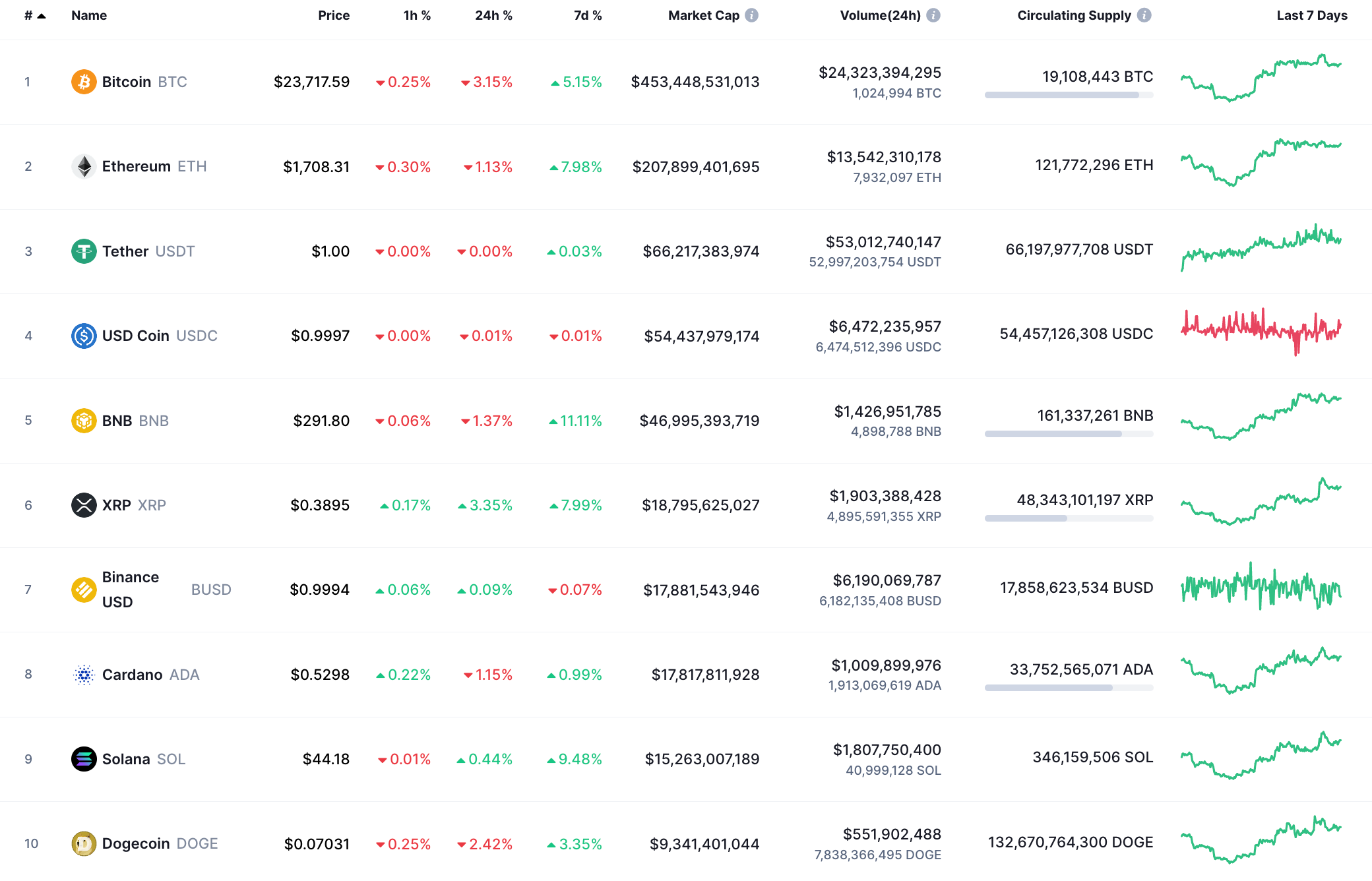

Most of the coins faced a correction period on the last day of the week.

BTC/USD

Despite the slight decline, the rate of Bitcoin (BTC) has risen by 5.19% over the last 7 days.

BTC/USD chart by TradingView

On the weekly chart, Bitcoin (BTC) looks bullish as the rate stays above the $23,000 mark. If bulls can hold the initiative, one can expect a continued rise to the $25,000 zone on the first days of the upcoming month.

Such a scenario is relevant until mid-August. Bitcoin is trading at $23,710 at press time.

ETH/USD

Ethereum (ETH) has gained even more than Bitcoin (BTC) as the rate has grown by almost 8%.

ETH/USD chart by TradingView

Ethereum (ETH) has continued the rise after the false breakout of the mirror level at $1,476. In this case, the more likely scenario is a test of the $1,900-$2,000 area within the next days. Ethereum is trading at $1,711 at press time.

XRP/USD

XRP is showing the same growth as Ethereum (ETH), rising by 8%.

XRP/USD chart by TradingView

XRP is trading near its resistance level at $0.3893 on the weekly chart. If the candle closes above this mark, there is a high possibility to see a sharp upward move to the $0.40 zone soon.

XRP is trading at $0.3895 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.