Cardano price drops ahead of Charles Hoskinson’s speech at US Congress Committee

- Charles Hoskinson was invited to speak at the US House of Representatives Committee on crypto and blockchain on June 23.

- Analysts are bullish on positive cryptocurrency regulation as Hoskinson would share his thoughts on crypto and address regulators.

- Still, the delay in the timeline of the Vasil hard fork may have serious consequences on ADA price.

Charles Hoskinson will speak about blockchain and cryptocurrencies in front of the US House of Representatives Committee on Agriculture on June 23. Proponents believe this is an exciting opportunity as Hoskinson’s message would reach Wyoming’s Senators and authors of the current crypto regulatory bill.

Charles Hoskinson to talk about crypto in front of the US Congress Committee

On June 17, Charles Hoskinson, the co-founder of IOG (formerly IOHK), said he was invited to speak at a US Congressional Committee on blockchain and cryptocurrencies. The meeting will be streamed live on YouTube on June 23, 2022, at 10:30 AM EST.

Hoskinson will address the US House of Representatives Committee on Agriculture about blockchain and crypto. Proponents have a positive outlook on the upcoming crypto regulation bill, as the co-founder of Cardano would share his thoughts on the regulatory bill in the US. Hoskinson is said to be close to Wyoming’s senators, where the Input Output Global (IOG), formerly known as IOHK, is headquartered. Senator Lummis is one of the main authors of the current regulatory bill.

Speaking in favor of the cryptocurrency industry as a whole, Hoskinson is expected to help educate the regulators in charge of crypto in the US under the Commodities Futures Trading Commission (CFTC).

Cardano’s Vasil hard fork delayed to July 2022

Hoskinson also revealed a few outstanding items to run to ensure that everything is working as expected for the Vasil hard fork. The engineering team identified seven bugs during the testing phase, and none of them were severe. Developers are now working on resolving these issues and want to allow more time for testing instead of rushing the hard fork event.

Nigel Hemsley, head of delivery and products, said the team would need a few more days to re-evaluate the latest status. The previous date for Vasil hard fork release on the Cardano mainnet was slated to be June 29.

#VASIL UPDATE: Progress continues positively with only minor bugs remaining. Today, however, we have agreed to ensure the core dev team and #Cardano ecosystem collaborators have more time for testing before commencing the mainnet countdown.

— Input Output (@InputOutputHK) June 20, 2022

More here: https://t.co/1p5YW4wloe

Input Output Global and the Cardano Foundation expect the Vasil hard fork to hit the mainnet at the end of July. The network upgrade is geared towards dApp developers and will enhance scaling and improve block diffusion on Cardano. The project’s developers are known for their “slow and steady” approach, and the community has applauded the decision to push the hard fork instead of rushing its mainnet release.

While proponents have appreciated Cardano’s move to delay the Vasil hard fork, the ADA price has witnessed a steep correction.

ADA price dropped 5% overnight

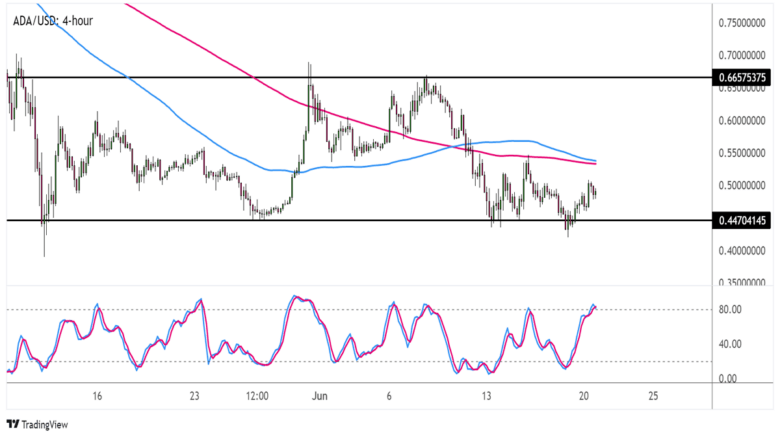

Cardano price hit its weekly high of $0.508 on June 21. Since then, the ADA price has declined, posting 25% in losses over the past two weeks and is nearly 85% below its record high of $3.09.

Analysts believe the altcoin is bouncing off of major support. Crypto analysts at Babypips.com are watching key levels in the ADA price chart, arguing that a looming bearish crossover could increase selling pressure on and push it lower. However, Cardano price could break out into a rally if it climbs above $0.55.

ADA-USD price chart

FXStreet analysts have revealed a bullish outlook on Cardano price and believe the ADA could reach $0.67. For more information, watch the video below:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.