Cardano developing a bear trap pattern, ADA poised for spike higher to $3

- Cardano price shows a bull trap pattern in development on its Point and Figure chart.

- The longer Cardano remains below $2.00, the more complex a breakout higher will be.

- Downside risks abound, and the selling pressure may not be finished for Cardano.

Cardano price is on its ninth consecutive week of weekly candlestick closes below the open – that’s a bearish near-term record no primary market cap cryptocurrency can match. But the constriction has been so prolonged that a breakout now could trigger some massive price spikes.

Cardano price has two potential trade setups on two different Point and Figure charts

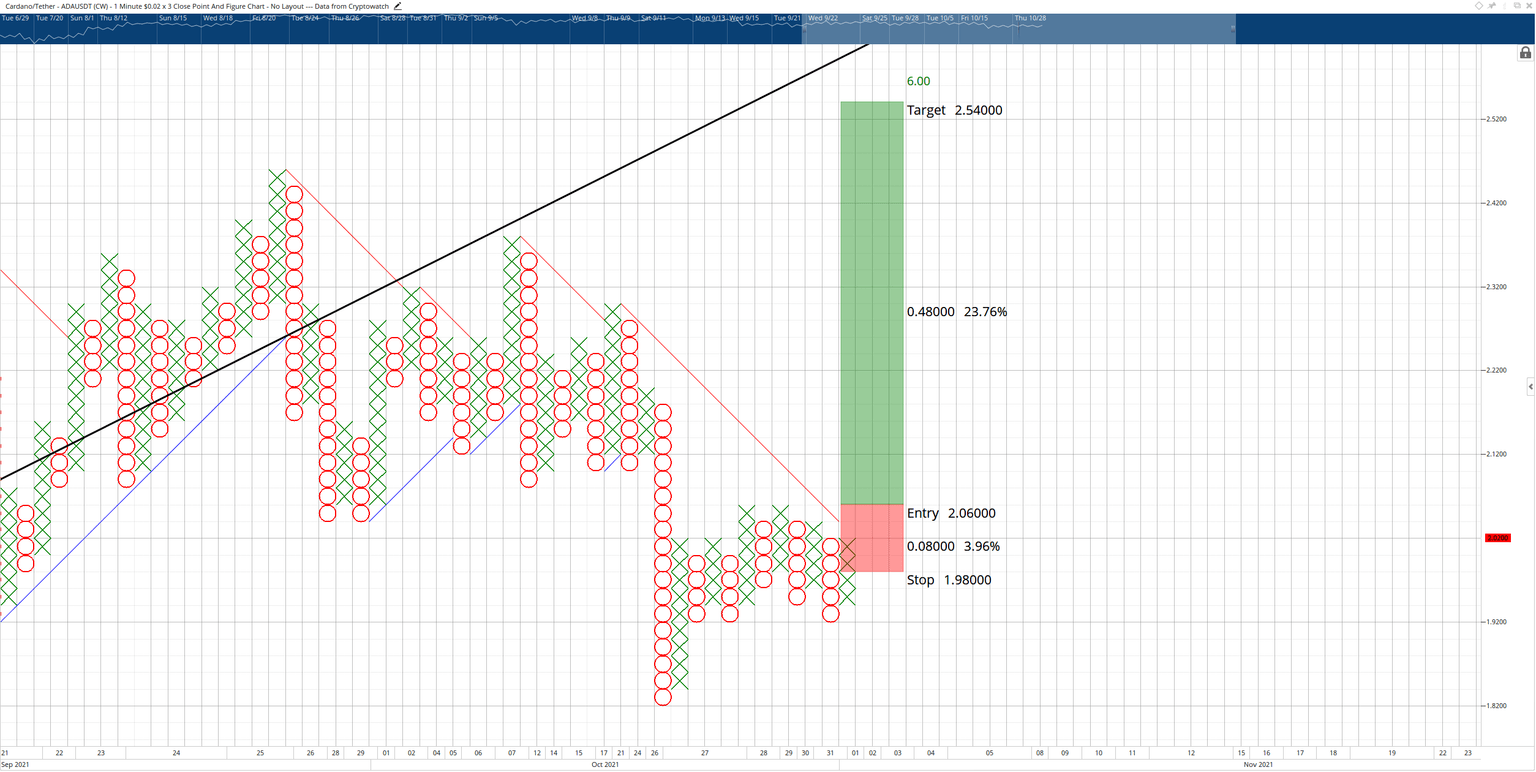

Cardano price has a potential long setup with a buy stop of $2.06, a stop loss at $1.98, a profit target at $2.54. The profit target is based on the Horizontal Profit Target Method in Point and Figure analysis. The entry itself accomplishes two bullish conditions at the same time. First, the entry breaks the bear market angle and converts the Point and Figure chart into a bull market. Second, the entry would confirm the bullish pattern known as a Bear Trap.

