- Dogecoin price is arriving at an inflection point as it slides closer to the $0.048 support level.

- A breakdown of this level could trigger a 60% crash to fill the FVG, extending up to $0.041.

- A weekly candlestick close above $0.109 will invalidate the bearish thesis for DOGE.

Dogecoin price has been on a downtrend, which can clearly be seen on the weekly chart. The sudden collapse in May and June exacerbated the correction pushing DOGE to a stable support level, a breakdown of which could trigger another brutal crash.

Dogecoin price is on edge

Dogecoin price peaked in May 2021 as it set a new all-time high at $0.739. Since then, DOGE has produced five lower highs. These swing points can be connected to further visualize the corrective phase.

More recently, Dogecoin price has crashed through the $0.070-to-$0.087 support area, denoting the massive sell pressure present in the ecosystem. The fallout from the Celsius Network seems to have affected many companies that were previously thriving.

Regardless, DOGE has one last support level at $0.048 that will prevent it from heading lower. However, if the sellers overwhelm the buyers, leading to a breakdown, it could trigger a brutal sell-off. In such a case, Dogecoin price will crash roughly 60% and fill the Fair Value Gap (FVG), aka price inefficiency, extending from $0.041 to $0.014.

DOGE/USDT 1-week chart

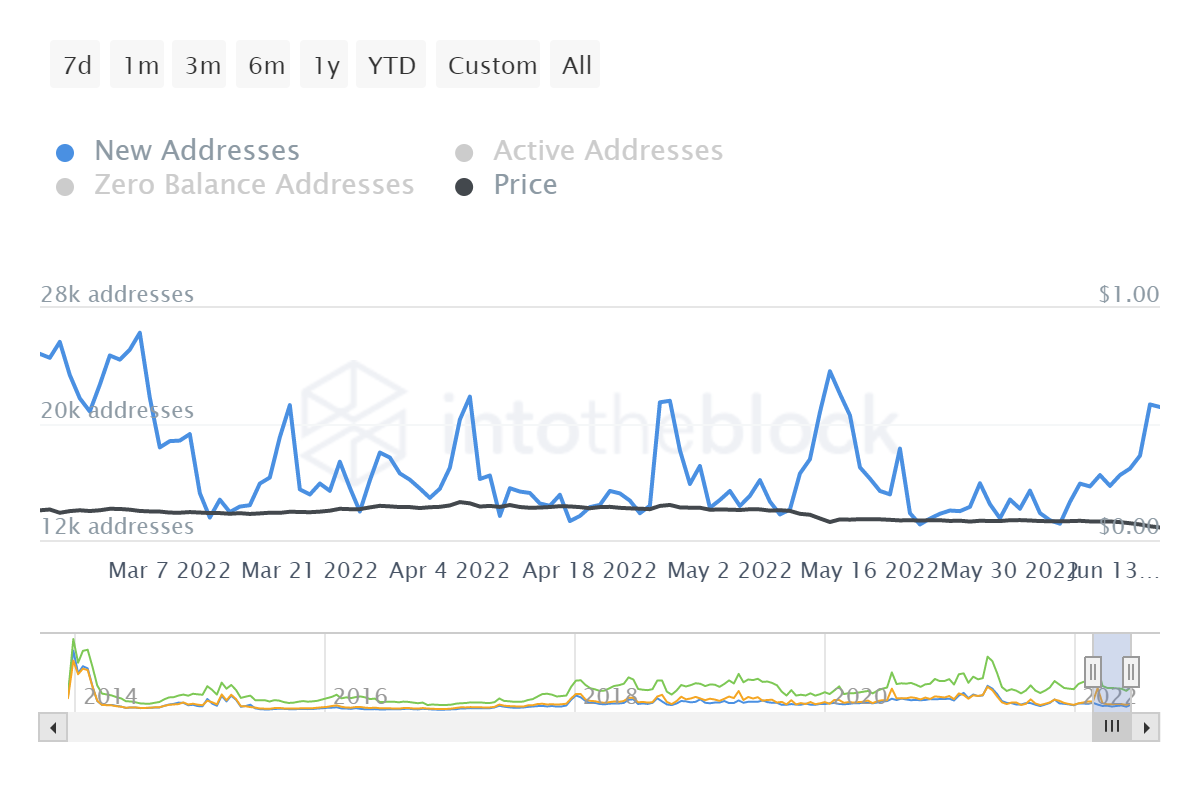

While the crypto markets are bleak for the right reasons, investors seem to be flocking to DOGE. The number of new addresses joining the Dogecoin network has been on an uptick since June 2 and has increased by 59% from 13,360 to 21,300 in under two weeks.

The last time the number of new addresses was this high was around the May 12 crash. At first glance this uptick might seem bullish but standalone, might not be enough to prevent a disaster in case of a massive market-wide sell-off.

DOGE new addresses

Regardless of the ongoing bearish narrative in the ecosystem, if the Dogecoin price manages to bounce off the $0.048 support level, the downside can be postponed. However, only a weekly candlestick close above $0.109 will invalidate the bearish thesis. Confirmation of a bullish trend will occur if DOGE sets up a higher high relative to the April 4 swing high at $0.179.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple Price Prediction: What's next for XRP as whales accumulate, exchange inflows drop, while support holds?

Ripple (XRP) price stabilizes above its $2.00 support during the late Asian session on Tuesday. An attempt to break out of the consolidation range the previous day left more long than short positions liquidated, dampening market sentiment.

Stacks Price Forecast: STX soars 20% as BTC surpasses $88,000

Stacks (STX) price is extending its gains by 9%, trading around $0.76 at the time of writing on Tuesday following a 10% rally the previous day. On-chain data paints a bullish picture as STX open interest and trading volume are rising.

ARK Invest integrates Canada's 3iQ Solana Staking ETF into its crypto funds

Asset manager ARK Invest announced on Monday that it added exposure for Solana staking to its ARK Next Generation Internet (ARKW) ETF and ARK Fintech Innovation ETF (ARKF) through an investment in Canada's 3iQ Solana Staking ETF (SOLQ).

Ethereum Price Forecast: ETH tackles $1,688 resistance as Vitalik Buterin proposes swapping the EVM for RISC-V

Ethereum (ETH) is down 1% on Monday following a proposal by co-founder Vitalik Buterin to replace its current Ethereum Virtual Machine (EVM) smart contract language environment with a more "efficient" RISC-V.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.