- Avalanche launches "meme coin rush" program to boost meme coins on its ecosystem.

- BOME posts an impressive 30% gain on Friday as other meme coins look set to rise.

- Bitcoin may crash a potential meme party if its price tanks.

Avalanche (AVAX) is looking to introduce the meme coin mania into its ecosystem following the launch of its meme coin rush program. This comes on the back of Shiba Inu (SHIB), Dogecoin (DOGE), Floki Inu (FLOKI), Book of MEME (BOME) and a host of other meme coins seeing huge losses after a massive rally earlier in March.

Avalanche wants in on the meme action

Avalanche, compared to Ethereum and Solana, has yet to see much of the meme coin hype that has recently taken the crypto market by storm.

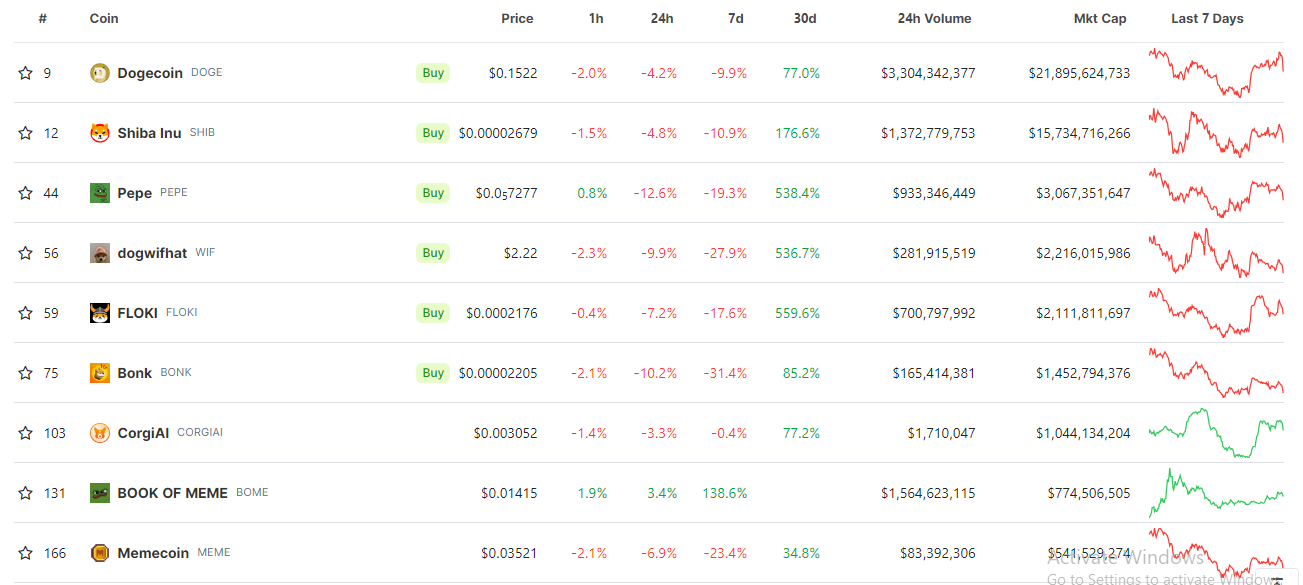

Since the beginning of March, large-capped meme coins like Dogecoin, Shiba Inu, Pepe and Floki led the crypto market in a frenzy, recording significant highs reminiscent of the 2021 bull run. A few weeks after, Solana meme coins joined the party as tokens like dogwifhat (WIF) and Book of MEME (BOME) recorded huge gains, according to data from CoinGecko.

Top meme coins

However, coming into the fourth week of March, much of the hype is winding down following the recent price correction in the market. But Avalanche may breathe life into the dying narrative by launching phase one of its "Meme coin rush" program.

Read more: Avalanche partners with Alipay+ amid fears of meme coin scam on its network

According to an announcement on the AVAX network, meme coin rush is a $1 million liquidity mining program that will "help scale liquidity and drive momentum...for the community coin ecosystem on Avalanche." This move may help spur meme coin development in Avalanche as the platform is making specific efforts to ensure this works. "Memecoins have become a cornerstone of Web3, representing the uniqueness and interests of diverse crypto communities," said Eric Kang, Business Developer Manager at Ava Labs.

