Cardano price at risk of a flash-crash to $0.35

- Cardano price continues to slide lower despite record accumulation.

- The Friday close may create the lowest close in nearly 400 days.

- ADA may temporarily flash-crash more than 50% before a new uptrend begins.

Cardano price continues to be one of the worst-performing major market cap cryptocurrencies. While a good amount of March remains to be traded, thus far, ADA is on its way to completing a record seven consecutive months lower. The weekly chart, likewise, shows five consecutive weeks lower. In addition, only four weeks out of the past eighteen have had weekly closes' above the open.

Cardano price continues to bleed out as it approaches a final support zone before capitulation begins

Cardano price action within the Ichimoku Kinko Hyo system is void of any support on the daily chart. Currently, no immediate bullish evidence of the broad accumulation recorded by on-chain data and metrics is visible.

Unless there is a major change to Cardano price during the Friday session, at the time of publication, ADA's close lowest daily close in the past 396 days. Additionally, the total absence of buyers' and sellers' control may trigger new 2022 lows.

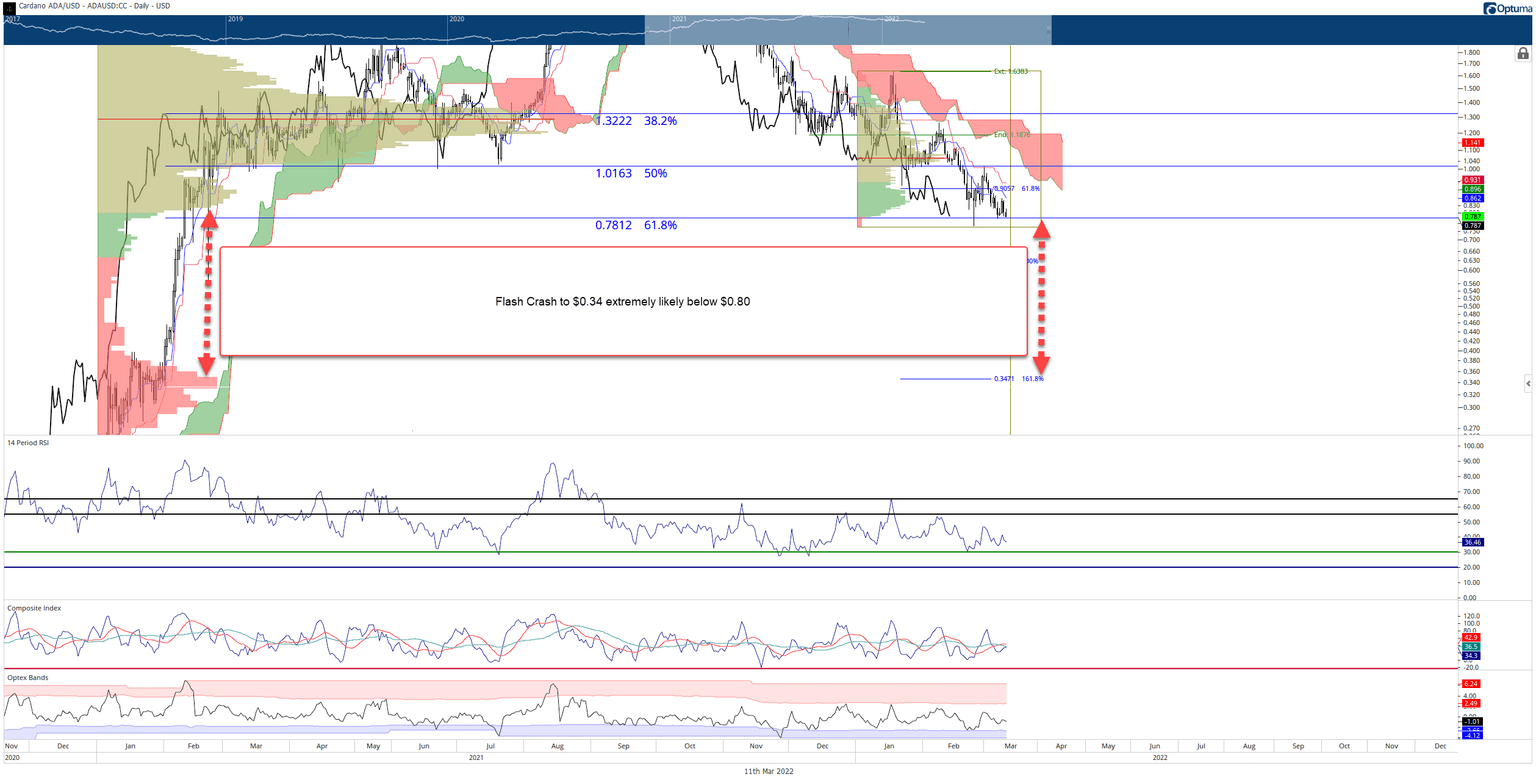

The only support on the daily chart remaining for Cardano price is the 61.8% Fibonacci retracement at $0.78. If that fails, then look out below. The extended 2021 Volume Profile shows a near-total absence of volume between $0.35 and $0.80. Already, ADA is in a position that could trigger an immediate flash crash to the $0.35 value area.

ADA/USD Daily Ichimoku Kinko Hyo Chart

While the likelihood of that scenario may appear unlikely, the probability of such an event is certainly greater now than in the past. The combination of increased volatility over the weekend with the ongoing war of Russia's invasion of Ukraine could be just the right combo to trigger a flash crash.

From a daily chart perspective, bulls have an extremely difficult path to avoid a total capitulation of Cardano price. At the very least, bulls will need to close Cardano price at or above the 2022 Volume Point Of Control at $1.07 – a 33% increase from the Friday open.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.