Can the rise of the cryptocurrency market continue next week?

The last day of the week is likely to be bullish for the cryptocurrency market as the majority of the coins are in the green zone.

Top coins by CoinMarketCap

BTC/USD

The passing week has been bullish for Bitcoin (BTC) as its rate has risen by 2.60%.

BTC/USD chart by TradingView

However, from the technical point of view, bulls could not seize the initiative to come back to the mid-term bullish trend. The price is located between the support at $39,573 and the resistance at $45,478.

Sideways trading is also confirmed by the low trading volume, which means that there are low chances to see sharp moves in the next week. In this case, the more likely scenario is the continued trend around $42,000-$44,000.

Bitcoin is trading at $42,830 at press time.

ETH/USD

Ethereum (ETH) has gained more than Bitcoin (BTC) with a price rise of 6.19% over the last seven days.

ETH/USD chart by TradingView

After the main altcoin made a false breakout of the $3,400 zone, the price is located around the recent resistance at $3,300. If bulls cannot seize the initiative and the bears' pressure continues, the possible drop may lead ETH to the area around $3,200 as early as next week.

Ethereum is trading at $3,302 at press time.

XRP/USD

XRP is the only loser from the list today as its rate has gone down by 0.54%.

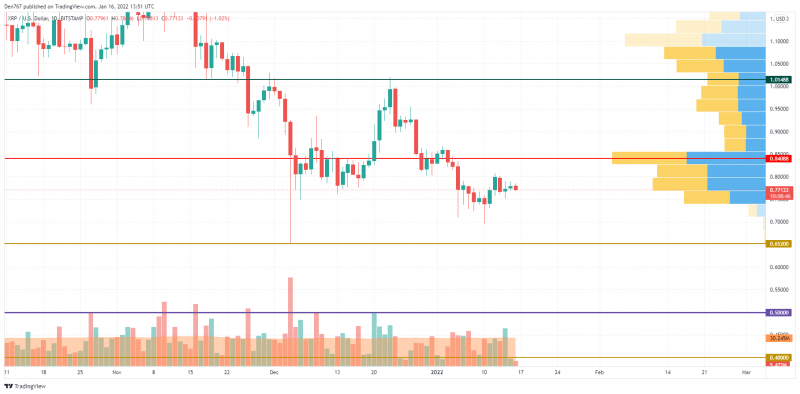

XRP/USD chart by TradingView

Despite the fall, XRP is located between the support at $0.6520 and the resistance, which serves the zone of the most liquidity at $0.84. If the price comes back to the area around $0.80, there is a possibility of seeing a further rise to $0.84.

However, it is too early to think about that as the growth is not supported by the trading volume.

XRP is trading at $0.7747 at press time.

BNB/USD

The rate of Binance Coin (BNB) is almost unchanged since yesterday; however, the rise over the last week is by 14%.

BNB/USD chart by TradingView

Binance Coin (BNB) has successfully fixed above the vital level at $489. If bulls can hold the gained initiative and the trading volume increases, the rate of the native exchange coin can keep the rise to the zone of the most liquidity around $520 next week.

BNB is trading at $497.5 at press time.

ADA/USD

Cardano (ADA) is the biggest gainer from the list today, rising by 20% over the previous seven days.

ADA/USD chart by TradingView

Cardano (ADA) has absorbed last week's fall, which confirms the power of the bulls over the bears. Thus, the buying trading volume is about to rise. If the situation does not change and the rate remains at the $1.30 mark, the growth may continue to the next level at $1.932 by the end of the month.

ADA is trading at $1.430 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.