Cardano is drifting off too far as traders turn their backs for now

- Cardano price is a big victim in the FXT meltdown as suddenly traders are not returning.

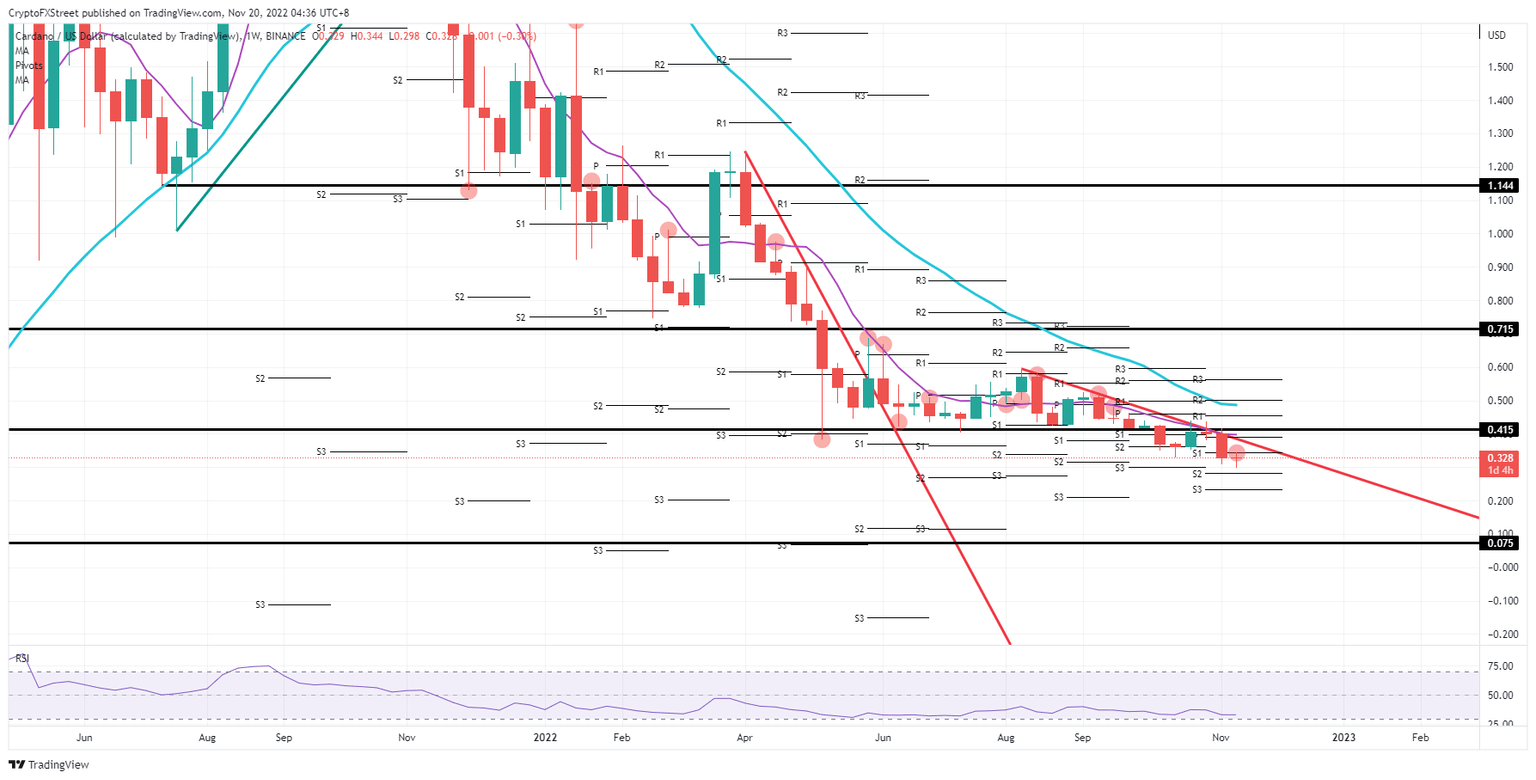

- ADA price sees the RSI nearly flatlining as if the patient's heart monitor is nearing a cardiac arrest.

- Expect to see an implosion in the price action before traders will want to re-engage in its trading.

Cardano (ADA) price is on the brink of a big collapse as price action almost comes to a halt, with traders unable to claw back after the purge from last week. It is almost becoming a perfect storm as the number of bearish elements exceeds the number of bullish positives in ADA. The risk at hand is a correction between 40% and 80% if the next week continues the past fourteen days.

ADA price the next victim in the crypto massacre?

Cardano price action is signalling issues and red flags all across the board as the FTX fallout is brutal in the crypto asset class. With the crypto winter already, a lot of interest, cash and market cap got burned to survive the frost. Now the FTX aftermath with a resurgence in geopolitical issues is becoming the one issue too many that bites in the last reserves crypto traders had parked in ADA.

ADA is now at risk of seeing more traders walking away and looking for the next best thing as the selling continues, with the Relative Strength Index (RSI) not able to pop above 50 since November of last year. This constant overweight of selling means that the body called ADA is losing blood at a quick pace. Expect, with trader interest fading again next week, to see Cardano price break below $0.280 and possibly dip towards either $0.200 or $0.075 before finally seeing a resurgence in the RSI with buying taking over.

ADA/USD weekly chart

As the year is nearing its end, there is still a possibility of a Christmas rally with boosted morale and traders cheerfully ending the year on a high note. ADA would be popping up, brushing against the red descending trend line that falls in line with the 55-day Simple Moving Average. The best possible bullish outcome would be to break that area and take over the pivotal level at $0.415 with a weekly close above. Traders would fall over one another as if it was a Black Friday sale to be part of the rally, and by the exploding buy-side demand, see price print quickly at $0.500 in just two weeks.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.