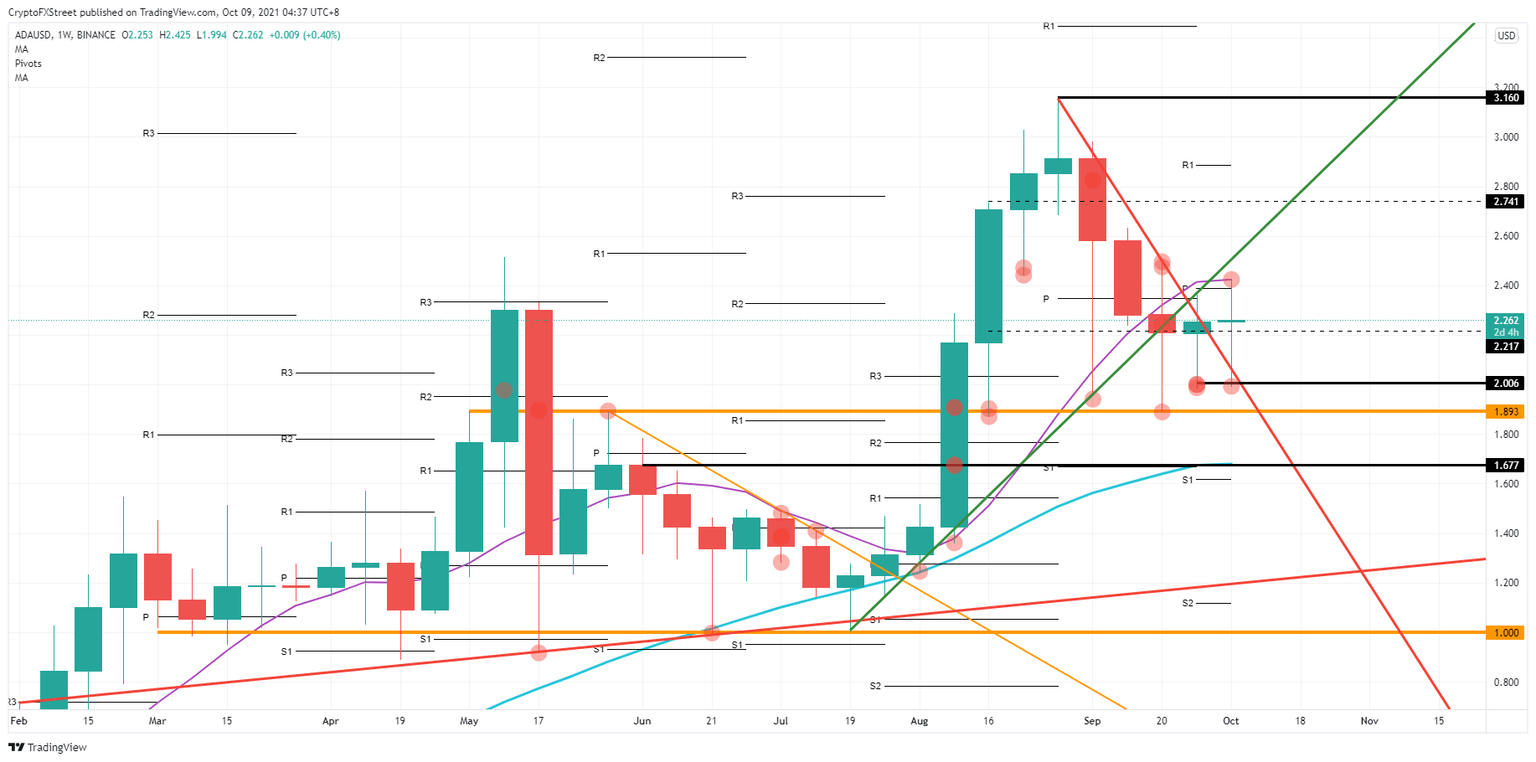

Cardano price could rise to $3.16 but ADA must claim this level first

- Cardano price action got picked up by bulls for a second consecutive week at $2.0

- ADA price favored bulls, however, faced headwinds from the monthly pivot and the 55-day SMA near $2.40

- If bulls could get a close above $2.50 in ADA price action, a new rally would emerge with 30% of profits.

Cardano (ADA) price action has had a second positive week with gains topped against the green ascending trend line. ADA bulls need to push price action above that trend line as $2.00 already acted twice as an entry point for bulls and will start to lose its importance. When Cardano price action can get a daily, or even better a weekly, close above $2.50, bulls would jump on the occasion and form another bull run that could go on for 30% or price profit in Cardano.

ADA price action set for the second stage of the bull run

Cardano price action saw bulls reengaging for a second consecutive week at $2.00. An identical pattern unfolded as bulls saw their profits limited to the green ascending trend line, originating from mid-July. With a second failed attempt, bulls need to make an effort to get ADA price action beyond this level so that a second stage in the bull run can start.

ADA price got rejected twice, around $2.40, with the monthly pivot level and the 55-day Simple Moving Average (SMA) limiting further gains for bulls. Any solid push from bulls would easily squeeze out the bears on that trend line, and a break back above would see ADA bulls flocking in to be part of the next rally towards $3.00, offering 30% of gains in Cardano price action.

ADA/USD weekly chart

Cardano price action could start to fade if bulls fail to break above the green ascending trend line. A retest of $2.00 would not hold this time as bulls have worn out the level as an entry point. A leg lower towards $1.90 would run stops from bulls and accelerate any selling with a drop towards $1.68.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.