Can the ApeCoin price retest this support level and then rally?

- Apecoin price has rallied by 10% since the start of the new year.

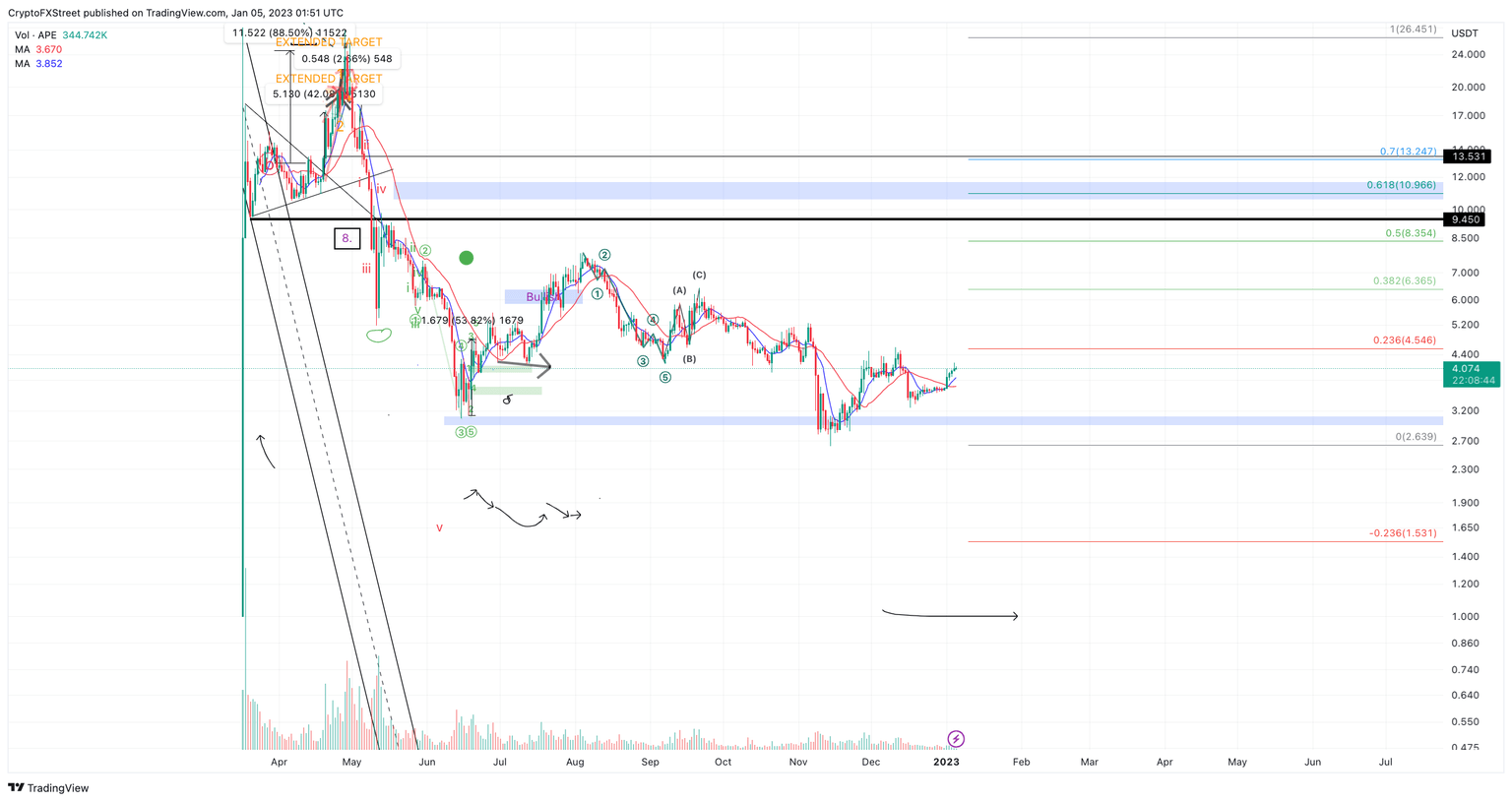

- The bulls have successfully hurdled the 8-day exponential and 21-day simple moving averages.

- Invalidation of the uptrend for APE is a breach below January’s low at $3.61.

ApeCoin price has shows short-term uptrend potential. Key levels have been defined to determine if APE can pull off the countertrend rally.

ApeCoin price is one to watch

ApeCoin price is currently up 10% for the month of January as the bulls have produced four days of persistent uptrend price action. If market conditions persist, the bulls may be able to replace more of the lost funds witnessed in 2022 back into the hands of investors.

APE price currently auctions at $4.06. The bull have successfully hurdled both the 8-day exponential and 21-day simple moving averages, following a classical bullish cross signal of the aforementioned indicators. As the uptrend has progressed, the range of the candlestick has progressively decreased, suggesting a substantial amount of bears are taking a profit.

Traders may want to wait for a retest of the 8-day ema followed by a pierce of the recent swing high at $4.20 before entering the market. Key levels to aim for would be the December 12 swing high at $4.58, resulting in a 13% uptrend rally. It is worth noting that A breach of the first target could create longer term swing trade idea targeting the mid-point of 2022’s downtrend near $8.50 in the months to come.

APE/USDT 8-Hour Chart

If the bullish scenario occurs, the Invalidation of the trend would be beneath January’s low at $3.61. If the level is tagged, the bears could challenge the November 14 swing low at $2.61, resulting in a 36% decline from APE’s current market value.

This video details how Bitcoin price moves could affect ApeCoin price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.