- The recent rally in Bitcoin has caused the total crypto market cap to go from $800 billion to $1 trillion.

- Low market capitalization altcoins like Coti, Injective and Dusk Network have seen explosive rallies in the last 24 hours.

- While the top three coins, Bitcoin, Ethereum and Ripple have slowed down, other altcoins have no intention of stopping.

Cryptocurrencies have benefited from a new-found optimism amongst investors since the start of 2023. Bitcoin (BTC) and Ethereum (ETH) did their part in the initial run-up, but now the profits from these major coins seem to be moving to other coins, causing rallies in multiple altcoins that are easily doubling in value. While this period provides a great opportunity to grow portfolios, investors need to be cautious as markets could quickly turn bearish if BTC tumbles.

Also read: Three reasons why crypto market is primed for a selloff

Altcoins explode as greed takes over - COTI, INJ, DUSK

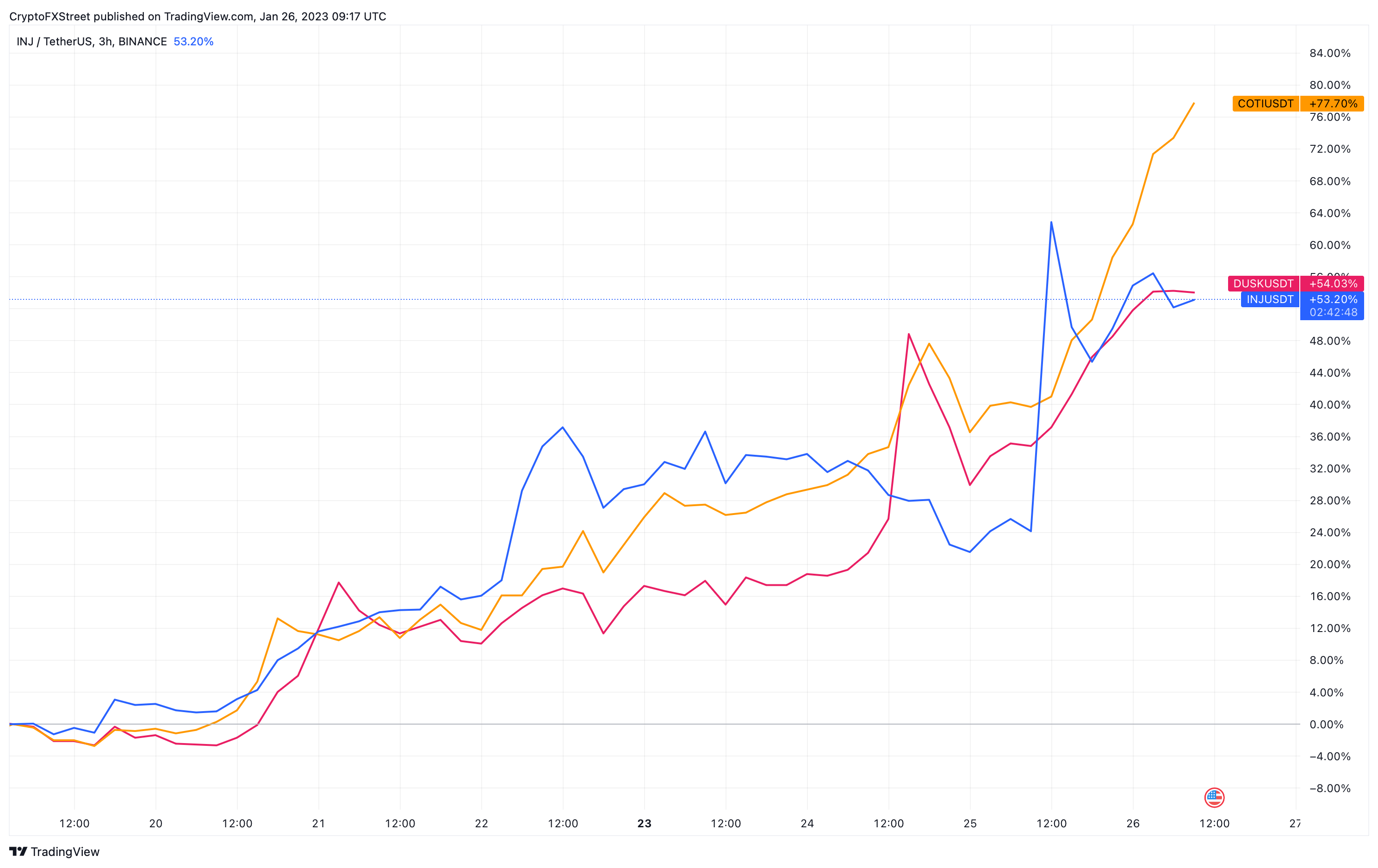

Coti (COTI), Injective Protocol (INJ), Dusk Network (DUSK) are three altcoins with market capitalizations of below $200 million that have taken the top three spots in the 24-hour price change. The returns for COTI, INJ and DUSK are 24%, 16% and 13%, respectively. Although these numbers are impressive, their seven-day performance is jaw-dropping.

COTI, INJ, DUSK 7-day returns

Despite the stellar performance, there is a possibility that this uptrend or bullish outlook will exhaust soon especially since Bitcoin price continues to consolidate around the $23,000 hurdle. Ethereum price has already seen a sudden sell-off in the last three days and altcoins are likely to follow soon if the big crypto gives in.

Until that happens, can altcoins rally? The answer to that is a resounding yes.

Is alt season upon us?

When Bitcoin rallies suddenly and settles around a certain level, it is usually followed by Ethereum, Ripple and Binance coin due to their high degree of correlation with the big crypto. Some times, Ethereum and other altcoins continue to rally while BTC rests and other times, ETH follows BTC closely, allowing low market capitalization altcoins to take center stage.

The second half of the phenomenon is known as “altcoin season” or colloquially known as “alt season.” The reason behind altcoins exploding in the second leg of a bull run is capital rotation, which is like a game of musical chairs. When the music stops aka Bitcoin price tanks or reverses, the altcoin rallies come undone quicker than retail can anticipate.

As a result, many FOMO-driven investors will be left holding the bag of altcoins or get liquidated on their futures trades.

In conclusion, yes, low market capitalization altcoins are likely to continue exploding as profits get redirected, causing them to move exponentially. However, this outlook is unsustainable if Bitcoin wakes up from its slumber and decides to favor the bears. Such a development would see altcoins crumble.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.