Cardano community digests DDoS attack on the network, ADA hovers below $0.40

- Cardano developer IOHK explained how the network was defended against the recent DDoS attack.

- The network suffered a spam incident early in July, and despite the load on the chain, transactions were processed at a reduced rate.

- Cardano hovers below $0.40 on Friday, losing nearly 3% value this week.

Cardano (ADA) developer Input Output Hong Kong (IOHK) dropped a video digesting the mid-July DDoS attack on the network with experts. The community defended against the attack, and transactions were processed at a slow pace during it.

ADA erased nearly 3% of its value this week and trades at $0.38 at the time of writing on Friday.

Cardano community digests DDoS attack with experts

Jack Briggs, from Intersect, was joined by subject matter experts for a roundtable discussion on the recent attack on Cardano’s chain. A bad actor (Spammer) produced a series of transactions that burdened the Cardano chain and increased the load to an extent that slowed down the network.

In the video shared by IOHK in their official announcement, Briggs explains that the network responded extremely well to the attack. The rate at which blocks are produced in the chain dropped by 20% at first, then recovered within a few hours.

Intersect is a group of members, builders, and contributors of the Cardano network. The group put together a technical task force and rallied the community for support to tackle the attack on the chain.

How did the Cardano network and its community respond to a recent spam attack? Our latest video brings together guests from @Intersect_MBO, Input | Output tech team, and the Cardano community to reflect on this challenge.

— Input Output (@InputOutputHK) August 2, 2024

Learn about the impact on the network, key DApps, and… https://t.co/eF7aC57Kor

Cardano loses 3% value this week

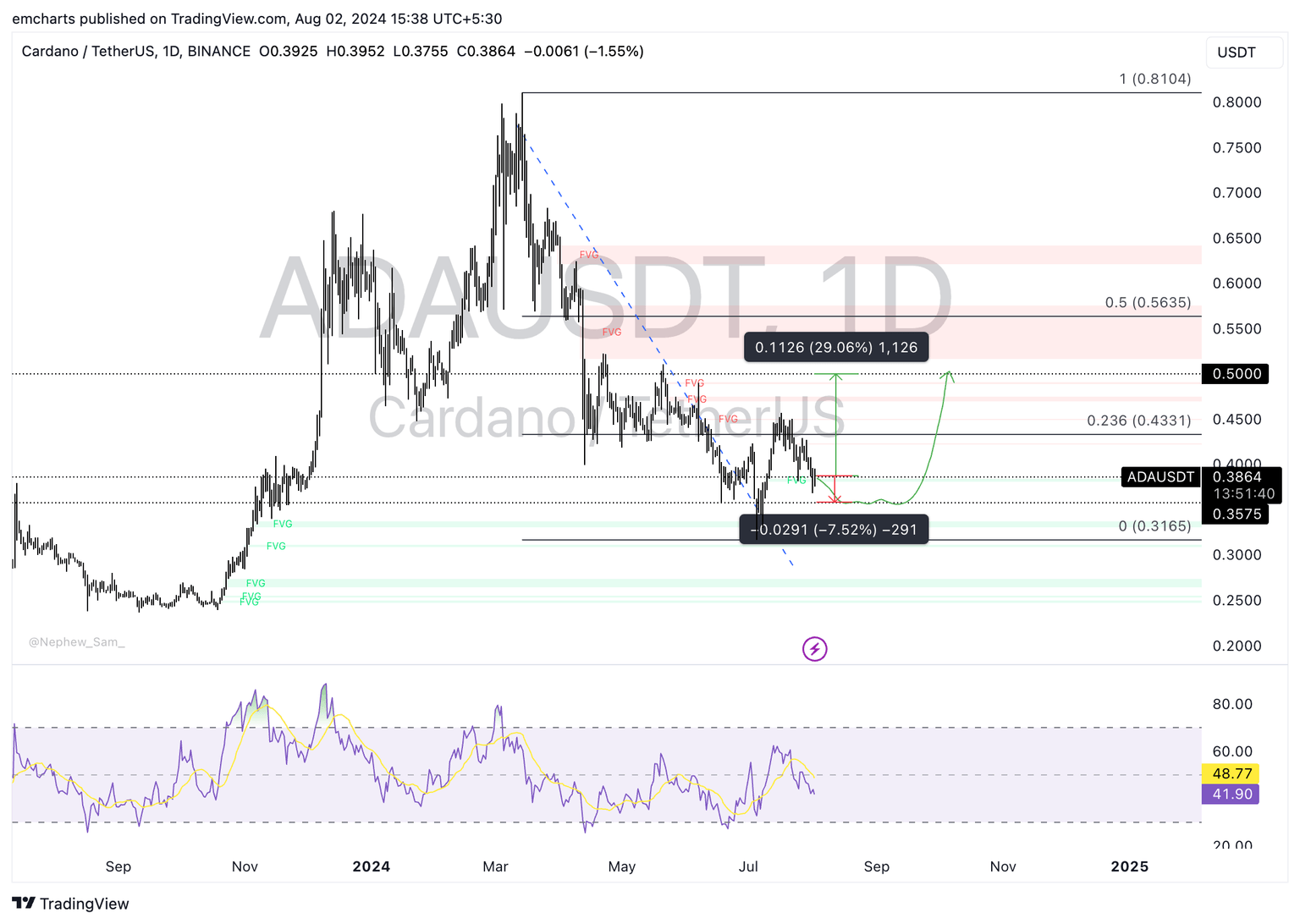

Ethereum-competitor chain Cardano’s native token ADA hovers around key support on Friday. The altcoin broke out of its downward trend on July 9. Cardano could extend its losses by another 6% from the current level of $0.38 and dip to the June 18 low of $0.3575 before beginning a recovery.

If the $0.3575 support holds and buying interest appears, Cardano could rally nearly 40% toward its target of $0.50. The altcoin rallied to this level in mid-May, as seen in the ADA/USDT daily chart below.

The Relative Strength Index (RSI) momentum indicator reads neutral at 41.90.

ADA/USDT daily chart

A daily candlestick close above $0.42 resistance could invalidate the bearish thesis for Cardano.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.