BOME, SHIB, DOGE, FLOKI may resume an upswing

Following Avalanche's ploy to grab the meme coin narrative, investors began shilling different projects on X as several meme coins saw increased activity.

BOME, for example, skyrocketed in the past 24 hours, recording almost a 31% gain.

SHIB is also seeing immense movements in holdings. On-chain activity shows that more than 2 trillion SHIB tokens have been shuffled between exchanges, trading desks and whales. For example, a transfer from the SHIB accumulator "0xdaA," totaling $11.9 million in SHIB, was directed to the wallet address "0XB22," according to data on Etherscan.

This whale activity isn't restricted to SHIB alone. On Thursday, DOGE was up nearly 20% as on-chain analyst Ali Martinez shared a Santiment chart showing that Dogecoin whales have bought 25 million DOGE tokens worth around $3.75 million since Tuesday. This action may be motivated by Coinbase Derivatives securing approval to list Dogecoin futures products. The price of DOGE later saw a correction and is down about 2% on Friday.

Floki also saw gains on Thursday as its price posted gains close to 30% before a correction. This comes off the back of several partnerships, including serving as an official crypto partner - together with TokenFi - for the World Table Tennis Championship in South Korea and integrations with the Carbon web3 browser.

Also read: Dogecoin soars nearly 20% after Coinbase announces listing of DOGE derivatives

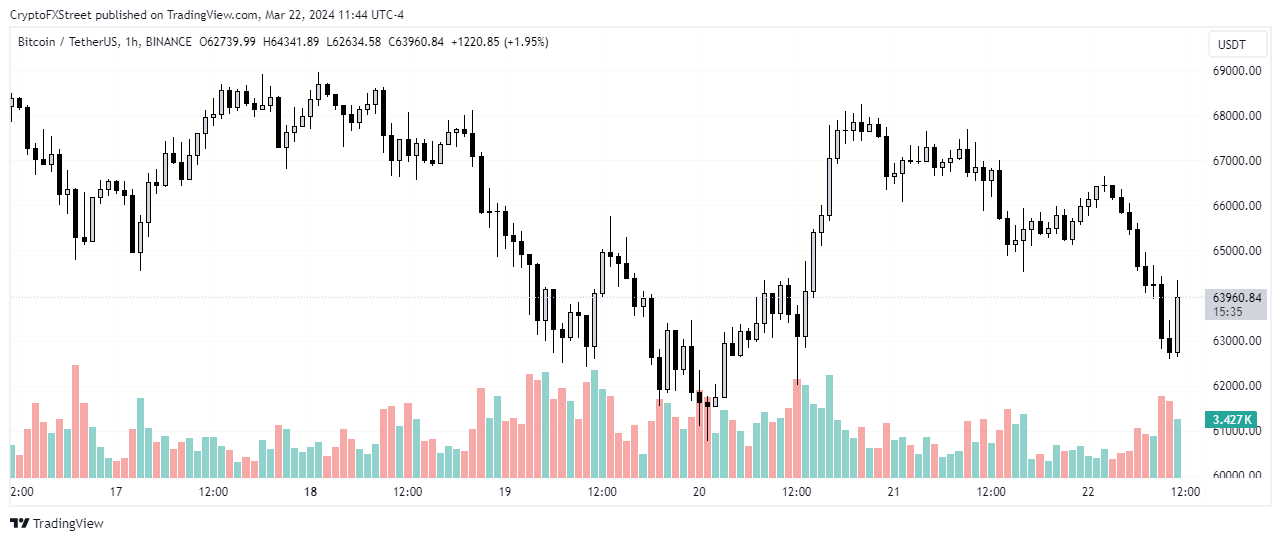

Bitcoin price crash may spoil the fun

A common factor among the rise of these tokens is the brief increase in the price of Bitcoin (BTC) following the Federal Reserve leaving interest rates unchanged. However, BTC's price action looks weak as it's down more than 6% in the last 24 hours. The market is also stagnating, as analysts at JP Morgan say that BTC is in overbought territory and has yet to see a major unwinding of positions. The analysts further predicted that profit-taking might continue as the Bitcoin halving event approaches.

BTC/USDT 1-hour chart

Considering Bitcoin's high correlation with altcoins, it may destabilize the entire market, including these meme coins discussed above.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.