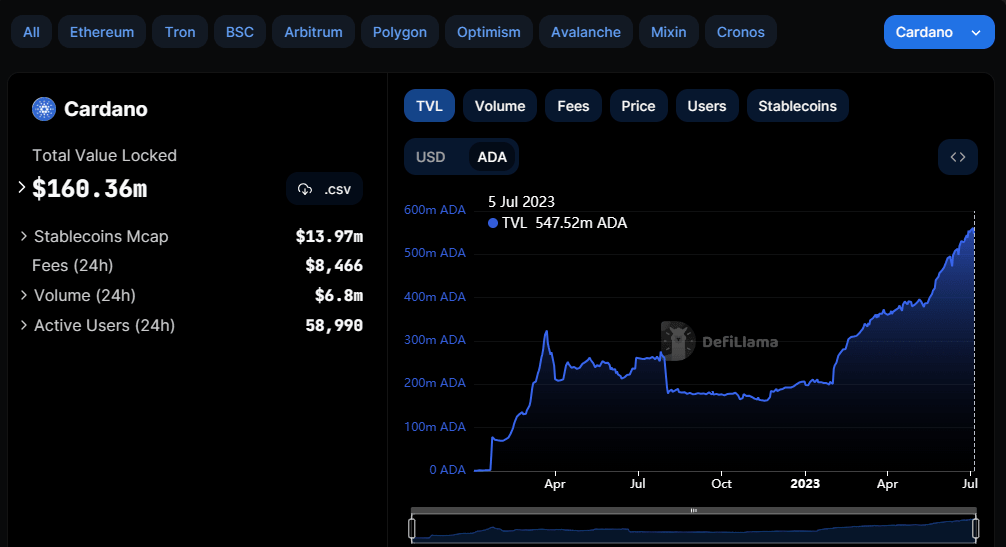

- As community members take in the news, ADA DeFi TVL has hit unprecedented levels approaching 550 million ADA.

Cardano (ADA) price is trading with a bearish bias, steadily writing off the gains made over the last week. The move is concerning given that the blockchain's users now have a new toolset where they can develop smart contracts and build decentralized applications (dApps). The move is part of individual efforts by projects in the crypto ecosystem to increase the value of their tokens.

Also Read: LUNC community calls for Binance CEO's leadership as Terra Luna Classic price falls 25%

Cardano price ignores new feature by mother company

Cardano (ADA) price is down almost 5% over the last day, a gains-shedding exercise that began on July 4. However, the two-day downtrend has not invalidated the altcoin's overall bullish outlook as ADA continues consolidating above an uptrend line with the Parabolic SAR indicator tracking the price from below.

ADA/USDT 1-Day Chart

The downswing in ADA market price is unprecedented, considering a new development by the company behind the Cardano blockchain, Input Output Global Inc. (IOG).

IOG launches Marlowe toolkit to allow anyone to build blockchain apps on Cardanohttps://t.co/EsdzXOSkhR

— Cardano Feed ($ADA) (@CardanoFeed) July 5, 2023

In an official announcement from IOG, the Cardano mother company has launched a new toolkit where the blockchain's users can build blockchain applications. The toolset, christened Marlowe, provides a seamless way for ADA community members to "create smart contract and dApps with no prior programming knowledge or coding expertise.”

Citing a paragraph in the official announcement on the Cardano feed:

Marlowe has been designed to introduce greater efficiency in the smart contract and dApp design and rollout process. It features reusable and customizable templates, a built-in simulator to test contracts before deployment, easy setup and example applications, and powerful APIs.

Based on the announcement, IOG has integrated TxPipe, a platform owned by cloud-based Demeter Run, coming in to increase the toolset's functionality. Specifically, TxPipe will provide access to the tool's runtime without users setting up or maintaining their own infrastructure.

With these infrastructures in place, Cardano blockchain users, developers, and non-developers alike can enjoy unlimited access to the ADA blockchain technology. The innovation gives users a chance to present their dApp ideas to life on the Cardano blockchain.

Cardano TVL records new milestone

Cardano (ADA) price's bullishness is not limited to its price as the token's total value locked (TVL) has recorded a new milestone.

Exciting: Cardano Total Value Locked In DeFi Hit All-Time Highhttps://t.co/Mzy52ZSCec

— Cardano Feed ($ADA) (@CardanoFeed) July 5, 2023

According to data on DeFiLlama, TVL is 547.52 million ADA, marking a new all-time high. Cardanofeed.com attributes this surge to a growing interest in Cardano's decentralized finance (DeFi) ecosystem among investors and market players in general.

This is remarkable considering the dark clouds that continue to abound above ADA token after the US Securities and Exchange Commission (SEC), the infamous financial regulator, labeled it, among other altcoins, as securities.

In the aftermath of this bearish tag, several cryptocurrency-related platforms delisted the token, including Robinhood and Revolut. The former is an American stocks and cryptocurrency trading platform, while the latter is a European exchange and payments company.

After the SEC branded ten altcoins as securities, up to $50 billion in value was wiped out from the cryptocurrency market capitalization in 24 hours. This came as exchanges shied away from listing tokens listed in the regulator's bad books, while holders shilled them into cold wallets as they awaited the tension to die down.

Read on for Cardano price prediction.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.