Cardano downtrend still in effect, but the tide is turning around

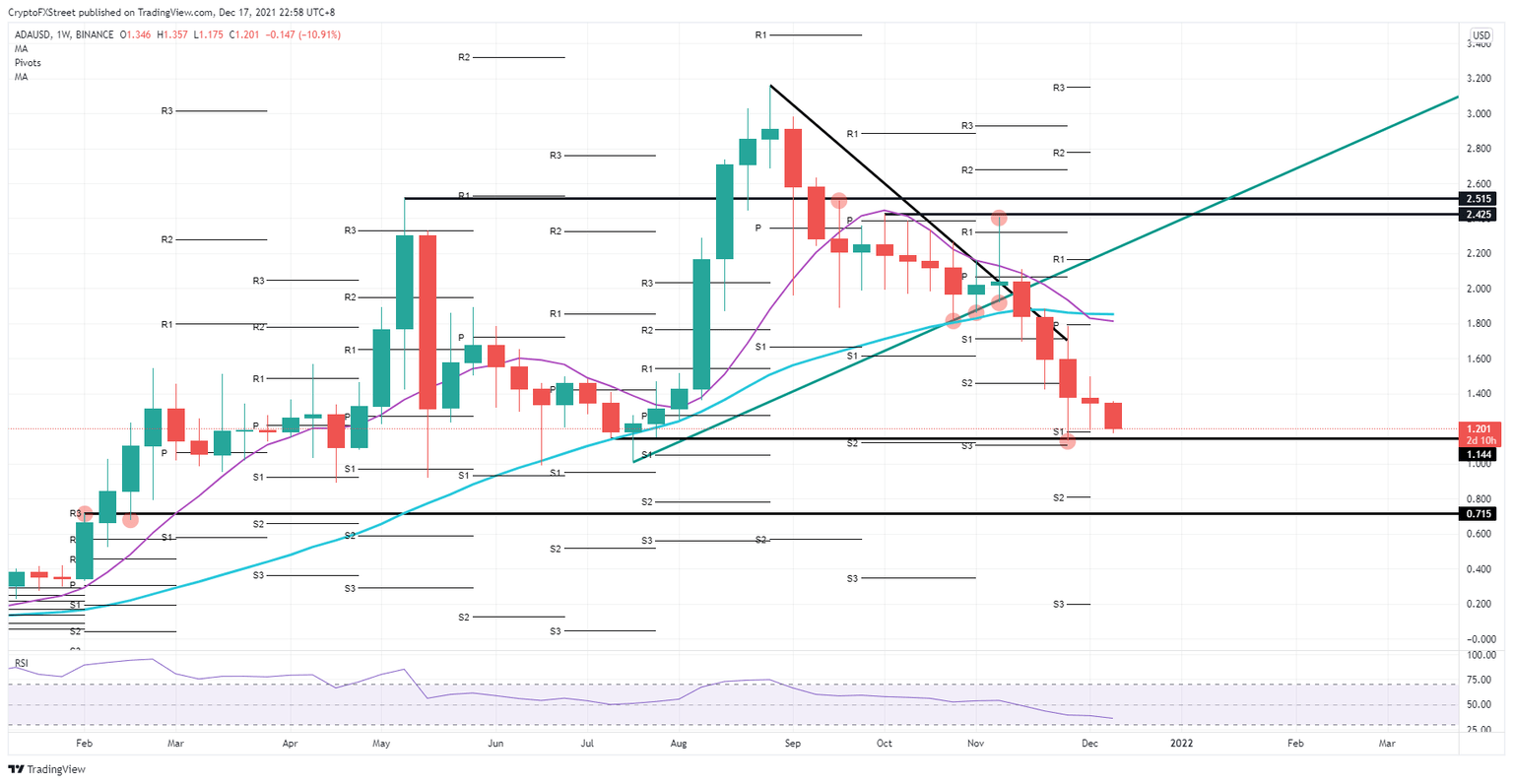

- Cardano price has been downtrend since September, but support is persistent at around $1.14.

- ADA price has bulls jumping on each occasion the monthly S1 support level gets hit.

- Expect a bullish breakout into the Christmas period and at the start of 2022.

Cardano (ADA) price has been under a constant downtrend for most of September, mounting already 63% in price devaluation. But investors have identified a fair value price where they would like to buy ADA coins at a discount, with the S1 monthly support level as additional backing. As more and more bulls add Cardano coins at this level, bears will start to back off as the price will struggle to push further to the downside, with a bullish breakout towards $1.80 as a result.

Cardano bulls are preparing for the Christmas pop towards $1.8

Cardano price has not had the best of times since the downturn started in September this year. But as the year almost comes to an end, it looks like Cardano might start 2022 with a rally that will see its spark around Christmas next week. Investors are defending $1.14 as a previous significant support level, and the monthly S1 just above adds to the conviction that this level will not give way anytime soon.

With the shift in sentiment last week, after a less hawkish central bank decision in the US, sentiment has shifted 180 degrees in favor of risk-on. This has seen an uptick in buying volume, with bears drowning in their attempt to keep price action muted to the downside. Expect to see a bullish breakout in the coming week that could rally into New Year at $1.18, already reversing 1/3rd of the occurred losses since September.

ADA/USD weekly chart

Should some headwinds start to weigh in against the tailwinds that emerged at the end of this week, expect some more pressure to mount on the $1.14 level, with investors fleeing the scene for the default. A break lower would push ADA price towards $0.80 with $0.71 as the ultimate support element to hold as this acts as a technical support element from February this year. By then, the Relative Strength Index will have breached into the oversold territory, limiting further downside gains for bears.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.