Cardano prepares to launch new stablecoin while ADA price is on the brink of a 30% move

- IOHK plans to demonstrate Plutus smart contract capabilities using Ergo's AgeUSD stablecoin.

- AgeUSD hopes to stand out from the Ethereum backed stablecoins by avoiding CDPs.

- Cardano is in consolidation, but a symmetrical triangle hints at a potential 30% upswing to $0.46.

IOHK or Input Output Hong Kong, the company behind the development of Cardano (ADA), is collaborating with the Ergo Foundation and EMURGO to launch the first-ever stablecoin asset on the Ergo blockchain. The new cryptoasset will, in the beginning, only execute on the Ergo blockchain. Still, it will be available on Cardano's blockchain following the launch of its much-awaited smart contract functionality.

AgeUSD brings new design to the stablecoin market

The stablecoin asset has been named AgeUSD and will stand out from the baseline of Ethereum-backed smart contracts like DAI. Emurgo is working on introducing a Staticoin protocol-inspired design.

The new technology avoids the popular Collateralized Debt Positions (CDPs) fronted by Ethereum. Besides, the change was necessitated by CDPs' vulnerability, especially during periods of volatility and congestion on the blockchain.

Emurgo cites the much remembered MakerDAO liquidations, triggered following extreme volatility. Investors suffered dire losses when the tokens' value plunged to zero, mainly because of congestion on the blockchain. A statement by Emurgo stresses that:

"Without CDPs, we do not have liquidation events nor the requirement for users to perform transactions to ensure that the liquidations actually work properly (rather than allowing a bad actor to steal funds away from the protocol). These are inherently vulnerable facets of using CDPs for minting stablecoins, and as such expose more risk to the end-users."

Will AgeUSD solve all stablecoin challenges?

Emurgo has, with its new stablecoin asset, AgeUSD, tried to avoid some inherent problems like the above mentioned. The idea is to automate the mathematics of the protocol, thus avoiding reliance "on dynamic transaction postings that can break down in the event of a blockchain overload."

However, Emurgo stated during the Ergo Summit 2021 that the improvements that it has made do not solve all the stablecoin problems. Yet, investors can choose to ride with a higher-security alternative from what is available in the industry.

How AgeUSD protocol functions

Two different parties interact on the protocol; Reserve Providers and AgeUSD Users. The work of Reserve Providers is to bring Ergs, Ergo's native currency, to the dAPP's reserves. This allows them to mint "ReserveCoins." Every ReserveCoin is a representative of a portion of Ergs that has been locked in the dApp.

On the other hand, AgeUSD users are required to submit Ergs to the DApp reserves, but on the contrary, they mint AgeUSD. Users are allowed to withdraw their AgeUSD at any time they deem fit and get Ergs from the dApp reserves, only that the tokens will be subject to the current exchange rate as determined by the Erg-USD oracle pool.

Reserve Providers benefit by redeeming their ReserveCoins only when Ergs price shoots up. Additionally, they earn extra ReserveCoins when a significant amount of fees is collected on the protocol. Reserve Providers ensure that the value of AgeUSD is stable. However, they absorb the shock when whenever the value of the underlying crypto in the reserve drops.

How does Cardano come in?

AgeUSD significance in the industry will surpass Ergo and deploy on other existing blockchains. On the other hand, EMURGO is subcontracted to create solutions for the Cardano blockchain. Hence, the plan to first launch on Cardano helps demonstrate the features, capabilities, and functionalities that can be explored using ADA's Plutus smart contract programming language combined with Ergo's ErgoScript.

The development of AgeUSD was revealed to the Cardano community via IOHK CTO Romain Pellerin's Twitter account. However, the announcement was brief and did not mention any timelines.

It is worth mentioning that Cardano is getting closer to the release of the Goguen phase, which will unlock the blockchain's smart contract functionality. With that in mind, we can predict that Age USD will debut during the third quarter of 2021, around the time IOHK will be finalizing on Goguen.

Cardano is on the verge of a 30% move

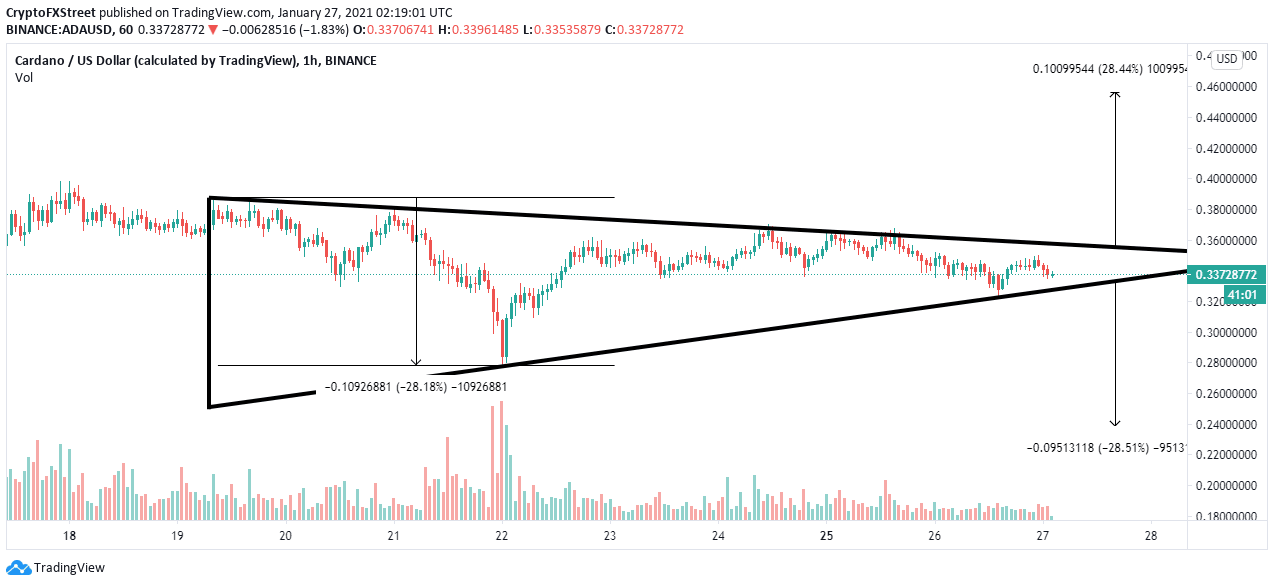

Cardano is exchanging hands at $0.33 amid the extended consolidation. Recovery from the recent dip to $0.28 has been limited under $0.37. The price is also under all the three applied moving averages, including the 50 SMA, 100 SMA, and 200 SMA on the 1-hour chart. It is apparent that recovery will be an uphill battle due to the growing overhead pressure.

However, ADA is trading within the confines of a symmetrical triangle, which hints at a possible 30% move. The pattern represents a period of consolidation before a significant move in price. It can either result in a breakout or breakdown.

A breakout occurs above the upper trendline and signifies the beginning of an uptrend. On the other hand, a breakdown happens if the price slices through the lower trendline. The price target for the breakout is exact and measured between the highest and lowest points of the triangle.

ADA/USD 4-hour chart

For now, holding above the lower trendline is key to sustaining the uptrend and pushing Cardano closer to the 30% upswing to $0.46. Price action above the moving averages will signify the bulls' ability to nurture the uptrend.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren