Cardano breaks through resistance, signals 20% advance

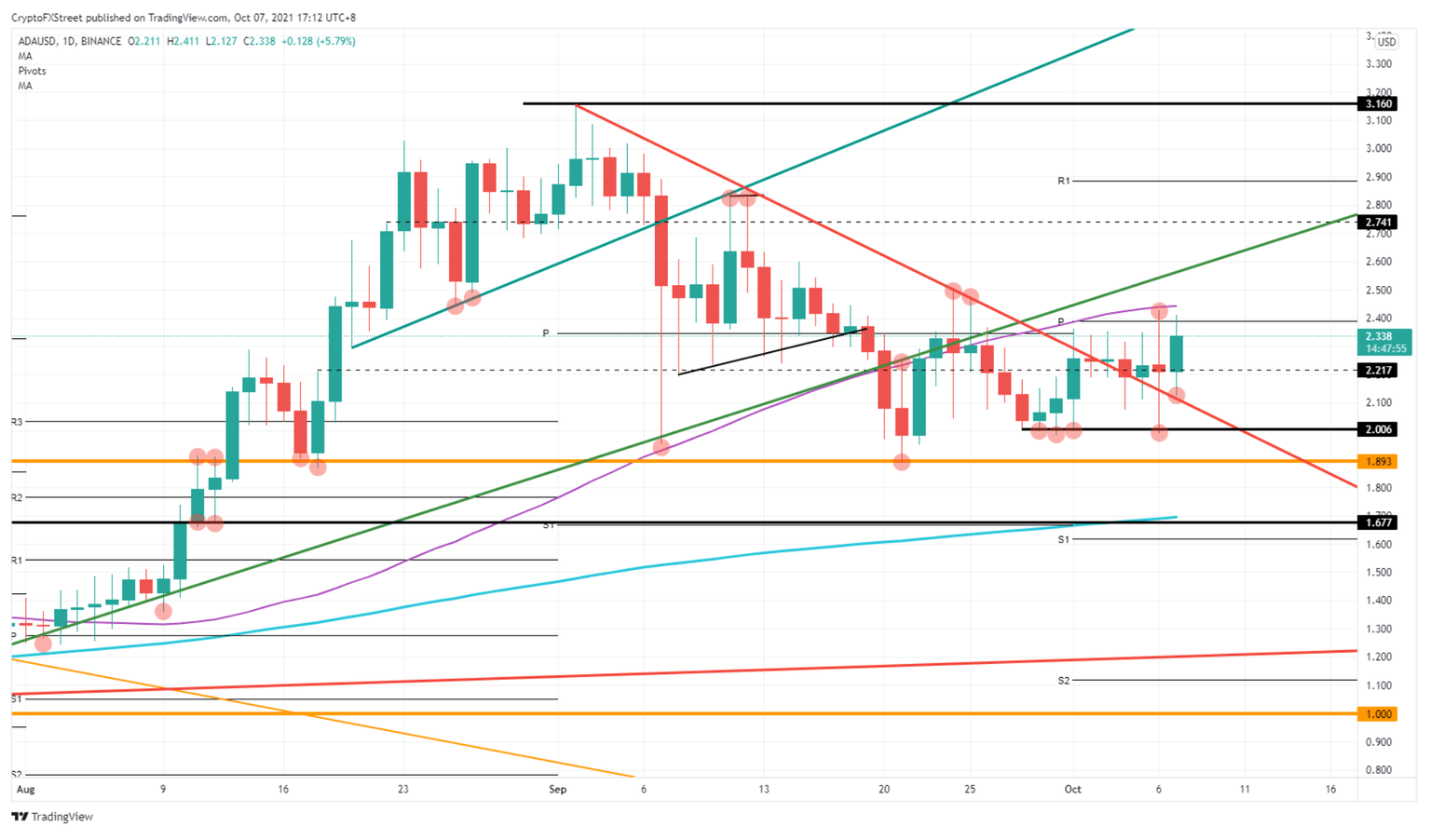

- Cardano price action is attempting to push above the monthly pivot.

- The 55-day SMA is keeping bulls' price action in ADA capped.

- With a clear bounce off the red descending trend line, bulls have plenty of volume to break the 55-day SMA, paving the way for $2.90.

Cardano (ADA) price saw some choppy price action this week. The turn came on Wednesday with bulls entering at $2.01, a level that showed its importance already in September. Bulls are now attacking the 55-day Simple Moving Average (SMA) around $2.45, which is putting a price cap on ADA for the moment.

ADA price bulls need to break $2.45 to have a free ride toward $2.90

Cardano price offered a solid entry on Wednesday at $2.01. That level already provided plenty of support back in September and did seem to be up for the chore again this month. Price ranged higher, attempting to break above the monthly pivot. But the 55-day SMA at $2.45 capped further price action in ADA.

ADA bulls have added more volume and fresh buyers to the rally, bouncing off the red descending trend line today. Bulls are now trying to regain control of the monthly pivot and with a possible second attack on the 55-day SMA just above there. Bulls are helped with the favorable tailwind of global markets.

When bulls in Cardano price action can push beyond the 55-day SMA at $2.45, expect price action to shoot up further with a price target at $2.90. On that level, there is the double top from September 11 and the monthly R1 resistance level forming a barrier and profit-taking area for the bulls.

When buyers fail to break the 55-day SMA in their second attempt, expect a fade in the Cardano price action, with a dip back toward the red descending trend line and $2.01 flat line. A quick spike lower is possible as most bulls will have their stops placed between $2 and $1.89. Expect the 200-day SMA to be near $1.70 to stop any further continuation to the downside in the short term.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.