Can Ethereum (ETH) and XRP recover faster than Bitcoin (BTC)?

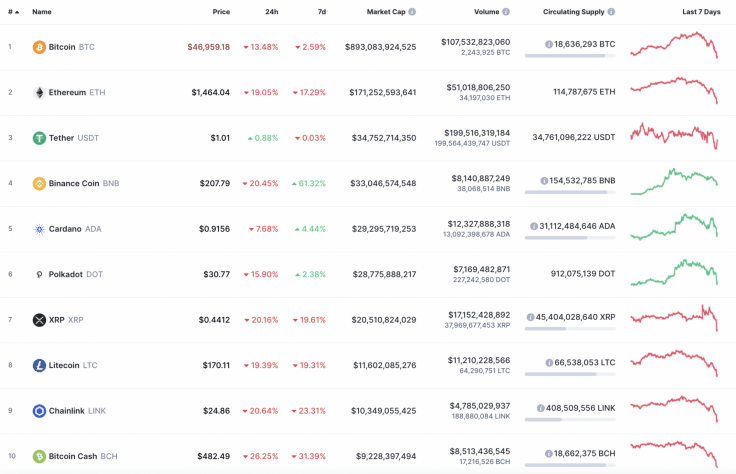

The crypto market seems unlikely to recover so fast as all of the top 10 coins are under bearish pressure. Bitcoin Cash (BCH) is the top loser, falling by 26%.

Top 10 coins by CoinMarketCap

BTC/USD

Yesterday morning, the Bitcoin (BTC) price rolled back to the support of the two-hour EMA55 (around $54.000). During the day, the pressure of the bears increased. They pushed the moving average and pulled the pair back to the uptrend line ($52,500).

BTC/USD chart by TradingView

Another bearish impulse knocked the pair out of the ascending channel and tested the support at $45,000. The BTC price bounced above the trend line, but the pair could not hold out in the upward channel until morning. If bulls hold the $45,000 level, there are chances of seeing a short-term rise to $50,000.

Bitcoin is trading at $46,590 at press time.

ETH/USD

The onslaught of sellers intensified yesterday morning, and during the day, they pulled the pair back below the support of $1,800. In the afternoon, the Ethereum (ETH) price pierced the trendline, setting a minimum of around $1,540.

Before the end of the day, the price bounced into an ascending channel, but it has not yet been able to gain a foothold in it.

ETH/USD chart by TradingView

As of this morning, the volume of sales has decreased. But even at low trading volumes, the pair may go down to the support around $1,300. One believes that this level will stop the decline and allow the pair to consolidate sideways.

Ethereum is trading at $1,472 at press time.

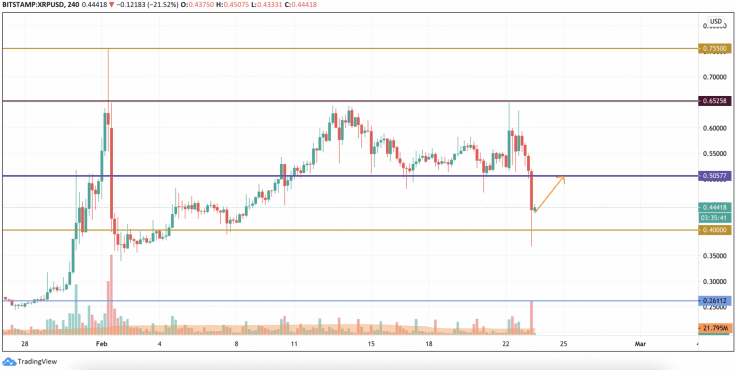

XRP/USD

Yesterday morning, strong bullish momentum tried to restore the XRP/USD pair to the upward channel. The price broke through the resistance of $0.60 and set a new February high at $0.649.

XRP/USD chart by TradingView

XRP looks more bullish than Bitcoin (BTC) and Ethereum (ETH) in the short-term scenario. The selling trading volume is high, which means that most bears may have already closed their positions. In this case, there is a chance for a bounce-off to the vital mark at $0.50.

XRP is trading at $0.44 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.