Cardano is still stuck in a bearish pattern with no real turnaround in sight for next week

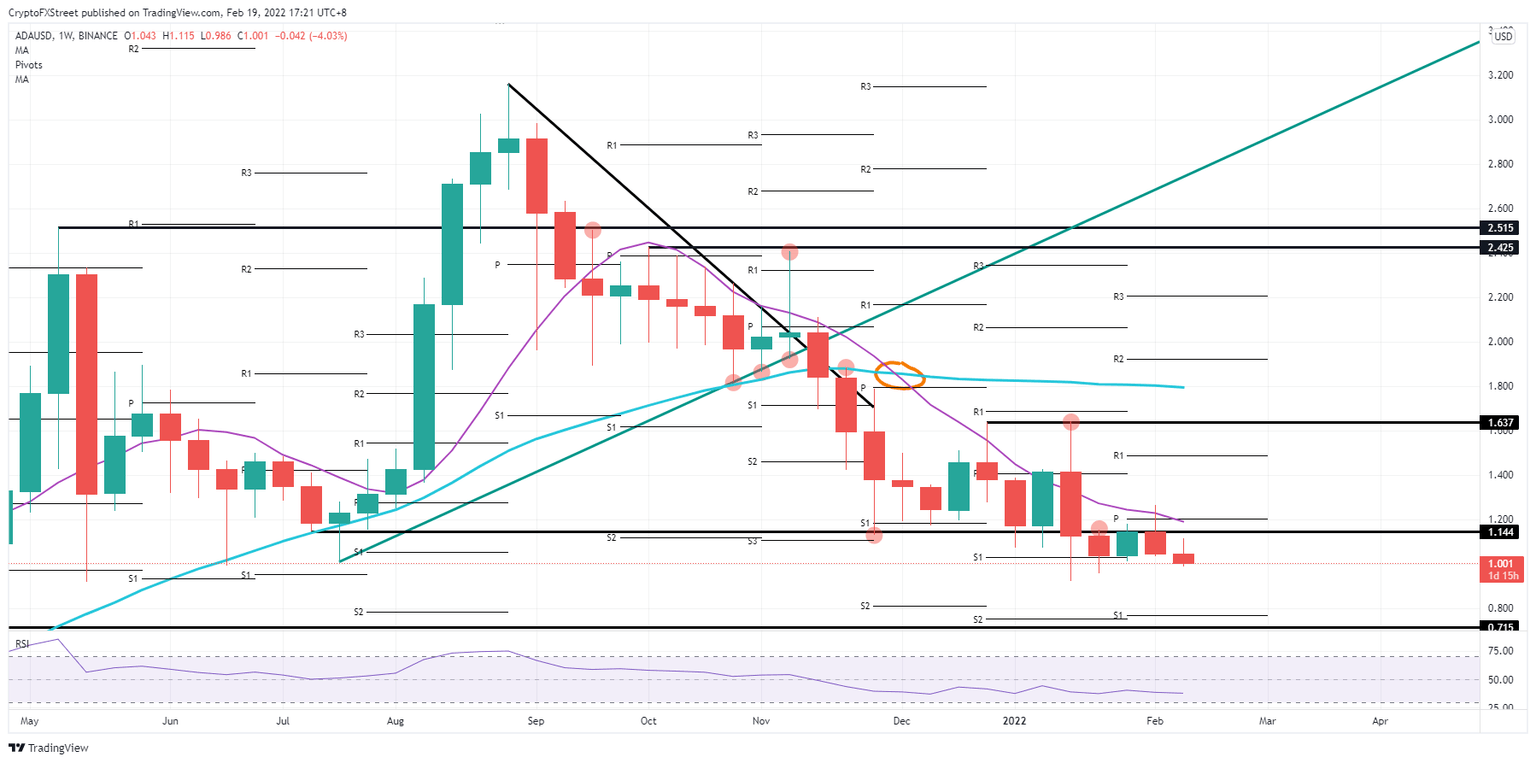

- Since August, Cardano bears are still keeping ADA price action muted with lower highs and squeezes against the low supporting levels.

- ADA bulls are trying to hold ground above $1.00, but pressures are mounting as most signs are against it.

- Only external tailwinds can break the longer-term downtrend.

Cardano (ADA) price action is nowhere near an uptrend as bulls look just too weak to deliver a big weekly bullish candle that breaks a previous high, let alone multiple previous highs of past weeks. Add to that the death cross with the 55-day Simple Moving Average (SMA) still firmly trading to the downside, below the 200-day SMA. For now, the $1.00 will hold, but some outside help is needed, coming from a relief rally or global markets finally looking beyond hawkish central banks that could attract investors back to the playing field.

ADA bulls are bleeding while they defend $1.00 from mounting bearish pressure

At the moment, the feel-good movie of Cardano is nowhere near a happy ending moment with bulls facing mounting pressure from bearish signals, and $1.00 is their last line of defence before price action could collapse another 32%. Bearish elements are the pressure from the death cross with the 55-day SMA capping any possible upward price movements, although a reasonable attempt was made four weeks ago but was cut short with that significant hawkish comment from the FED.

As it stands, hawkish central banks are front and centre, and it is just a matter of time before $1.00 will fall in the hands of the bears. A further descent is seen towards $0.92, the low of January. Should markets start to get hurt by more violence and a possible war with Russia, expect a sharp nose dive move towards the monthly S1 at $0.80 and $0.71 as the last line of defence. That level goes back to February last year and will have erased the uptrend of 2021 in total, but in the process will be an exciting level for bulls to go back in and pick up some pieces of the shattered price action in Cardano.

ADA/USD weekly chart

With the two main catalysts defined, Ukraine-Russia and central banks expect one or both to work as well in the other way around. Should we see a result of any peace talks, or should the FED steer the markets around the inflation slightly and curb that same inflation in the meantime, expect some solid upticks with big bullish candles breaking through the bearish territory. The first would be $1.14, following the 55-day SMA and monthly pivot at $1.20. Indeed, a firm break above the 55-day SMA and a weekly close above would be perfect for confidence and could set the scene for the start of a longer-term uptrend back towards $1.63 and $2.42.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.