Cardano price eyes 30% breakout if ADA bulls can overcome this strong hurdle

- Cardano price has been stuck inside a downward sloping parallel channel since August 31.

- Although ADA broke out on September 23, it awaits a retest to kick-start a new uptrend.

- If the $1.91 support floor is breached, it will invalidate the bullish thesis.

Cardano price is in a suspended state after its recent breakout from the bullish pattern. If ADA finds a launching pad, there is a high chance a new uptrend begins. Interestingly, there is a confluence of support, indicating a bullish outlook.

Cardano price awaits catalyzing agent

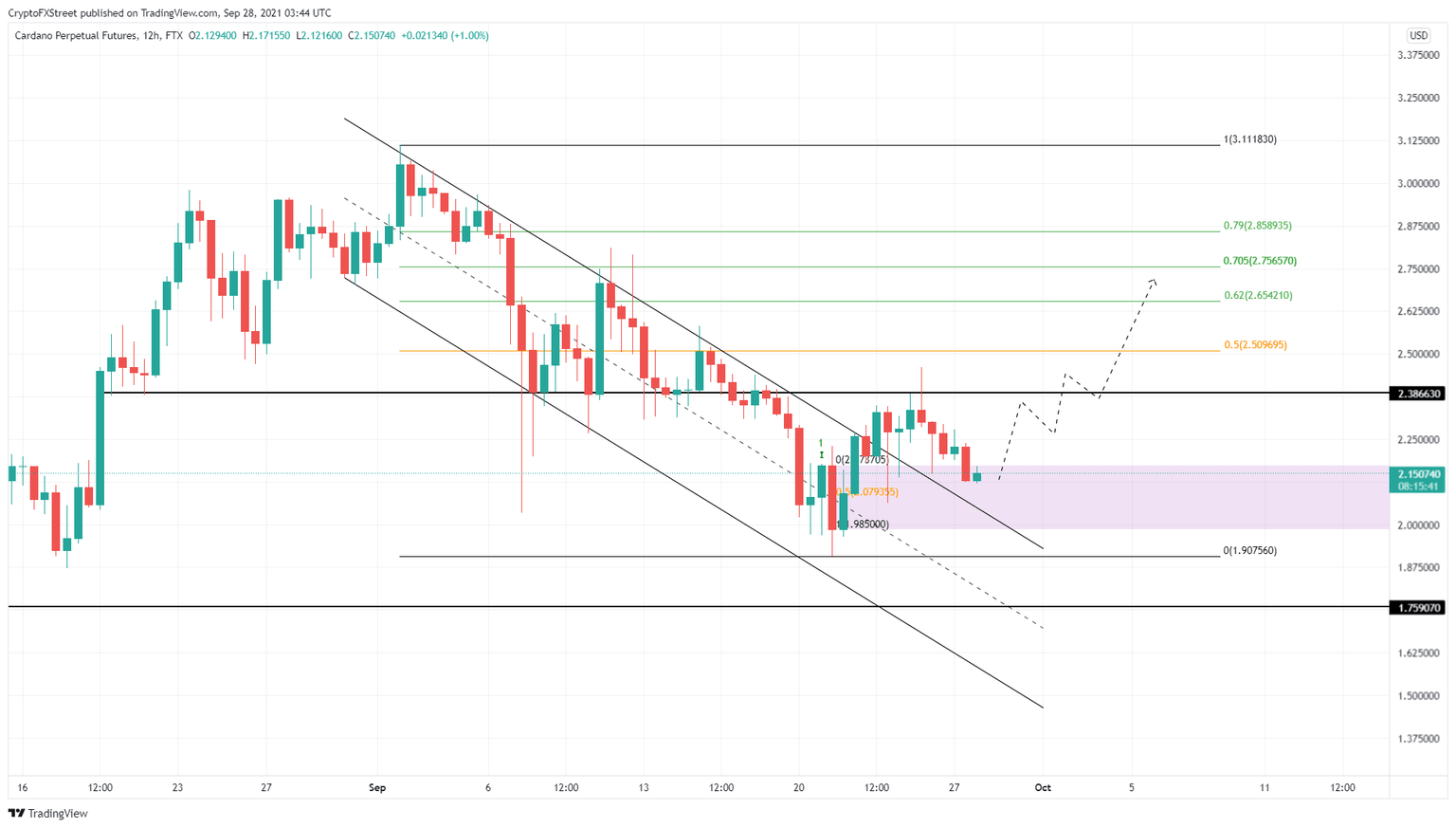

Cardano price bounced on September 21 to set up a swing high at $2.46 after a 28% ascent. This move was followed by a retracement to the demand zone, ranging from $1.99 to $2.17, which is likely to give it the boost necessary to rally.

ADA needs to grapple with the hurdle at $2.39 and produce a 12-hour candlestick close above it to have any chance of scaling higher highs.

Assuming Cardano price has the bullish momentum to flip $2.39 into a support level, investors can expect the uptrend to slice through the 50% Fibonacci retracement level at $2.51 and take aim at the high probability reversal zone extending from $2.65 to $2.86.

The ideal points where ADA could retrace due to profit-taking are $2.65 and $2.75

ADA/USDT 12-hour chart

On the other hand, if Cardano price fails to slice through $2.39, it will knock ADA back to the demand zone stretching from $1.99 to $2.17. A breakdown and a 12-hour candlestick close below the lower limit at $1.99 will create a lower low and invalidate the bullish thesis.

In this case, ADA could venture lower and retest the $1.76 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.