Can Shiba Inu rally price higher after BONE listing on Dubai-based exchange?

- Shiba Inu price nears psychological support that could trigger a falling knife when broken.

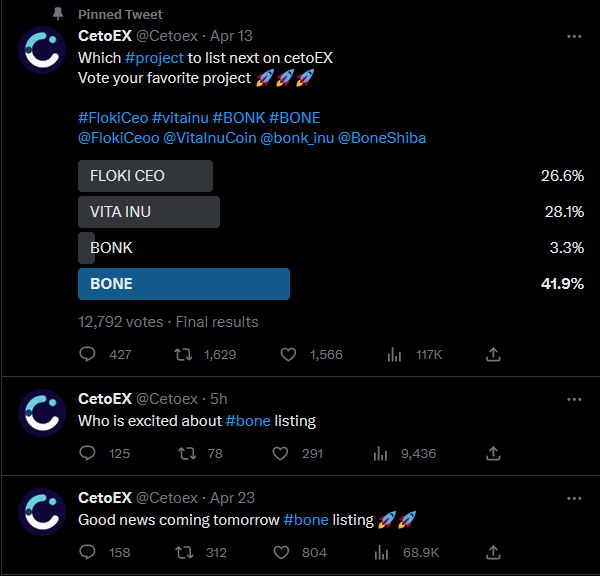

- SHIB receives positive news from CetoEX, a top exchange in Dubai, on the possible listing for BONE.

- A tailwind could come quickly and lift SHIB back above $0.00001100.

Shiba Inu (SHIB) price is in bad paper as some dark clouds are hanging over the price action. This Monday morning, however, some positive news out of Dubai could bring about a tailwind that opens up the sky for SHIB bulls. CetoEX, a fast-growing exchange in Dubai, is set to list BONE on its platform, which might conjure additional interest for SHIB’s price action.

Shiba Inu sees positive development coming in at this crucial time

Shiba Inu price broke below the always crucial 200-day Simple Moving Average (SMA) last week and is, from a technical point of view, set to sink lower. That was the idea until this Monday morning when an official statement out of Dubai could bring the much-needed tailwind for SHIB to lift price action back up. CetoEX, one of the fastest-growing exchanges in Dubai, has expressed its intent to list BONE ShibaSwap (BONE), which is the governance token of ShibaSwap.

CetoEX Official Tweet Announcement

SHIB might see revamped interest on the back of this communication with additional interest from investors. Expect to see a gradual pickup of interest that could see SHIB print 10%. Around $0.00001100 would be ideal, as bulls would then have reclaimed the monthly pivot and could be seen trading higher in the coming weeks toward $0.00001200.

SHIB/USD 4H-chart

The threat to the downside is with the Death Cross that is nearly being formed on the chart. The 55-day Simple Moving Average is already heading lower as the 200-day SMA is flatlining. Another few negative candles could be enough to drag the 55-day SMA below the 200-day SMA and even tilt that 200-day SMA to the downside. If a Death Cross gets activated, it will trigger massive sell-offs across the board, with SHIB tanking toward $0.00000966.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.