Can this setup trigger a 50% bull rally for Shiba Inu price

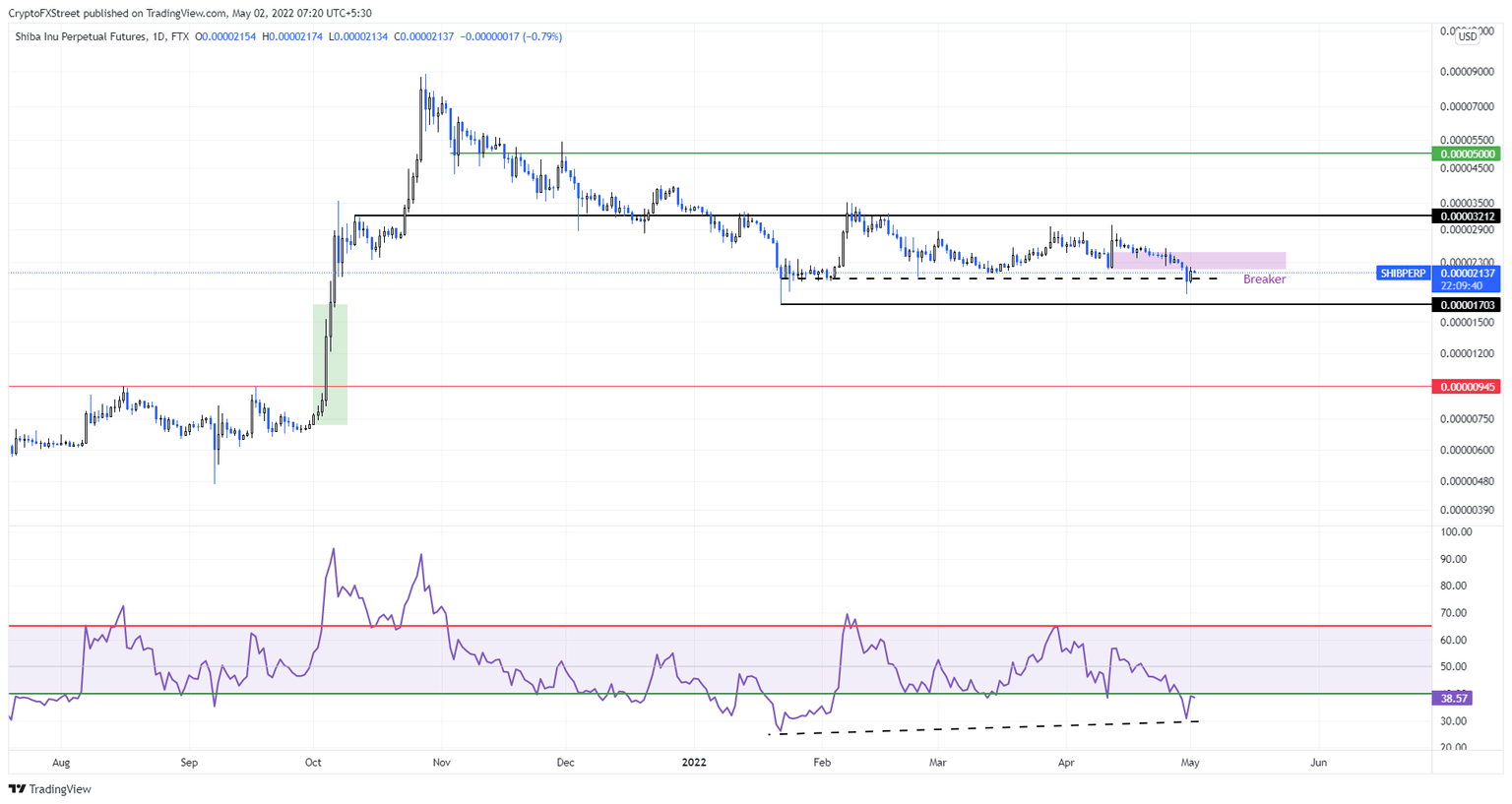

- Shiba Inu price has set up a technical setup known as exaggerated divergence, hinting at an uptrend.

- Investors need to wait until SHIB breaks through the $0.0000218 to $0.0000246 breaker to reach $0.0000321.

- A daily candlestick close below $0.0000170 will invalidate the bullish thesis.

Shiba Inu price shows potential for an uptrend as it forms a specific bullish pattern on the daily time frame. This formation could trigger a move for SHIB to retest a significant level after a decent uptrend.

Shiba Inu price readies its propulsion system

Shiba Inu price produced somewhat of an equal low around the $0.0000203 level, making it into a makeshift support level for the time being. This development occurred after SHIB crashed 10% on April 30 to breach the $0.0000218 to $0.0000246 demand zone.

This downswing flipped the said demand zone into a breaker that will prevent any further ascent. Therefore, any uptick in buying pressure needs to overcome the trapped investors’ sell pressure to see a move higher.

One of the proponents of an upswing is the Relative Strength Index (RSI), which is currently dipping into the oversold territory of around 30. Often, reversals occur when the asset is extremely oversold.

To add credence, the RSI is producing a higher high, indicating that the momentum is increasing and the Shiba Inu price has produced equal lows around $0.0000203. This technical formation is known as the exaggerated bullish divergence setup.

This setup forecasts and foreshadows an upswing. Therefore, a daily candlestick close above the breaker’s upper limit at $0.0000246 will indicate the resurgence of buyers. In such a case, SHIB will trigger a run to $0.0000321, constituting a 50% ascent from the current position at $0.0000213.

SHIB/USDT 4-hour chart

Regardless of the bullishness of the setup, Shiba Inu price needs to stay neutral, which will happen if it does not produce a lower low. However, a daily candlestick close below $0.0000170 will create a lower low and invalidate the bullish thesis for Shiba Inu price.

In such a case, SHIB could trigger a swift crash to $0.0000094 due to the fair value gap that extends from $0.0000170 to $0.000071.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.