ADA/USDT $0.02/3-box Reversal Point and Figure Chart

The hypothetical long trade setup will be invalidated if Cardano price moves below $1.90.

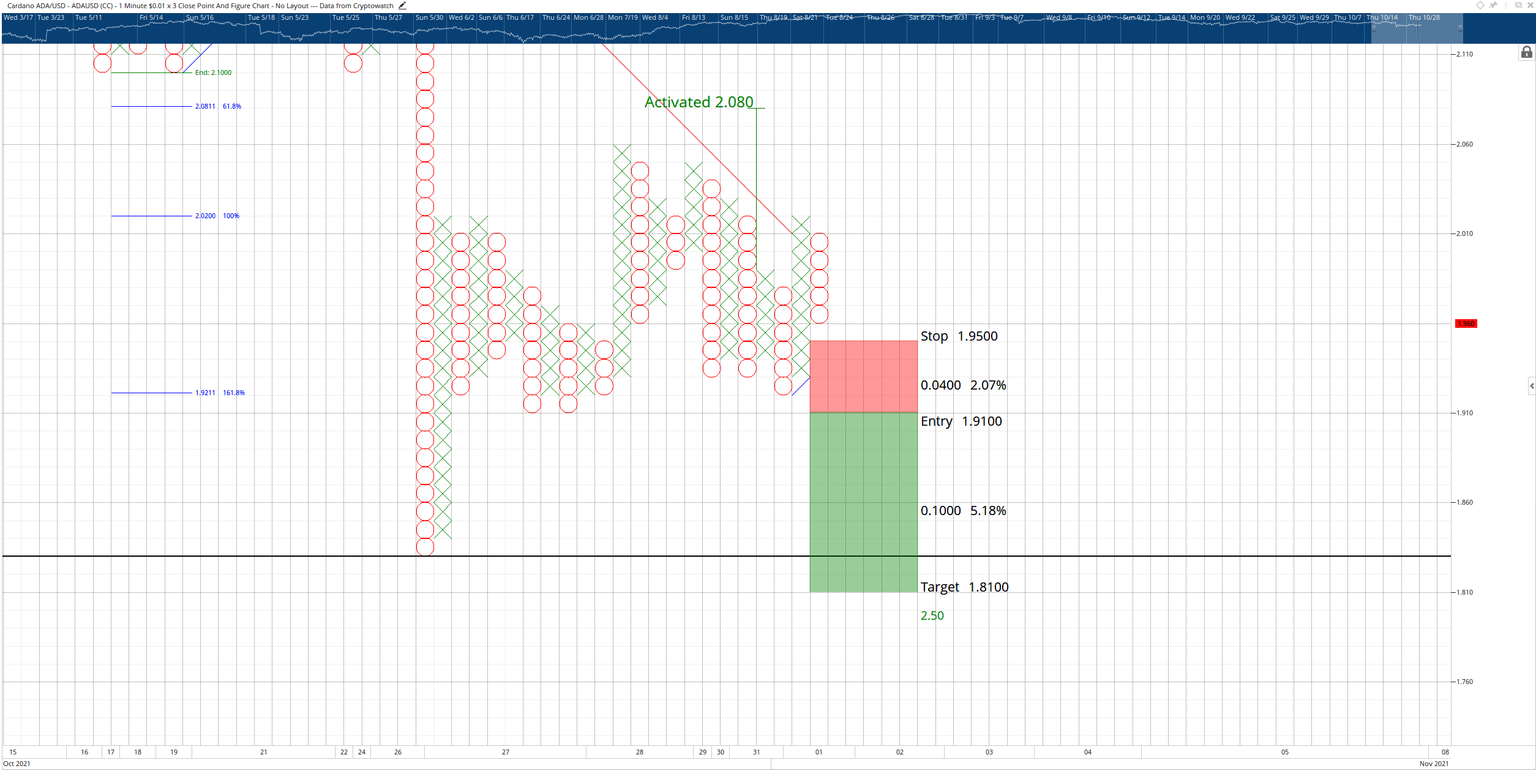

There is a potential short trade as well. The short trade is based on a pattern known as a Bearish Catapult. This pattern developed after a triple-bottom and is followed by a double-bottom. The theoretical entry would be at $1.91 with a stop loss at $1.95 and a projected profit target at $1.81. The short idea has a much smaller projected profit target range due to the intense volume profile support levels near $1.80.

ADA/USDT $0.01/3-box Reversal Point and Figure Chart

The short trade idea would be invalidated if Cardano price were to close above the $2.14 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.