Can the second half of 2022 be kind to SafeMoon price?

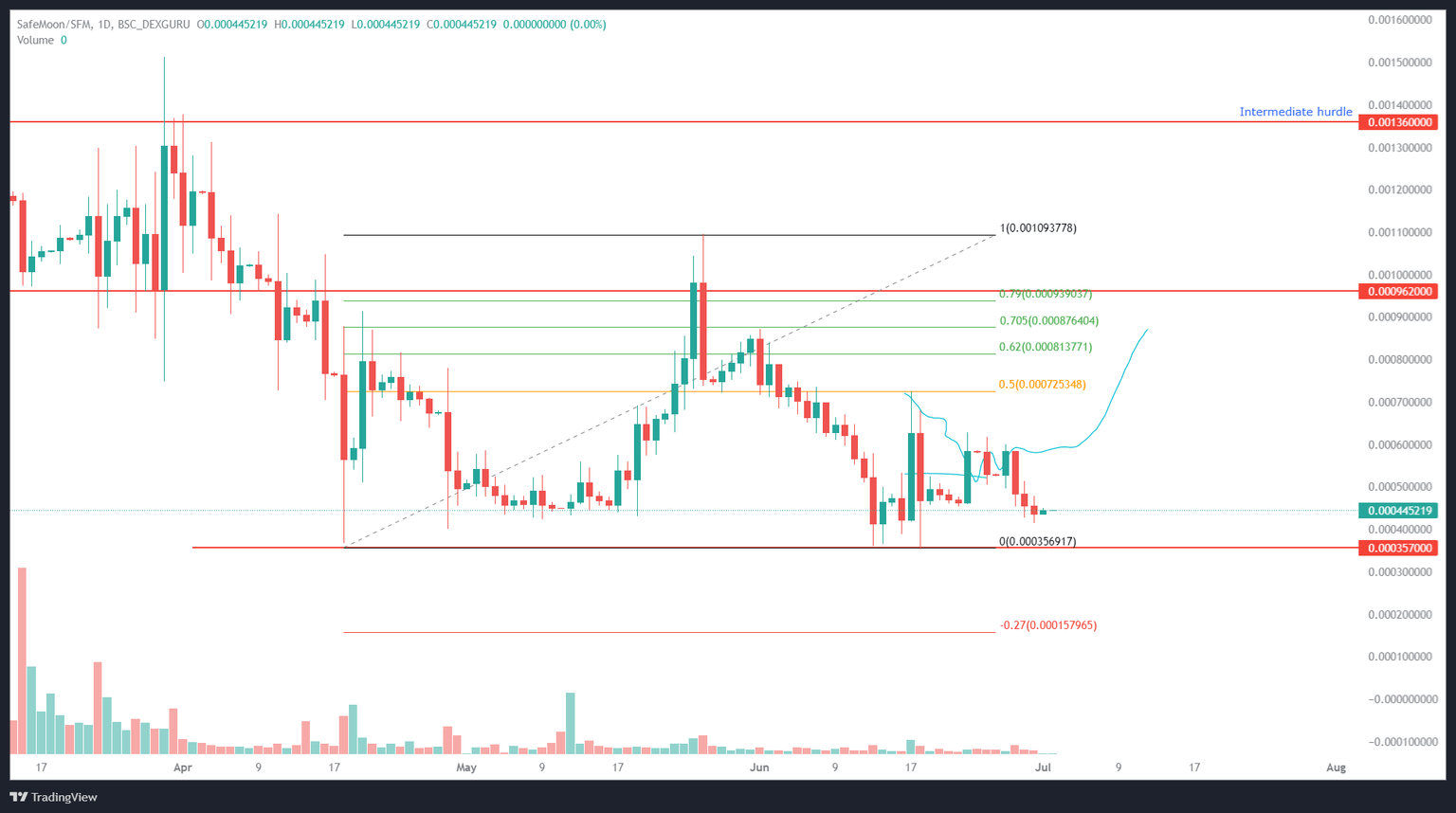

- SafeMoon price shows signs of recovery after consolidating for days between $0.000584 and$0.000414.

- Investors can expect a bounce to result in roughly a 100% upswing to $0.000876.

- A daily candlestick close below the range low at $0.000356 will invalidate the bullish thesis for SAFEMOON.

SafeMoon price shows a bullish outlook that seems too good to be true. Investors that do not practice proper risk management could get caught off guard.

SafeMoon price prepares for a run-up

SafeMoon price consolidated between the $0.000584 and $0.000414 levels since June 19. This coiling up capped the altcoin’s volatility. However, the recent bounce off the lower limit suggests that SAFEMOON is ready for a quick move higher.

Factoring in the state of Bitcoin, which is looking bullish and ready for a bounce, investors need to prepare for a similar outlook for SafeMoon price. The most probable level that the altcoin can retest is the 50% retracement level at $0.000725.

If bullish momentum overcomes this hurdle, market participants can expect SafeMoon price to make a run for the 70.5% retracement level at $0.000876. This run-up would constitute a 100% upswing for SAFEMOON and is likely where the upside is capped.

SAFEMOON/USDT 1-day chart

While things are looking bullish for SafeMoon price after the recent consolidation, investors need to note that the altcoin tagged the range low at $0.000356 multiple times. This development leaves a lot of liquidity below it, making it malleable for market-maker manipulation.

If a sweep of the said level materializes, SafeMoon price could produce a daily candlestick close below the range low to invalidate the bullish thesis.

In such a case, SAFEMOON could crash 56% to the next support level at $0.000157.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.