Cardano price could extend gains riding on bullish on-chain metrics

- Cardano on-chain metrics flash capitulation signals, supporting a bullish thesis for ADA price.

- The Cardano Foundation announced its commitment to push ADA towards complete decentralization.

- ADA price is currently in an uptrend, trading above the $0.3786 mark.

Cardano is currently in an uptrend, and the altcoin is likely to extend its gains according to on-chain metrics. The Cardano Foundation recently committed to using its 11.42 million ADA token wallet to vote in favor of the goals of Cardano Improvement Proposal (CIP) 1694.

Also read: Binance moves nearly $4 billion amidst US DoJ demand to end years long investigation

Cardano price rally likely to extend, with these catalysts

Cardano’s weekly gains of 6.11% are likely to be sustained, and ADA price could extend its rally, riding on two bullish catalysts. The first is on-chain metrics, Network realized profit/loss (NPL) and Market Value to Realized Value ratio (MVRV), flashing bullish signals and the second is developments in the ADA ecosystem.

An independent not-for-profit, the Cardano Foundation, is focused on decentralizing the Cardano network and supporting ADA in its advancement and application in enterprise. The Foundation announced early on Tuesday that it would utilize its 11.42 million ADA tokens to vote in favor of improvements on the Cardano blockchain.

The Cardano Foundation is unwavering in its commitment to furthering the goals of CIP-1694 and steering #Cardano towards a fully decentralized on-chain governance system. Explore the specifics of our involvement in the Cardano ballot. #CIP1694

— Cardano Foundation (@Cardano_CF) November 20, 2023

(1/7) pic.twitter.com/HMKajPaXcX

On-chain metrics supporting ADA price gains

Based on data from crypto intelligence tracker, Santiment, there is a spike in net realized losses of wallets that acquired ADA tokens in the past thirty days. This marks capitulation in Cardano and following periods of capitulation, typically, there is a rally in the asset’s price, seen in the chart below.

NPL on Cardano and price

The MVRV ratio for seven days reveals that addresses selling ADA tokens at the current price of $0.3786 are realizing losses. Typically, market participants are less likely to shed their assets and realize losses, implying a low selling pressure on the asset across exchanges. This supports ADA’s recent gains and presents a neutral to bullish outlook on the asset.

MVRV ratio (7-days) and price

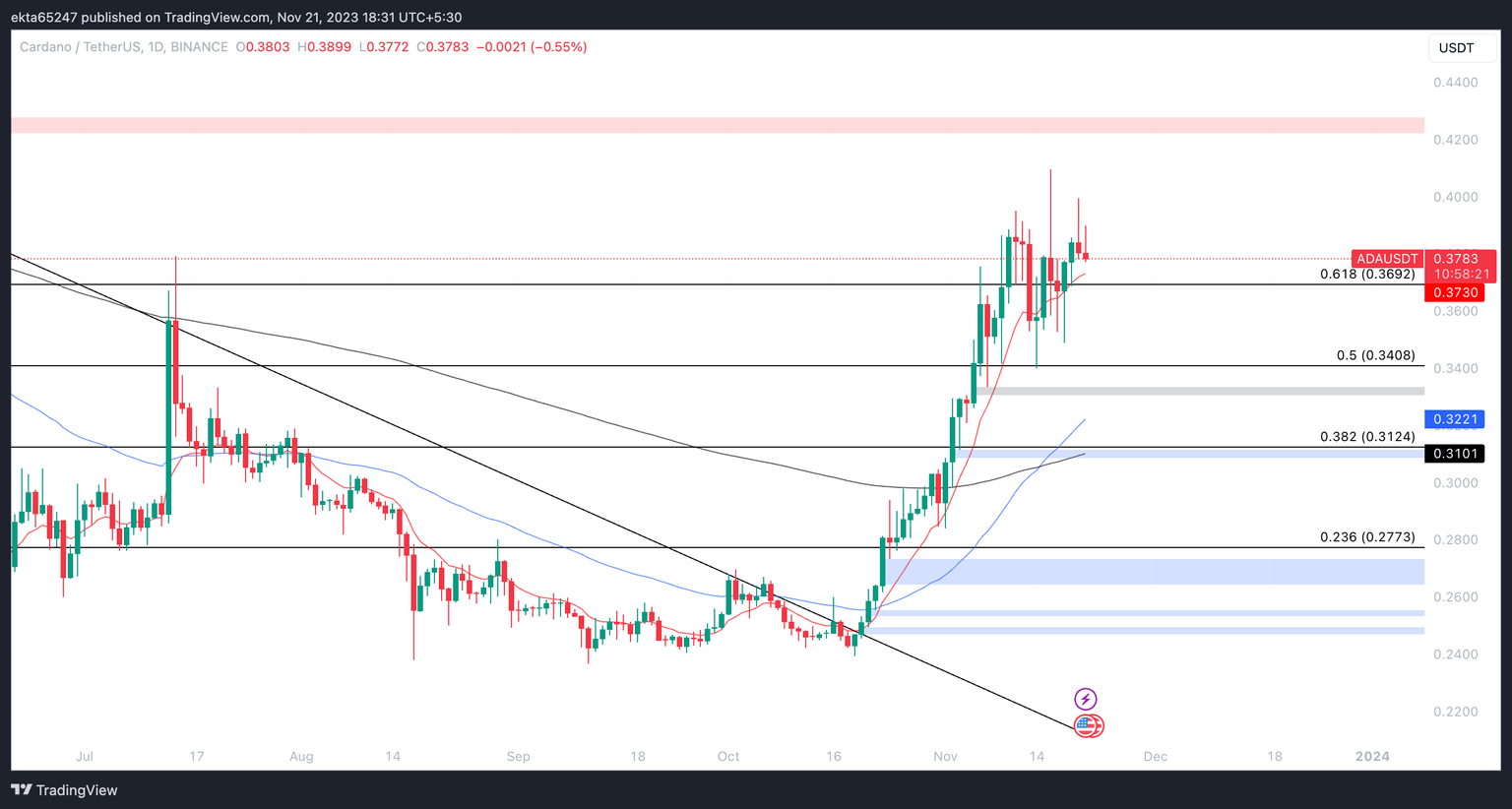

At the time of writing, ADA price is above the 0.61 Fibonacci level of the decline from the April 15 top of $0.46 to the June 4 bottom of $0.22, and is trading at $0.3786. The asset is likely to extend its gains as long as it sustains above the 0.50 Fibonacci level at $0.3408. A candlestick close below this level could invalidate the bullish thesis for Cardano price.

ADA/USDT 1-day chart

Cardano price is likely to find support at the 10-day Exponential Moving Average (EMA) at $0.3730, in the event of a decline.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B18.08.36%2C%252021%2520Nov%2C%25202023%5D-638361695305761619.png&w=1536&q=95)

%2520%5B18.08.57%2C%252021%2520Nov%2C%25202023%5D-638361695596409381.png&w=1536&q=95)