Cardano could tank to $1 if ADA fails to defend crucial support

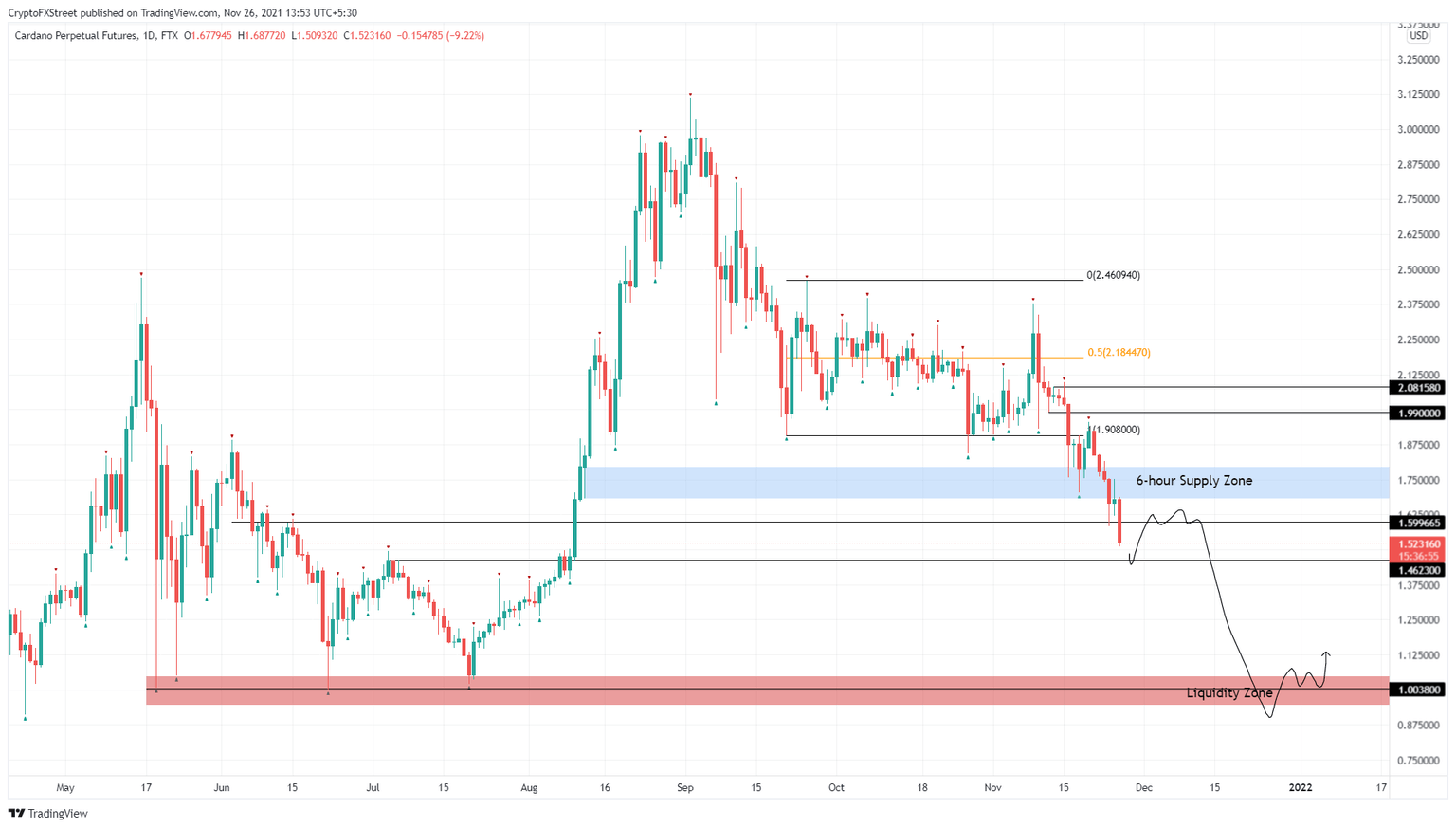

- Cardano price is currently hovering below a freshly shattered 6-hour demand zone, ranging from $1.68 to $1.79.

- This resulting crash could extend to the immediate and critical foothold at $1.40.

- A breakdown of this barrier will provide market makers an opportunity to crash ADA to $1 and lower.

Cardano price seems to be continuing its downtrend without any signs of a let up. ADA has sliced through a wide area of support, hinting at a massive crash, however, this bearish outlook is contingent on one more key foothold giving way.

Cardano price looks ready for further downfall

Cardano price has dropped 12% so far today, November 26, and more weakness is likely if the cryptocurrency markets continue to tumble. For the so-called “Ethereum killer,” the crash and its extent are dependent on whether the stable $1.40 support level can hold or not.

In the past, this level provided a ceiling of resistance when ADA was consolidating beneath. Its breach led to the start of an ascent that propelled Cardano price to an all-time high of $3.11. The $1.8 support level also played an equally important role in helping ADA scale higher. The recent crash has pushed ADA below it, leaving $1.40 to defend the onslaught on panic sellers.

If the selling pressure continues to increase, investors can expect ADA to slice through $1.40. A daily close below this level will trigger a 24% descent to between $0.94 and the $1.04 demand zone. In total, this crash would represent a 35% loss from the altcoin’s current position at $1.53.

ADA/USDT 1-day chart

If Cardano price manages to stay above $1.40, there is a high chance buyers might cauterize the bleed and push ADA up by 20% to retest the 6-hour demand zone, extending from $1.68 to $1.79.

A daily close above $1.79 will signal the potential start of a new uptrend, however, a higher high above $2 will invalidate the bearish thesis for ADA and suggest more gains on the horizon.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.