Can DOGE and SHIB outperform other coins?

Bears have turned out to be more powerful than bulls on the last day of the week as most of the coins are in the red zone.

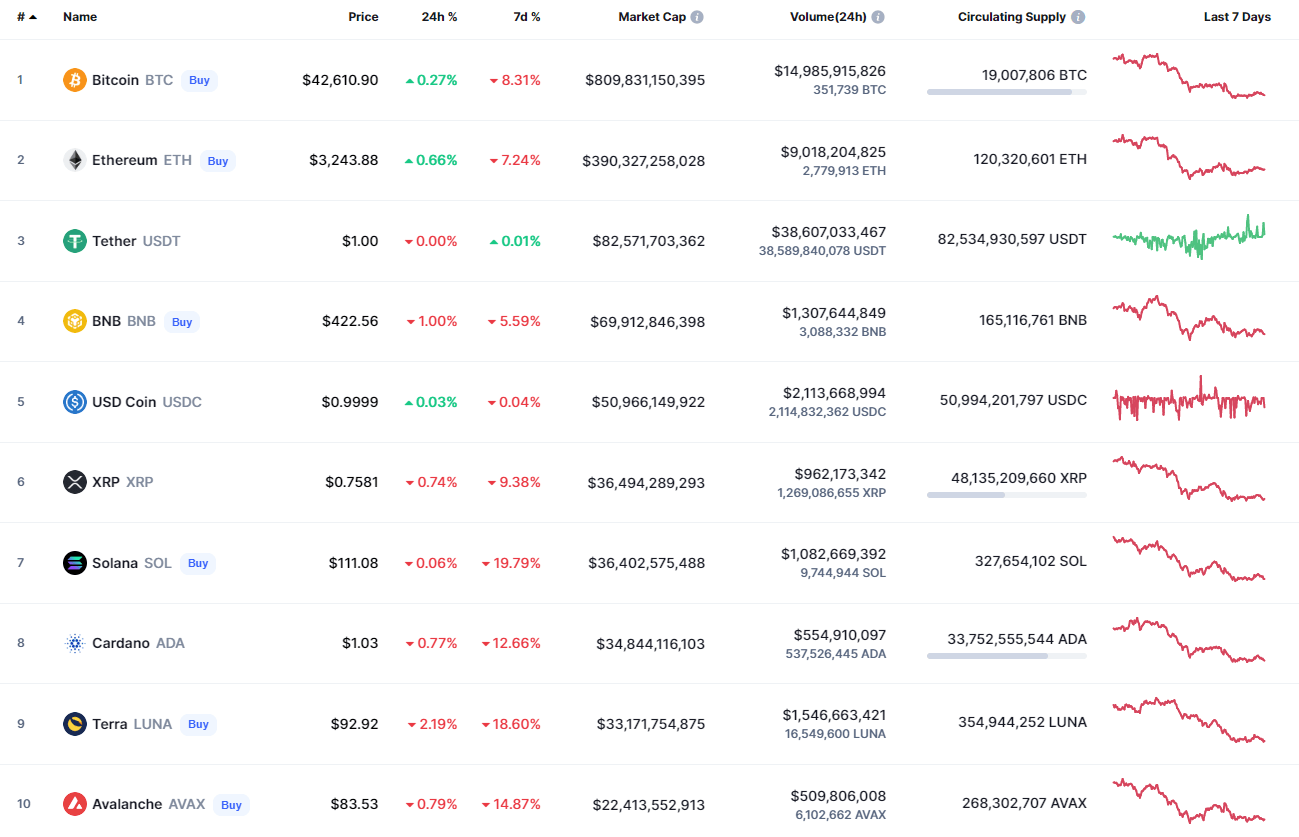

Top coins by CoinMarketCap

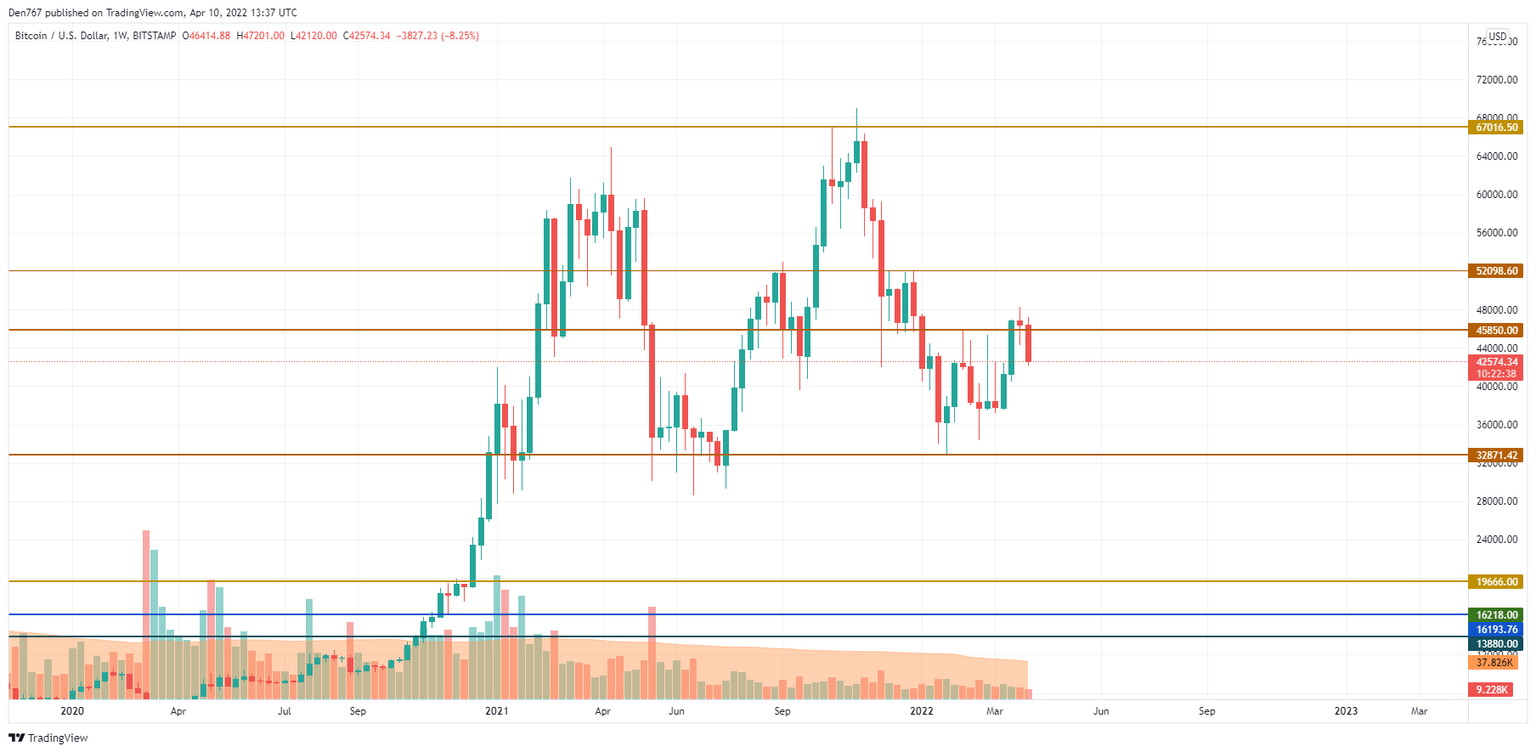

BTC/USD

Bitcoin (BTC) is among those coins who keep trading in the green zone. However, despite the slight growth since yesterday, it has fallen by 8.31% over the last week.

BTC/USD chart by TradingView

Bitcoin (BTC) could not fix above the $44,000 mark, which means that buyers might need more time to accumulate energy for further growth. Such a statement is also confirmed by the declining selling trading volume. In this case, the bullish scenario remains relevant if bulls can hold the vital $40,000 mark. In another case, a drop is possible to the support level at $32,871.

Bitcoin is trading at $42,557 at press time.

