Cardano price could be set for 12% gains just this week alone

- Cardano price pops higher this Monday trading session as the dollar takes a step back.

- ADA price sees a potential short-term turnaround higher as markets let the dust settle on last week's events.

- Expect this week to see some modest gains, although the trend remains bearish..

Cardano (ADA) price action could set itself up this week for a perfect opportunity for traders to go long in a bear market. Although the current big events and risks at hand are still very present, they have had another escalation on several fronts and may have now peaked, which could mean they will ease this week. As such, markets may experience some risk-on this week, with markets potentially set to jump, and equities and a weaker dollar offering some room for cryptocurrencies to rally in.

ADA price up for +10% gains in the coming days

Cardano price prints a mild 1% gain at the moment of writing but holds a promising forecast of more gains up for grabs this week. Traders and markets have had enough time over the weekend to filter several news headlines about the sabotage of Nordstrom I and the speech from Putin that held some harsh words towards the West. With the gas storage further filling up and several countries prepared to go into winter, expect some relief as there might be a slim chance that Europe will and can get through this.

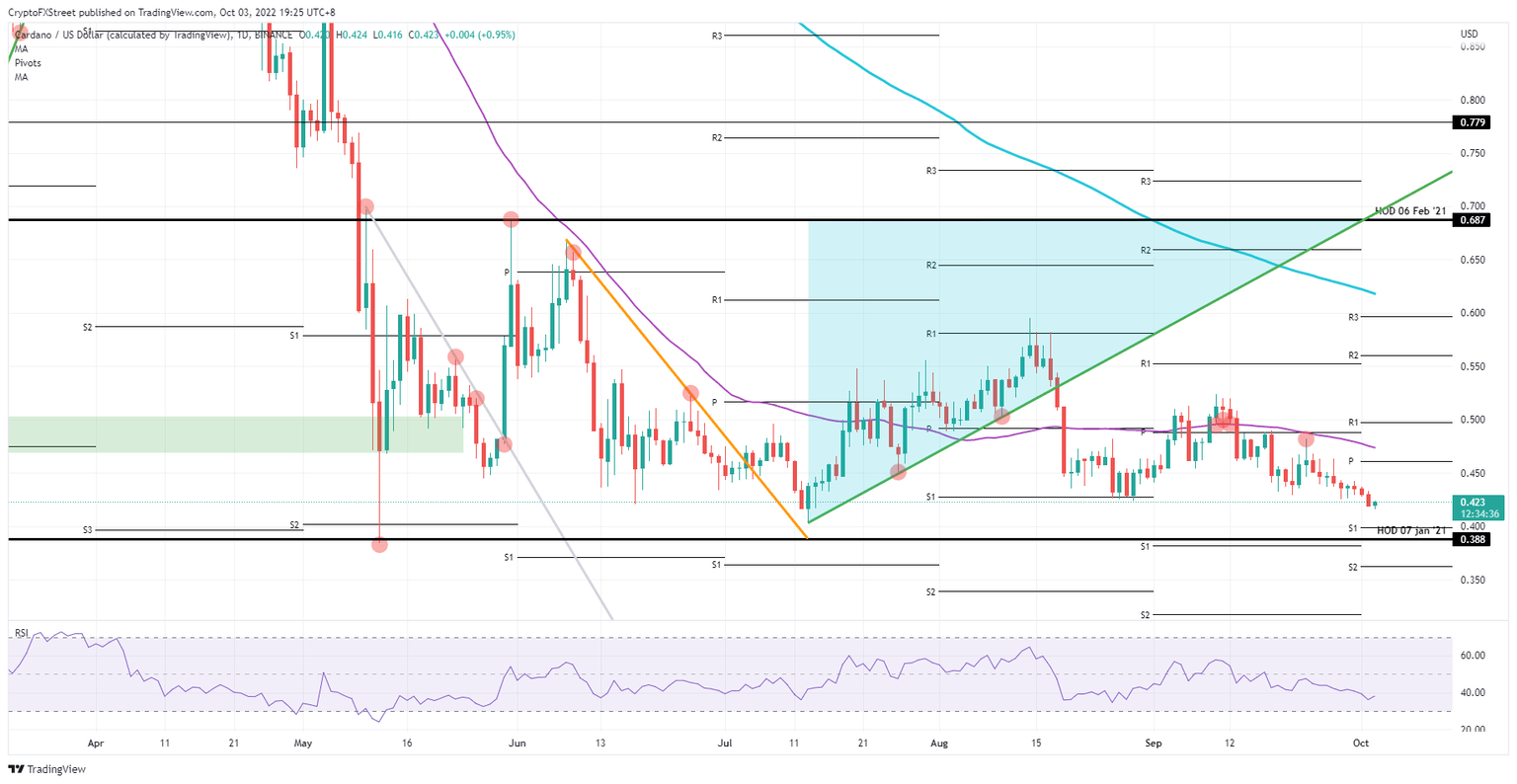

ADA price is thus set to jump on the back of this dynamic. A target presents itself at the 55-day Simple Moving Average (SMA), which holds over 12% profit. Any more profit might be very short-lived as the current overshadowing events are still present and do not look to be going away anytime soon.

ADA/USD Daily chart

Although these tail risks are set to take a step back this week, that does not mean they will end. Rather they could easily explode or surge again at any time with any headline or event. Traders should remember this in their trade management, as ADA price could easily drop back to $0.388, below $0.400, the low of 07 January 2021, on a piece of bad news.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.