Cardano must close above $2.60 before testing new all-time highs

- Cardano price continues to trade in highly constricted conditions.

- Cardano falls below key Ichimoku levels that could indicate a resumption of selling pressure.

- Bulls need substantial volume to support higher prices.

Cardano price action suggests that some near-term selling pressure is likely to come in unless buyers step in and provide support. It is effortless to find a bias for leaning bearish as well as bullish at present. Currently, the conviction of the buyers is being tested – and they don't have much time to respond before a breakdown occurs.

Cardano price shows signs of weakness; bears could take control soon

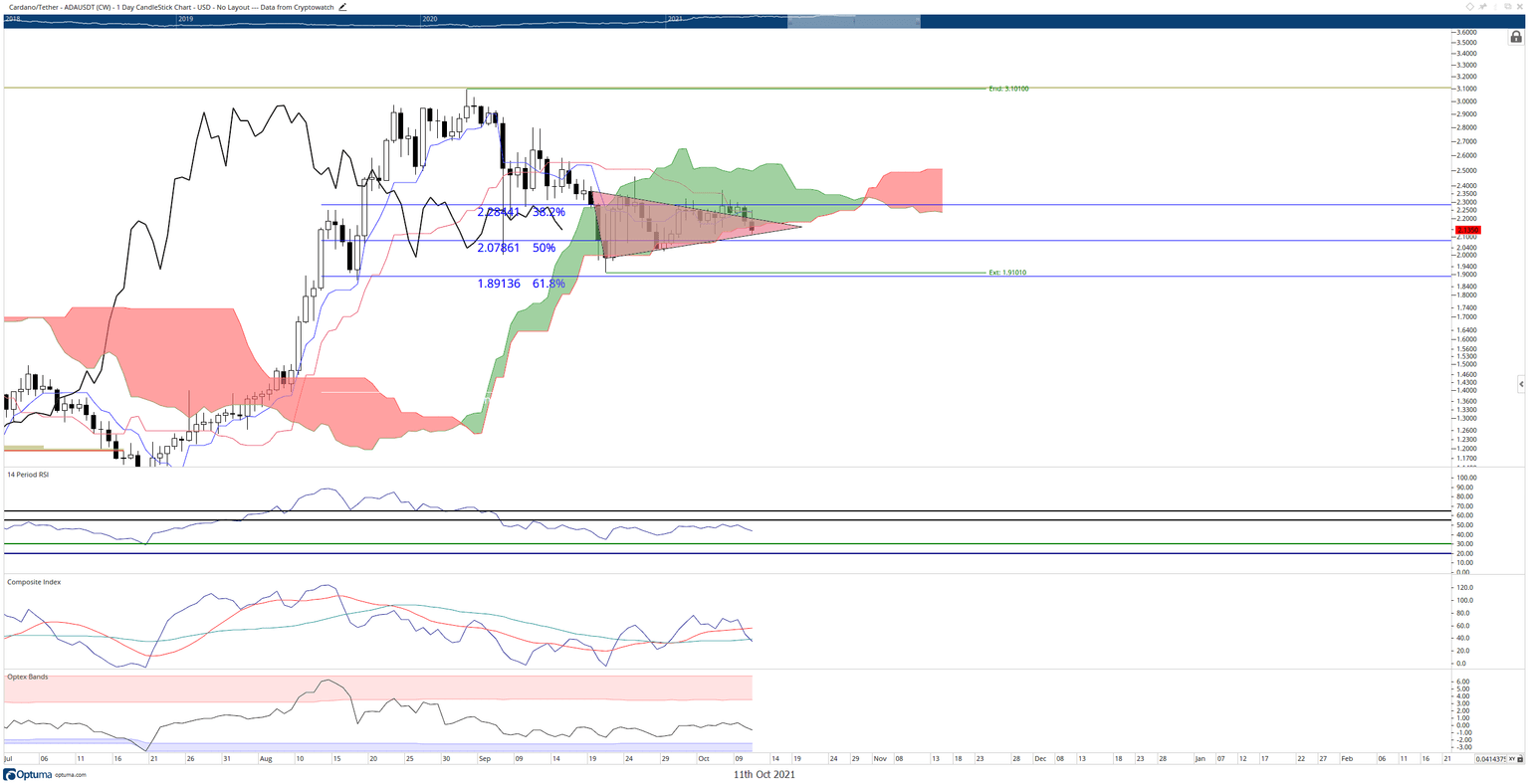

Cardano price has recently moved below Senkou Span B, the Kijun-Sen and the Tenkan-Sen – and it moved below those three levels simultaneously. That means that Cardano is below all four primary Ichimoku levels. The only thing supporting Cardano right now is the Chikou Span getting support at Senkou Span A.

Below Senkou Span A is the final support level for the Chikou Span at Senkou Span B ($2.05). If Senkou Span B fails to hold as support, then Cardano price is likely to capitulate towards the $1.80 value area. But the sellers, for whatever reason, have not yet decided to capitalize on the current near-term bearish conditions.

ADA/USDT Daily Ichimoku Chart

The current setup could be interpreted as positioned for a bear trap. If the bulls can maintain Cardano price near Senkou Span B over the next six days, then every day after October 11th decreases the Cloud's size. The decrease means it will be easier for buyers to rally Cardano to a close that would begin a rise towards new all-time highs.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.