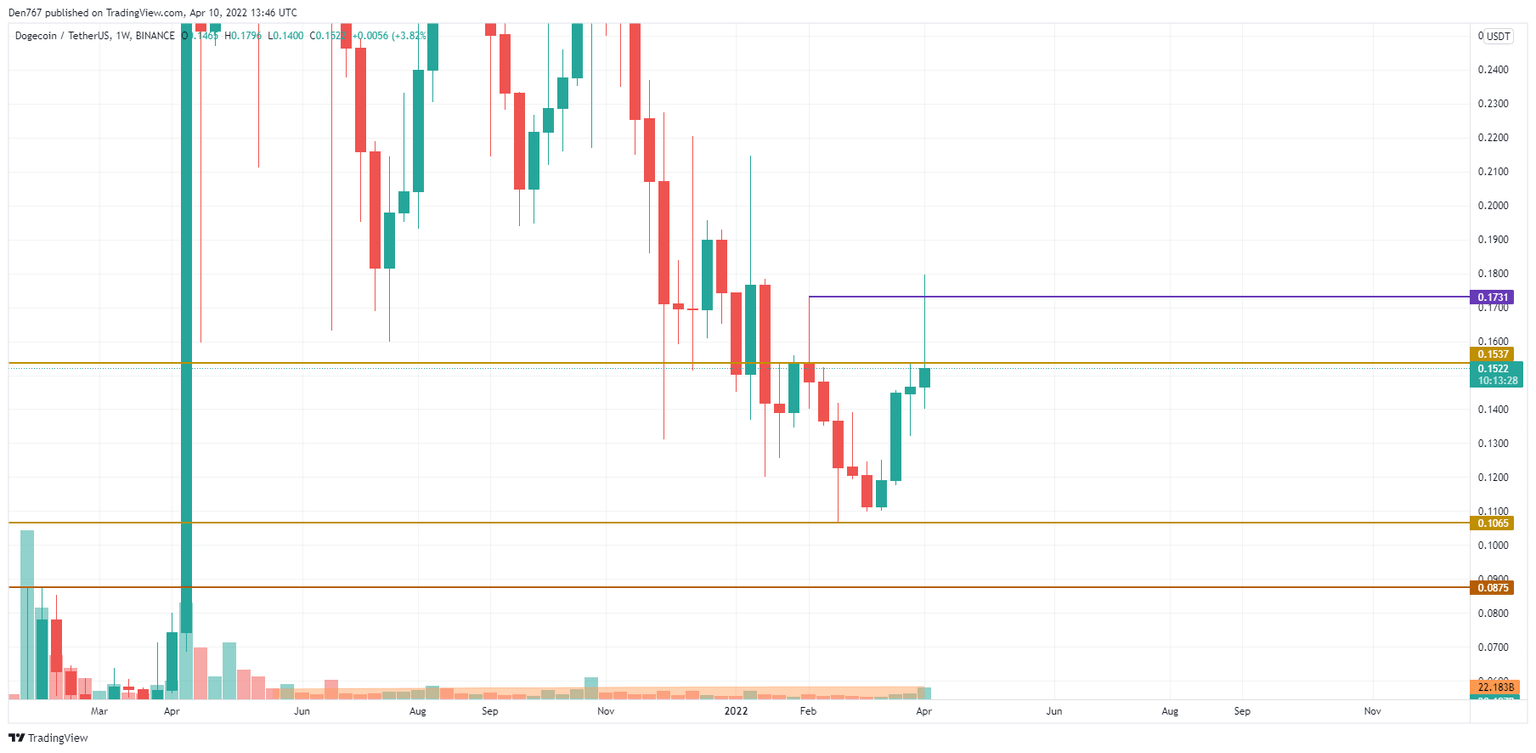

DOGE/USD

DOGE is the biggest gainer from today's list as the price of the meme coin has gone up by 3.62%.

DOGE/USD chart by Trading View

DOGE has made a false breakout of the recently formed resistance level at $0.1731. The price has also gone below another level at $0.1537, which means that one should not expect fast growth from the coin. In this case, the more likely scenario is sideways trading in the range of $0.14-$0.16 by the end of the month.

DOGE is trading at $0.1519 at press time.

