- Cardano price opened trading at $1.05 on Monday, having consolidated below the $1.10 resistance over the last 3 days.

- The Cardano blockchain network has recorded 10,000 new funded wallets since December 19.

- ADA technical indicators suggest buyers remain dominant despite prolonged sideways movement.

Cardano’s price opened trading at $1.05 on Monday after consolidating below the $1.10 resistance over the last three days. On-chain data shows ADA has attracted a significant number of new buyers since the 30-day countdown to Donald Trump’s inauguration began.

Cardano price holds $1 support amid early profit-taking

As the cryptocurrency sectors’ positive start to 2025 intensified on Monday, Bitcoin price grazed the $100,000 mark, while top altcoins like Cardano (ADA) and Solana (SOL) faced considerable headwinds.

With the likes of BTC, AVAX and XRP having hit new milestone peaks at $100,000, $45 and $2.50 respectively, ADA price remained below the $1.10 market over the weekend.

As seen above, ADA price has consolidated within the $1.05 to $1.10 narrow range since its 30% rally peaked on Friday.

ADA remains rooted at the $1.09 mark at press time on Monday, despite bullish sentiment dominating the broader crypto market.

This signals mild profit-taking among short-term traders, nullifying market demand surge and keeping Cardano’s price stagnant.

10,000 new investors join Cardano network 30 days from Trump's inauguration

Promising zero crypto taxes and a flurry of appointments hinting at a friendlier regulatory stance, Trump's upcoming inauguration on January 20 has dominated crypto traders’ mindshare in recent weeks.

Trump’s proposed crypto tax legislation is rumored to eliminate taxes on cryptocurrencies founded in the United States (US).

This has improved investors' sentiment around the crypto projects with firm US roots such as Bitcoin (BTC), Ripple (XRP) and Cardano (ADA).

Recent transaction trends show the Cardano network has recorded an unusual increase in new investors since December 20, coinciding with the 30-day countdown to Trump’s inauguration.

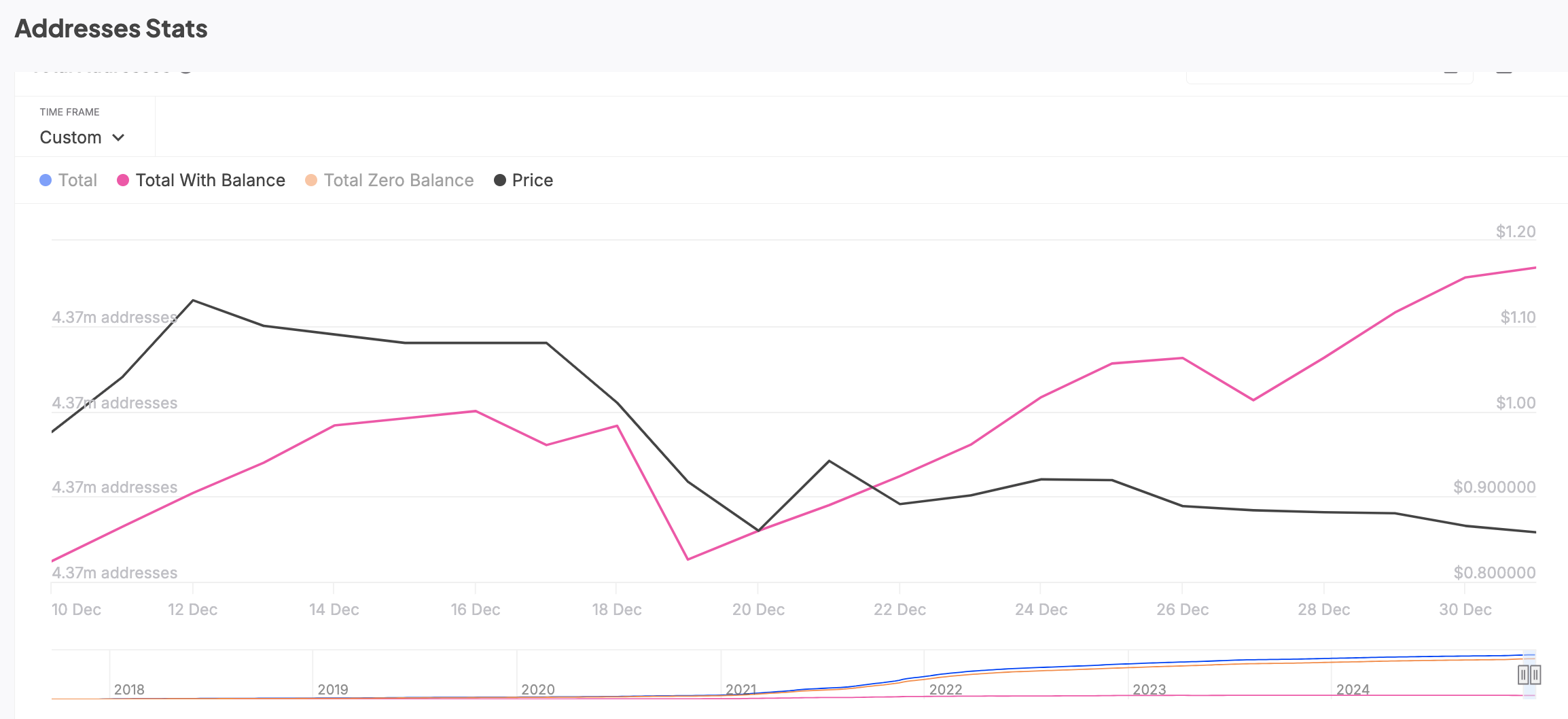

The IntoTheBlock chart below tracks daily changes in total funded wallets existing on the Cardano blockchain network.

This provides clear insights into the rate at which new investors are joining or exiting the ADA market.

Cardano Funded Addresses | Source: IntoTheBlock

Cardano Funded Addresses | Source: IntoTheBlock

As depicted above, the Cardano blockchain hosted 4.37 million funded wallets as of December 19.

Since then, investors have opened 10,000 new ADA wallets, bringing the total funded wallets count to 4.38 million on Monday.

Strategic investors interpret such a persistent influx of new wallets as a signal for imminent bullish price action for two reasons.

As the newly funded wallets conduct economic transactions on the Cardano network, it could lead to increased on-chain activity, driving higher network value.

Additionally, the steady growth in new wallets signals rising confidence among retail investors, often a precursor to a positive shift in market momentum.

Cardano Price Forecast: $1.20 breakout in focus after 3-day consolidation

Cardano has entered a 3-day price consolidation near the $1.07 mark. However, considering the recent influx of 10,000 new investor wallets and positive sentiment surrounding Trump’s inauguration, ADA appears to be building momentum for a breakout toward $1.20.

The Donchian Channels set resistance at $1.20 as a critical level to watch if bullish momentum continues.

Supporting this outlook, the Bull-Bear Power indicator has turned positive, reflecting strong buyer dominance in the current market phase.

More so, ADA Parabolic SAR is trending firmly below the current price levels, further confirming bullish momentum and suggesting a continuation of the upward trend.

Cardano Price Forecast | ADAUSD

Cardano Price Forecast | ADAUSD

Conversely, a failure to breach the $1.20 resistance level could trigger a bearish scenario.

In this case, the immediate support lies at $1.00, which aligns with the lower Donchian Channel.

A breach below $1.00 would expose ADA to further downside risks, with $0.92 acting as the next key support level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.