- ADA holders will be able to receive staking rewards on the recently launched testnet.

- ADA/USD is consolidating losses after a sharp sell-off.

As of November this year, users of Cardano network and ADA holders will be able to receive staking rewards, according to Charles Hoskinson, the CEO of IOHK, the company behind Cardano. He made an announcement during Cardano Summit Bulgaria.

Recently, the project launched Shelley testate, which is the first decentralized implementation of Ouroboros Genesis consensus algorithm. Currently, the team is working on staking protocol functionality.

“It’s a nice little sandbox…just like Cardano, the only difference is you can register as a stake pool, you can delegate, you’ll have all the interfaces to start actually staking,” Charles Hoskinson explained.

On the next stage, real ADA users will be able to participate in testing staking functionality.

According to Hoskinson, coins bought on the secondary markets will not be eligible for staking. Also, users won’t be able to sell the coins they received as a staking reward. New coins will be transferred to the new network that is expected to be launched in the first quarter of 2020.

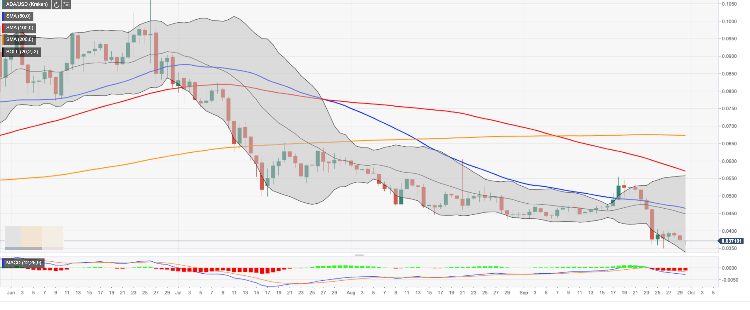

At the time of writing, ADA/USD is changing hands at $0.0371, down 1.6% on a day-on-day basis. It is the 12th largest digital asset with the current market value of $965 million. ADA has been moving in sync with the market recently, staying in a tight range after a sharp collapse in the previous week.

ADA/USD, daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin falls below $92,000 as exchanges show overheating conditions

Bitcoin (BTC) continues its ongoing correction, falling below $92,000 on Monday after declining almost 4% last week. CryptoQuant data shows that BTC is overheating in exchanges and suggests further decline ahead.

Top altcoins Solana and Cardano show bearish signs in momentum indicators

Solana’s price extends its decline on Monday after falling more than 11% in the previous week. Cardano’s price trades in red on Monday after correcting over 11% last week.

Ondo Price Forecast: 20% ONDO unlock on January 18

Ondo price continues to edge down, trading around $1.16 on Monday after declining more than 21% in the previous week. Ondo Foundation tweeted that there will be a 20% ONDO unlock on January 18, leading to 134% of the current circulating supply.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP remains strong

Bitcoin and Ethereum prices continue to trade in red on Monday after declining more than 3% and 10% in the previous week. However, Ripple remains strong and breaks above its upper symmetrical triangle boundary, suggesting a rally ahead.

Bitcoin: Room for a recovery or continuation of the pullback?

Bitcoin’s price slightly recovers and trades around $94,700 on Friday after declining nearly 6% earlier this week. US Bitcoin spot Exchange Traded Funds data shows signs of mild recovery, with a total net inflow of $462.2 million until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.