- Cardano price retests the $0.805 support level, a breakdown of which could lead to a steep crash.

- A 50% crash to $0.381 is plausible based on the volume profile indicator

- A daily candlestick close above $1 will invalidate the bearish thesis for ADA.

Cardano price has been on a downtrend for the longest time and is currently retesting a vital support level. This foothold is crucial in preventing a massive correction to a level last seen in early 2021.

Cardano price heads south

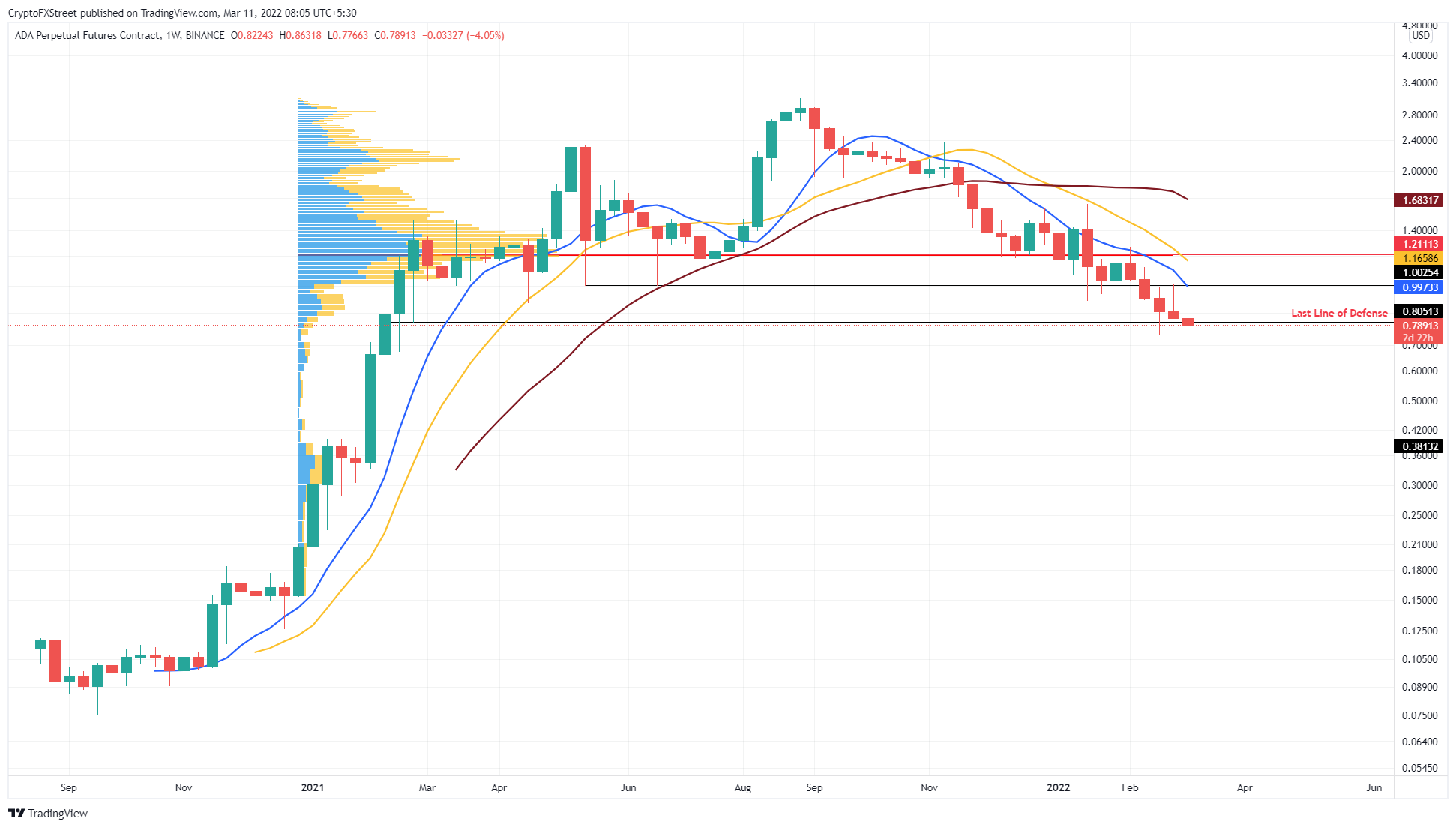

Cardano price has crashed roughly 74% from its all-time high at $3.104 and is currently trading around $0.789. Based on the volume profile indicator, the volume traded for ADA thins out considerably after $0.805 up to $0.381.

Hence, a decisive close below $0.805 will give bears the control. Such a development would lead to a 50% crash from the current position to $0.381. Therefore, bulls have one last chance to make their efforts count.

Failing to do so could lead to a capitulation level crash. While bearish, it would signal that a bottom is in for Cardano price.

ADA/USDT 3-day chart

Cardano price has sliced through the 50-day, 100-day and 200-day Simple Moving Averages (SMAs) in the last four months or so. Any attempts to move higher were capped, leading to an extended bear rally.

However, if Bitcoin’s situation improves, there is a good chance Cardano price will see some bullish reaction as well. If ADA produces a decisive close above the 50-day SMA at $1, it will invalidate the bearish thesis.

In this case, the so-called “Ethereum killer” might make a run for the next crucial hurdle at $1.20, where the current volume point of control is present.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP stabilize as SEC Crypto Task Force prepares for First roundtable discussion

Bitcoin (BTC) price hovers around $84,500 on Friday after recovering nearly 3% so far this week. Ethereum (ETH) and Ripple (XRP) find support around their key levels, suggesting a recovery on their cards.

XRP sees growing investor confidence following SEC ending legal battle against Ripple

Ripple's XRP trades near $2.43 on Thursday after seeing a rejection at the $2.60 resistance. The remittance-based token has seen a 400% growth in network activity since the beginning of March. The growth may continue, considering the SEC recently dropped its appeal against Ripple.

SEC confirms Proof-of-Work crypto mining doesn't fall under securities laws

The Securities & Exchange Commission's (SEC) Division of Corporation Finance released a statement on Thursday clarifying its position on proof-of-work (PoW) crypto mining.

Swiss National Bank rejects Bitcoin reserve proposal

Swiss National Bank has rejected a proposal to adopt Bitcoin as a reserve asset, citing concerns over volatility, security, and liquidity.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.