Can XRP price kick-start 30% upswing if China removes zero-Covid restrictions?

- XRP price struggles with the $0.400 hurdle as it attempts to flip it into a support level.

- If China lifts its zero-Covid restrictions, it could trigger a rally in risk-on assets.

- The remittance token could embark on a 30% rally to collect the buy-stop liquidity resting above $0.510.

XRP price shows that it is taking its sweet time to overcome and sustain above a crucial resistance level. If successful, it could catalyze a quick run-up. However, the lack of volatility in crypto markets has made it impossible for the remittance token to do this by itself.

A change in China’s Covid policy breathes hope

The much-needed volatility might come in the next two hours. A news conference is likely to be held at 0700 GMT in Beijing by the Joint Prevention and Control Mechanism of the State Council in China. There are speculations that China might announce lifting its zero-Covid policy. This development could ease the tensions among investors who moved to safe-haven assets after protests broke out in China.

If there is an announcement that confirms the lifting of the zero-Covid policies, it could provide a bullish push for risk-on markets, including cryptocurrencies.

XRP price ready to make a move

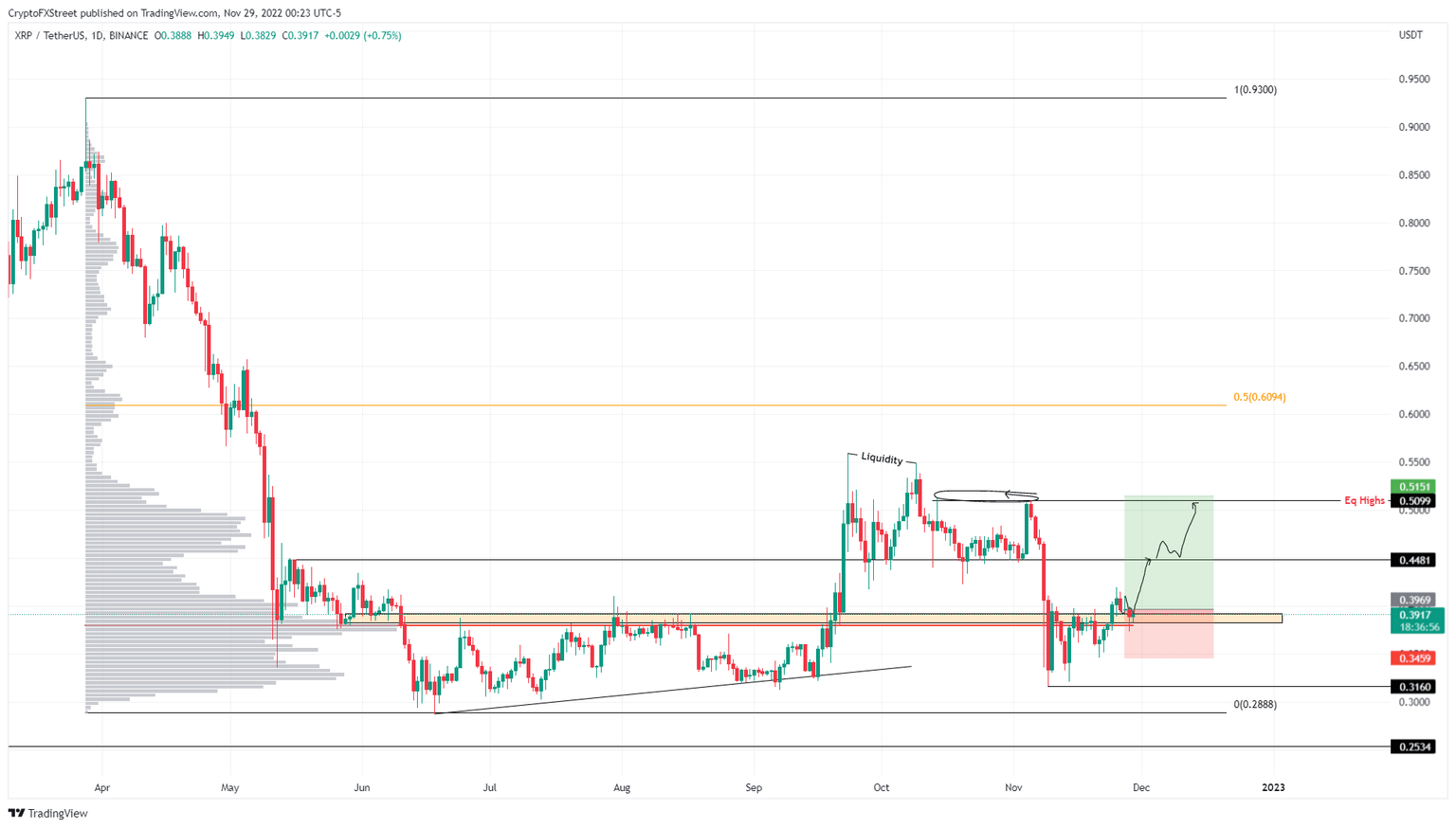

XRP price sliced through the $0.400 hurdle on November 22 but failed to sustain above it. As a result, the altcoin slipped below the aforementioned level. Bullish rumors from China could bring much-needed volatility with it, triggering a successful breakout.

In such a case, XRP price will aim to collect the buy-stop liquidity resting above the $0.510 equal high. This move would constitute a 30% upswing and is likely where the upside is capped for the remittance token.

XRP/USDT 1-day chart

On the other hand, if XRP price fails to hold above the $0.379 support level, it will invalidate the bullish thesis. This development could see the remittance token slide to the $0.316 foothold, where buyers can band together and scoop XRP at a discounted price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.