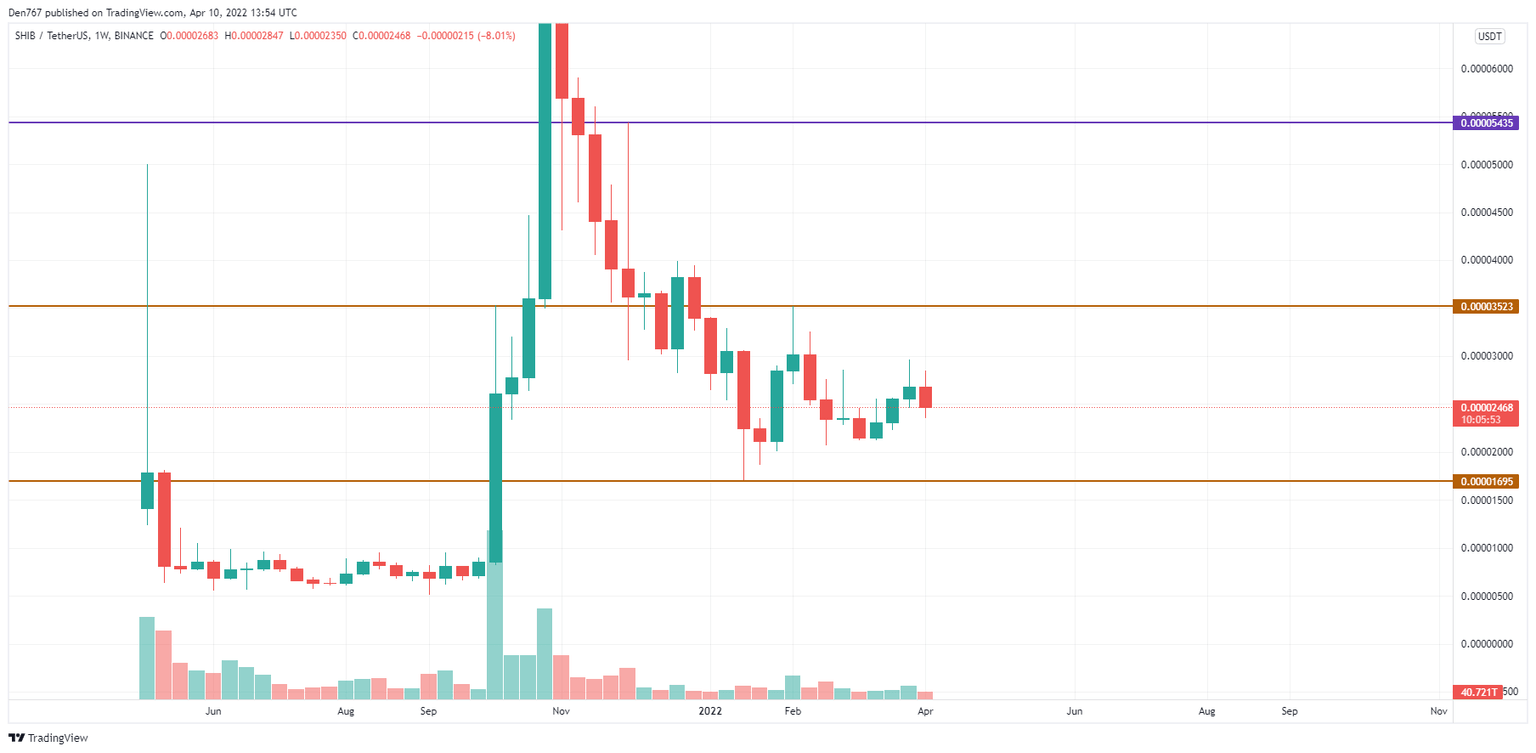

SHIB/USD

SHIB has followed the rise of DOGE, rising by 2% over the past 24 hours.

SHIB/USD chart by TradingView

Despite today's growth, SHIB is neither bullish nor bearish in the mid-term secnario as the rate is located in the middle of a wide channel, between the support at $0.00001695 and the resistance at $0.00003523. The current weekly candle is about to close red, which means that bears control the situation at the moment.

SHIB is trading at $0.00002460 at press time.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.