Cover image via www.tradingview.com

The bullish mood has turned bearish as almost all of the Top 10 coins are red. Bitcoin (BTC) is trying to remain in the green zone, rising by 0.05% over the last day.

The decline of most of the altcoins has positively affected the market share of Bitcoin (BTC), which has increased by 1% and now accounts for 55.1%.

The relevant Bitcoin data for today:

-

Name: Bitcoin

-

Ticker: BTC

-

Market Cap: $201,927,701,737

-

Price: $10,920.28

-

Volume (24h): $34,371,398,129

-

Change (24h): 0.16%

The data is relevant at press time.

BTC/USD: Can traders expect a false breakout of the $11,000 mark?

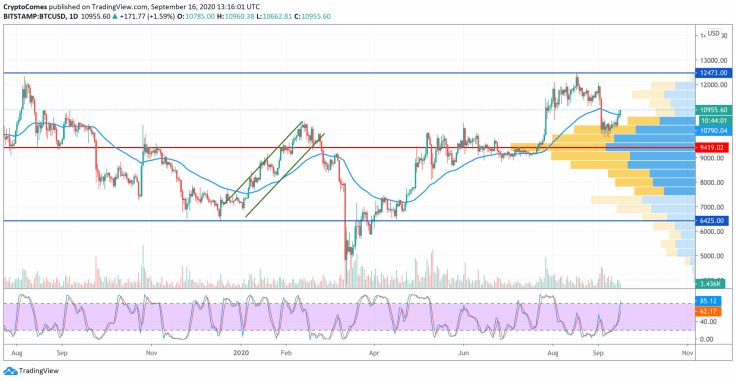

Yesterday, buyers managed to pierce the daily EMA55 and set a weekly high around $10,940. However, sellers paused the recovery in the Bitcoin (BTC) price and did not allow the pair to gain a foothold above the level of $10,800.

Today, the rollback from the daily moving average EMA55 is not over yet. During the day, the pair may decline to the support of $10,500. If this level stops sellers, the attempt to break through the daily average price level will be repeated and the maximum is expected in the resistance area of $11,200.

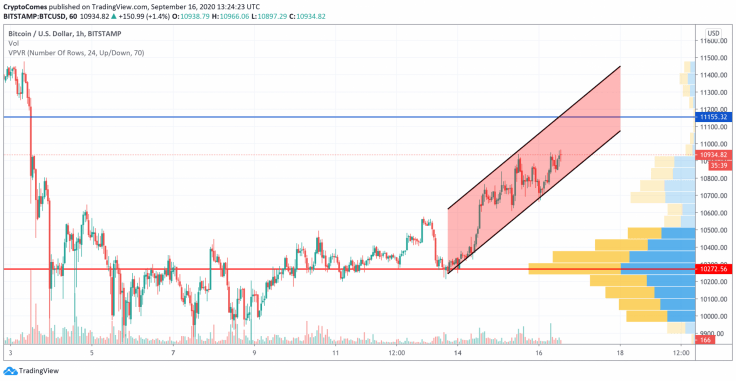

On the hourly chart, Bitcoin (BTC) keeps trading within the rising channel formed a few days ago. The trading volume remains high, however, liquidity is decreasing, which means that a reversal will start soon.

The endpoint of the growth might be the "mirror" level at $11,150, where bears may seize the initiative.

However, on the 4H time frame, the picture is bearish. The rise of Bitcoin (BTC) from $10,500 has not been supported by a rising trading volume, which means bulls are unlikely to update local peaks. Applying the Bollinger Bands indicator on the chart, a decline from around $11,000 may end at $10,500, where most of the liquidity is focused. Such price action is relevant through the end of the week.

Bitcoin is trading at $10,942 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC demand and liquidity conditions remain weak

Bitcoin price has been consolidating between $94,000 and $100,000 since early February. US Bitcoin spot ETF data recorded a total net outflow of $489.60 million until Thursday.

Sonic (prev. FTM) rallies as TVL hits record high and market capitalization surpasses $3.1 billion

Sonic (S), previous Fantom (FTM), rallies over 20% in the last 24 hours and trades around $0.90 at the time of writing on Friday after rising almost 64% this week. The migration of FTM to S token at a 1:1 ratio was completed on January 17.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC gears up for volatility while ETH and XRP fight to stay afloat

Bitcoin price has been consolidating between $94,000 and $100,000 since early February; this consolidation phase could soon end. Ethereum price shows signs of strength while Ripple price fights to stay afloat.

Crypto Today: BTC tops $98K on US-Russia diplomacy, while NEAR and Bittensor lead AI tokens’ $30B rally

The global crypto market rose 3% on Thursday, adding $45 billion to reach an aggregate market cap of $3.2 trillion. The crypto AI sector witnessed a 15% rally, with Bittensor (TAO) and NEAR emerging as top performers on the day.

Bitcoin: BTC demand and liquidity conditions remain weak

Bitcoin (BTC) price has been consolidating between $94,000 and $100,000 since early February, hovering around $98,000 at the time of writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.