The last day of the week has turned out to be bullish for the cryptocurrency market as all coins are in the red zone.

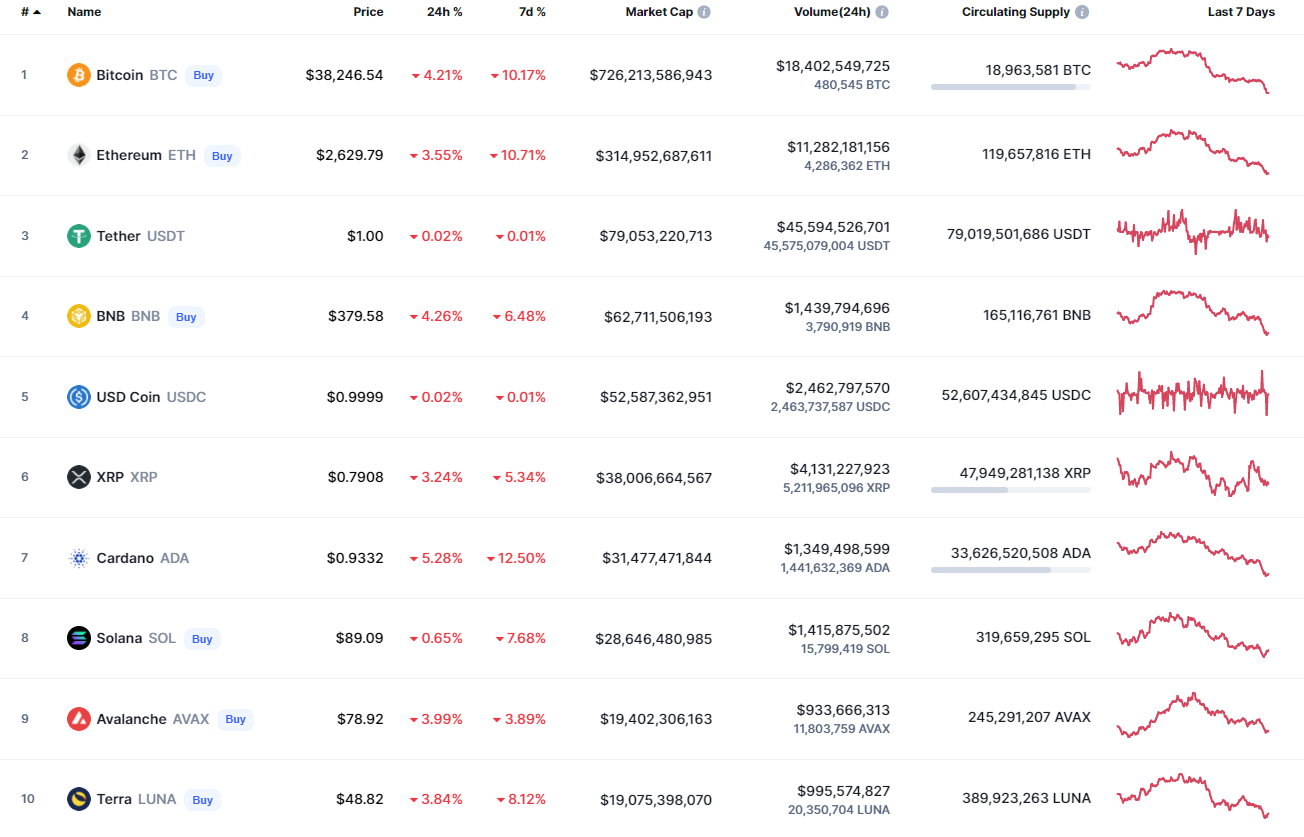

Top coins by CoinMarketCap

BTC/USD

The rate of Bitcoin (BTC) has gone down by 10% over the past seven days.

BTC/USD chart by TradingView

Bitcoin (BTC) has entered the short zone on the daily chart, having broken the support level at $39,573. At the moment, bears are controlling the situation, as the trading volume remains high. If bulls cannot seize the initiative next week, there is a chance to see a further drop to the next vital level at $38,000 shortly.

Bitcoin is trading at $38,299 at press time.

ETH/USD

Ethereum (ETH) has followed the leading crypto, going down by almost 11% since the beginning of the week.

ETH/USD chart by TradingView

Ethereum (ETH) also broke its support level at $2,815 and kept going down. Even though the selling volume is decreasing, buyers do not seem ready to buy back the main altcoin at the current level.

In this case, the more likely scenario is the retest of the level at $2,300 within the next few days.

Ethereum is trading at $2,636 at press time.

XRP/USD

Despite the fall, XRP is looking much stronger than other coins.

XRP/USD chart by TradingView

XRP keeps trading in a wide channel between the support at $0.74 and the resistance at $0.91. At the moment, the rate is located close to the bottom line, which means that bears are more powerful than bulls, to a certain extent. If the pressure continues and the daily candle fixes around $0.74, there is a high possibility of seeing a breakout and a further price drop.

XRP is trading at $0.7907 at press time.

ADA/USD

Cardano (ADA) is the biggest loser from the list today as the fall has made up 12% over the last week.

ADA/USD chart by TradingView

On the weekly time frame, the price is about to close near the support at $0.917. If the pressure continues, one can expect a sharp drop below $0.90 shortly. The next level at which a short-term reversal is possible is the $0.81 mark.

ADA is trading at $0.936 at press time.

BNB/USD

Binance Coin (BNB) is not an exception from the rule, falling by almost 5%.

BNB/USD chart by TradingView

Binance Coin (BNB) is trading sideways despite the fall this week. Currently, the price is about to approach the support level at $336. If nothing happens, the fall may lead to a break, followed by the test of the vital $300 mark.

BNB is trading at $378 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Slow but positive start

Bitcoin edges slightly lower, trading around $96,500 on Friday after an over 2.5% recovery this week, with historical data showing modest average January returns of 3.35%. On-chain metrics suggest the bull market remains intact, indicating a cooling-off phase rather than a cycle peak.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

BTC, ETH and XRP eyes for a rally

Bitcoin’s price finds support around its key level, while Ethereum’s price is approaching its key resistance level; a firm close above it would signal a bullish trend. Ripple price trades within a symmetrical triangle on Friday, a breakout from which could signal a rally ahead.

Could XRP surge to new highs in January 2025? First two days of trading suggest an upside bias

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders (LTH) continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.