Can Ripple’s recent win against the SEC help XRP price rebound?

- XRP price prepares for a massive crash as the technicals indicate a bearish continuation pattern.

- A breakdown of the $0.386 level will trigger a 42% crash to $0.221.

- If Ripple bulls flip the $0.488 hurdle into a support level it will invalidate the bearish thesis.

XRP price shows an extensive bearish outlook that matches Bitcoin’s macro narrative. The pessimistic scenario is only one support breakdown away from triggering a nosedive. So, investors need to be careful with their investments in XRP/Ripple.

Ripple gains the upper hand versus SEC

Over the last few weeks, Ripple aka the defendant has filed four RFAs (Request For Admission) with regard to a speech delivered by the former SEC director William Hinman in 2018. The speech, which mainly outlined the application of the securities laws on digital assets is now a pivotal piece of information that will help decide the case.

As reported earlier, the last few requests for admissions have been denied by the prosecutors aka the US Securities and Exchange Commission (SEC). The SEC claims that the documents or the internal discussions that went into the speech are legal and bound by attorney-client privileges.

However, in a development on June 8, the SEC stated to the judge that Hinman sought legal counsel from the SEC attorneys on the application of securities laws to digital assets for his speech.

The prosecutors further added, “that speech was very legal.”

Judge Sarah Netburn interrupted the SEC’s response to make sure she heard that sentence properly.

This development is a huge win for Ripple since the SEC has taken multiple stances on what the speech was. In some of the hearings, the prosecutors stated that former director William Hinman’s speech was his opinion but claimed at following hearings that conversations were protected by the attorney-client privilege.

Therefore, the burden of proof will be on the SEC lawyers, allowing Ripple to gain an upper hand.

XRP price needs to get culled

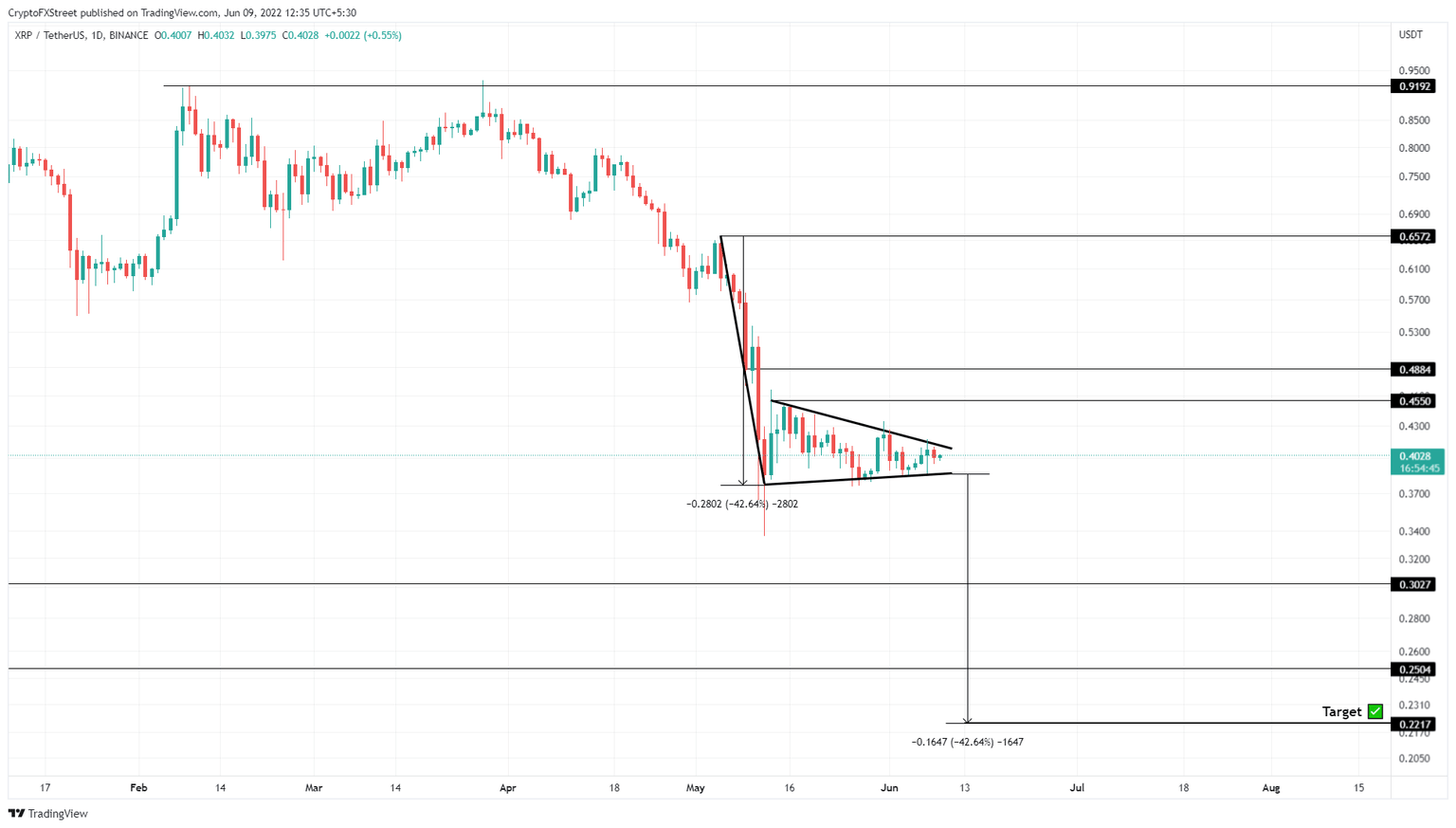

XRP price seems to be traversing a continuation pattern known as a bearish pennant. These patterns are composed of two parts – the initial steep decline or ‘flagpole’ followed by the sideways consolidation or ‘pennant’. In the case of Ripple, the 42% crash between May 5 and 12 formed the flagpole and the consolidation that followed, in the form of lower highs and higher lows, the pennant.

The pattern forecasts a 42% crash which is basically an extension of the length of the flagpole lower. This produces a target of $0.221 from a theoretical breakout point at $0.386.

From a macro perspective, this bearish pennant formation makes sense since Bitcoin price, which influences all other cryptocurrencies, also forecasts a potential crash to $20,000 or lower. Hence, market participants looking to invest over the long-term horizon should wait before making any decisions based on intraday volatility.

While the setup forecasts a 42% nosedive to $0.221, there are multiple support levels that might absorb the selling pressure. The $0.302 and $0.250 are two such blockades that will give bears a run for their money.

These levels played significant roles from late 2018 through to late 2020 and are likely to put up hefty support. Hence, a breakdown of these levels is crucial for bears to reach their targets.

XRP/USDT 1-day chart

Yet, if XRP price were to witness a sudden surge in buying pressure that pushed it up to breach the pennant’s upper trend line, it would dent the bearish narrative. This move might also be a fakeout, however – a bull trap that will eventually fall back down anyway.

On the other hand, the recent development of the SEC v Ripple lawsuit seems to have given Ripple the upper hand while the SEC is on the back foot. If there is even a slight hint that the defendants will come out of this case victorious, the XRP price could surge exponentially.

In such a case, a flip of the $0.488 hurdle into a support level will invalidate the bearish thesis. This development could see the XRP price climb higher and retest the intermediate resistance barrier at $0.578.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.