Cardano, Polygon, Solana prices undeterred despite Revolut's delisting

- Revolut has been added to the list of companies delisting Cardano, Polygon, and Solana after the SEC labeled them securities.

- The company said buying would cease immediately while selling and hodling deadlines will be communicated.

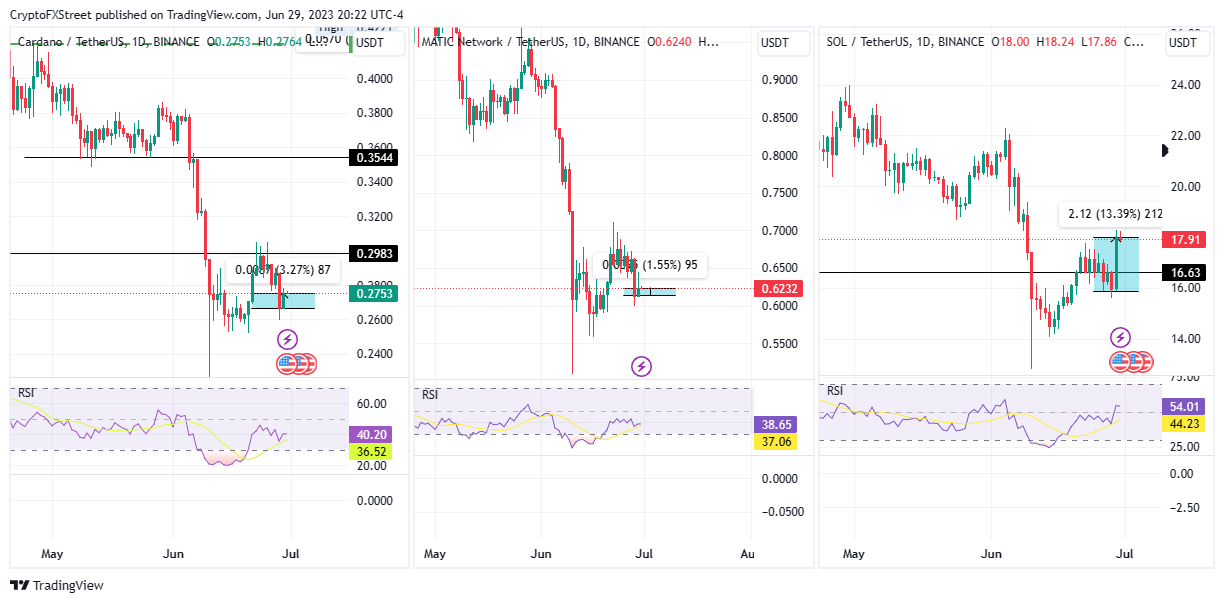

- ADA, MATIC, and SOL are up 3.27%, 1.55%, and 13.39%, respectively.

Cardano, Polygon, and Solana continue to suffer the brunt of a crackdown by the US Securities and Exchange Commission (SEC). This comes after the financial regulator labeled these altcoins securities during its clampdown against cryptocurrency exchanges Binance and Coinbase.

Cardano, Polygon, and Solana lose another listing

Cardano, Polygon, and Solana cryptocurrencies, all of which feature among crypto’s top 13 on CoinMarketCap and boast enormous market capitalizations, continue to suffer the aftermath of the SEC’s regulation by enforcement. In the latest report, Revolut, a European exchange and payments company, has delisted the three altcoins for its US operations. As of 2019, the company had a global customer base with over 10 million personal account users and 250,000 business users. The number is expected to have grown by now, which indicates the expansive need across the globe for exchange and payments company's services.

Effective immediately, users will not be able to buy either of these altcoins, but deadlines for selling and hodling will be communicated. This means it is currently impossible for US-based customers to accumulate ADA, MATIC, and SOL on this platform, but they can sell or continue to hodl.

However, Revolut has cautioned its US customer base that once the selling and hodling deadline (which will be communicated) elapses, any ADA, MATIC, and SOL holdings present in their accounts would be sold off automatically, and the proceeds deposited into their individual Revolut accounts.

SEC is driving business out of the US

The resolve only affects customers in the US, owing to the country’s regulatory actions, which have been called out for driving firms away from America and inspiring weakening domestic consumer confidence in cryptocurrencies in the US.

The UK, Dubai, Singapore, and Hong Kong are among the countries that have seized the opportunity, offering companies “greener pastures” to bring business into their borders. For instance, the United Kingdom passed the Financial Services and Markets Bill only hours ago, after receiving approval from King Charles, to bring cryptocurrencies and stablecoins into the scope of regulations.

On the other hand, Singapore has created an enticing environment, drawing in the likes of Gemini cryptocurrency exchange that is looking to expand to the Asia-Pacific (APAC) regions and establish a hub of its crypto-related operations.

More interestingly, Hong Kong has been proactive in developing policies favoring cryptocurrencies and therefore meant to drive the adoption of Bitcoin (BTC), Ethereum (ETH), and altcoins in China’s Special Administrative Region (SAR). The move intrigued many, including Binance and Tron executives Changpeng Zhao and Justin Sun, who lauded the region for its crypto-forward policies.

Cardano, Polygon, and Solana remain bullish

Cardano, Polygon, and Solana price continue trading in the green despite losing their space on Revolut’s US catalog.

ADA/USDT 1-Day Chart, MATIC/USDT 1-Day Chart, SOL/USDT 1-Day Chart

Undeterred, ADA, MATIC, and SOL are up 3.27%, 1.55%, and 13.39% in the last 24 hours, beating crypto market giants BTC and ETH, which are recording daily rises of 1.10% and 0.72%, respectively, at the time of writing.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.