Cardano introduces Layer-2 solution Hydra, as ADA price looks to rally 25%

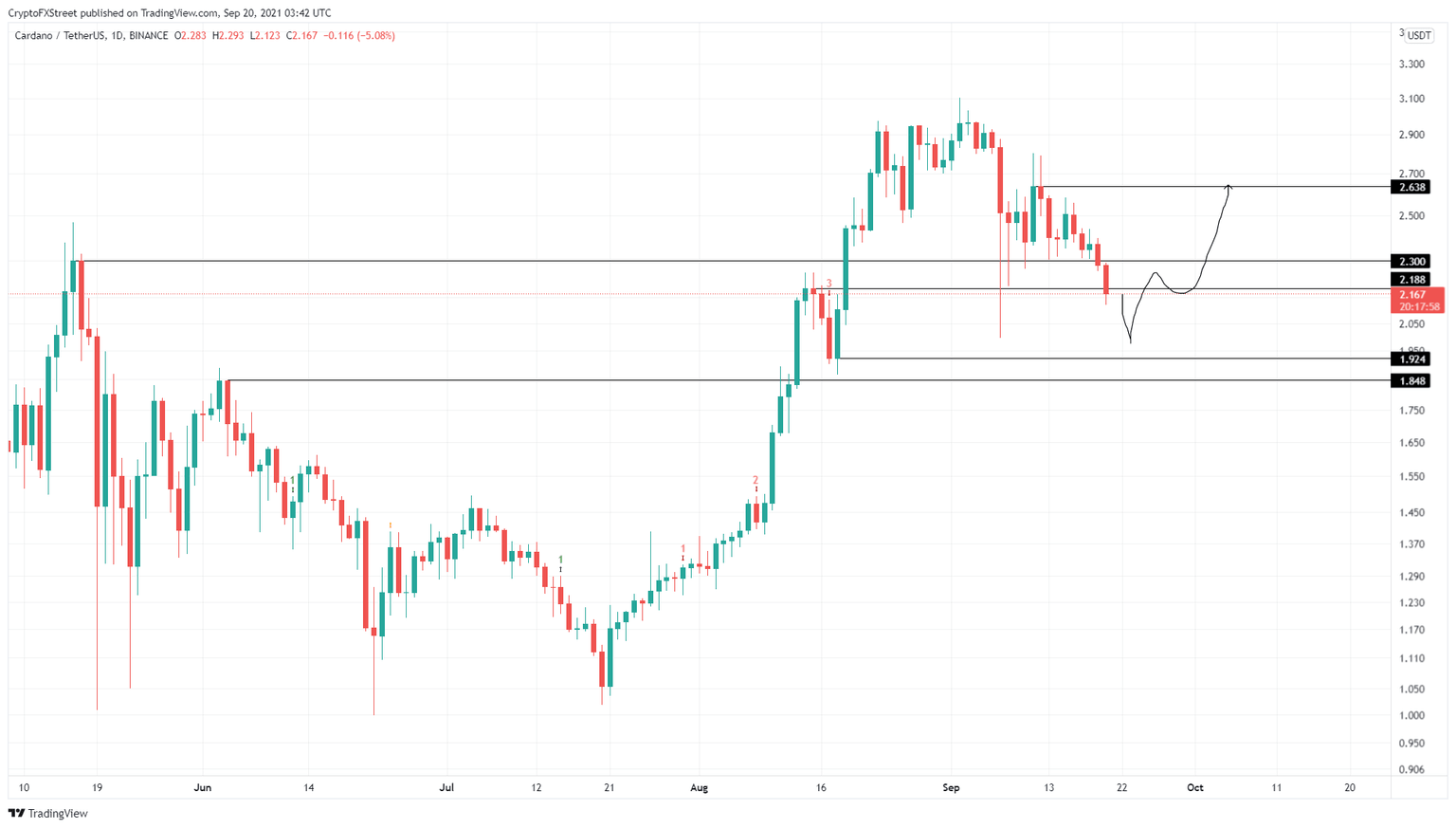

- Cardano price might slide below the $2.188 support floor before kick-starting an uptrend.

- The resulting rally will likely slice through the immediate resistance barrier at $2.300 and retest $2.638.

- A breakdown of the $1.924 demand level will invalidate the bullish thesis.

Cardano price is grappling with a crucial support floor on the daily time frame as the big crypto experienced a minor crash. Investors can expect ADA to slice through this barrier before restarting its uptrend.

However, the bullish outlook is based on the assumption that BTC recovers and proceeds to go higher.

Layer-2 solution for Cardano is on its way

InputOutput (IOHK), the development team behind Cardano, announced Hydra on September 17, a Layer-2 solution for Cardano. Based on the recent revelations, the Ouroboros proof-of-stake layer or the main chain will be where transactions settle but are processed off-chain. Doing so will retain the security guarantee.

The blog further details that Hydra,

allows Tx fees and minimum UTXO Value to be configured as low as 1 or 2 lovelaces, critical to microtransactions and the use cases these unlock.

It also explains that Hydra will introduce isomorphic state channels to reuse the same ledger representation, yielding uniform, off-chain ledger siblings called “Heads.”

This feature allows native assets, non-fungible tokens (NFTs) and Plutus to be available inside each Hydra Head, permitting the extension of the system.

The recent implementation of the Alonzo upgrade will allow the DeFi ecosystem to birth on the ADA blockchain. With the successful launch of Hydra, the burgeoning space on Cardano will have no friction or bottleneck and can be expected to grow exponentially.

According to the latest update, IOHK has already implemented the basic Hydra Head protocol as a proof-of-concept in a developer preview. Moreover, this integration will be ready during the upcoming Cardano Summit, starting on September 25.

Cardano price at a decisive moment

Cardano price has shed roughly 24% over the past nine days as it retests the $2.188 support floor. Although BTC is crashing violently, ADA seems to be show resilience around the demand barrier mentioned above.

However, considering the uncertain nature of big crypto’s price action, there is a chance Cardano price might dip below $2.188 briefly before recovering above it. Doing so will not impact the bullish outlook for ADA. Instead, it might trigger an uptrend to the immediate resistance level at $2.30. Flipping this barrier into a support floor will pave the way for a retest of the $2.638 ceiling. This run-up from $2.188 to $2.638 would constitute a 20% ascent.

ADA/USDT 1-day chart

On the other hand, if Cardano price fails to recover above the $2.188 foothold, it will indicate a weakness among buyers and increased selling pressure. Moreover, it might also catalyze a move to $1.924.

If ADA produces a lower low below this barrier or $1.848, it will invalidate the bullish thesis and suggest a shift in trend favoring the bears

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.